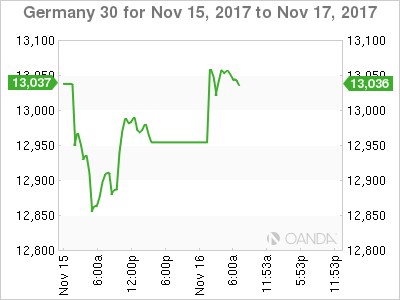

The DAX index has posted gains in the Thursday session. Currently, the DAX is at 13,047.00, up 0.46% since the end of Wednesday trade. On the release front, Final CPI gained 1.4% and Core Final CPI gained 0.9%, as both readings matched the forecasts. On Friday, ECB President Mario Draghi and German Buba President Jens Weidmann speaks at Frankfurt European Banking Congress.

The DAX has rebounded on Thursday, after suffering strong losses over the past week. Cyclical stocks are in green territory. Financial stocks have moved higher, led by Commerzbank (DE:CBKG) and Deutsche Bank AG NA O.N. (DE:DBKGn), with gains of 1.90% and 2.13%, respectively. Auto and technology stocks are also higher on Thursday. The stronger euro and profit-taking has weighed on the European markets, and it remains to be seen whether the DAX has turned a corner and the upward direction will continue.

Central banks do their best to avoid causing market volatility, which requires clear communication with the public and the markets. However, with bank policymakers making public statements on a daily basis, differences in opinion on future monetary policy or quantitative easing are bound to come up, and this can lead to market movement. Early in the week, Fed Chair Janet Yellen and ECB Mario Draghi participated at an ECB event which focused on communication with the markets. Yellen acknowledged that the FOMC committee of 19 members posed problems, as members did not always speak with a unified voice. Yellen admitted that this problem would not be solved anytime soon, saying it was “a work in progress”. To be fair, this is also an issue for the ECB, as the markets have on occasion reacted to comments from individual policymakers.

Economic Calendar

Thursday (November 16)

- 5:00 Eurozone Final CPI. Estimate 1.4%. Actual 1.4%

- 5:00 Eurozone Final Core CPI. Estimate 0.9%. Actual 0.9%

Friday (November 17)

- 3:30 ECB President Mario Draghi Speaks

- 8:00 German Buba President Weidmann Speaks

*All release times are GMT

*Key events are in bold

DAX, Thursday, November 16 at 6:40 EDT

Open: 13,043.50 High: 13,073.00 Low: 13,006.00 Close: 13,047.00