The DAX Index has edged higher in the Tuesday session, as the DAX continues to have an uneventful week. Currently, the DAX is at 12,062.40. On the release front, it’s another quiet day in the eurozone, with no economic indicators on the schedule. The sole event is a meeting of EU finance ministers.

The recent Dutch election results were cheered by EU backers across the continent and boosted the euro. Next stop on the election train is France, which holds presidential elections next month. Polls have far rightist Marine Le Pen and centrist Emmanuel Macron running neck and neck in the first round of the presidential election on April 23. Still, Macron is expected to win in the second-round vote in May. In a highly-anticipated television debate on Monday, Macron and Le Pen had a chance to hawk their wears, and a survey found that Macron won the debate.

Le Pen, a far right candidate and euro-sceptic, has pledged to take France out of the euro and hold a referendum on EU membership. Macron’s strong showing in the debate has improved market sentiment and helped boost the euro on Tuesday. France boasts the number two economy in the eurozone, so we can expect more volatility from the euro as we get closer to Election Day.

With the Fed’s quarter-rate point behind us, what’s next for Janet Yellen & Co.? The CME Group has priced a rate hike in May at just 6%, while a June move is priced at 54%. With a dearth of key fundamentals in the US this week, the markets are left to monitoring comments from FOMC members who will be speaking this week, including Fed Chair Janet Yellen.

On Monday, Chicago Fed President Charles Evans said he expects the Fed to raise rates two more times this year. This echoed the Fed’s projection in its rate statement last week. Although three rate hikes in 2017 appears impressive, market players want four hikes, and have reacted with disappointment to the Fed’s more cautious approach. This has sent the US dollar lower, and the euro has improved to 5-week highs, briefly punching past the 1.08 line on Tuesday.

Economic Calendar

Tuesday (March 21)

- All Day – ECOFIN Meetings

Wednesday (March 22)

- 5:00 Eurozone Current Account. Estimate 29.3B

- Tentative – German 10-y Bond Auction

*All release times are EST

*Key events are in bold

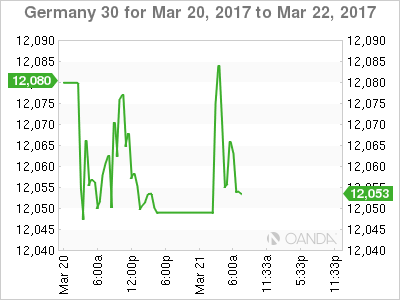

DAX for Tuesday, March 21, 2017

DAX, March 21 at 6:35 EST

Open: 12,036.50 High: 12,086.15 Low: 12,079.65 Close: 12,062.40