Market movers today

The key event today will be the Norges Bank meeting, where both consensus and ourselves are looking for a 25bp rate hike, see page 2 and Norges Bank Preview - hiking and signalling further tightening , 17 June 2019.

The Bank of England also meets, but in our view, the bank is firmly on hold. It is one of the small meetings without an updated inflation report or a press conference so we don't expect much change in the bank's message. The UK also releases May retail sales.

A two-day EU summit starts today, where the main focus will be on potential clarity on the front-runners for the EU Commission presidency, ECB presidency other EU top positions. We will also monitor if the EC will formally open an EDP against Italy. On the data front, we expect Euro area consumer confidence for June to stay unchanged.

The US Philly Fed survey and initial jobless claims will add to indications of how much the US economy is slowing. The PMI and Empire indices have pointed to weakness.

Selected market news

Risk sentiment was benign yesterday as the market digested the dovish ECB message from Tuesday and was waiting for the end of the Fed meeting in the evening. The risk rally continued after the Fed meeting. Overall, the Fed was as dovish as it could be without cutting rates at its meeting. In line with our view, there were several important dovish changes to the statement. Most importantly, the Fed removed the wording that it was "patient " and now said it "will act as appropriate to sustain the expansion " while also saying that uncertainties have increased. Also dovish was that the FOMC was divided on whether to signal cuts outright this year or not (8 signalling cuts, 8 on hold and 1 hike). We stick to our view that the Fed will cut rates in July by 25bp and deliver a total of 75bp of rate cuts in H2 19 (Jul, Sep, Dec). The trade war is an important risk to our outlook in both directions. For more details, see our FOMC review: Fed as dovish it could be without cutting rates already .

The ECB comments on Tuesday satisfied markets so far, as the blockbuster measure (ECB credibility measures) 5y5y is 12bp higher than prior to the speech; however, a Reuters story suggested that the message from Draghi is not consensus in the GC.

Oil traded in a relatively tight range of around 62USD/bbl, with some volatility. The Brent price dropped on the back of news that OPEC+ finally agreed to meet (1-2 July), as the countries must decide on the new output level. Brent spiked above USD62/bbl on a drop in US crude stocks.

As expected, the BoJ kept its QQE with yield curve control and its forward guidance unchanged at a meeting ending overnight with a 7-2 vote. The BoJ kept its assessment of the economy but it is more concerned about downside risks from overseas economies.

The NIER June confidence survey showed business confidence dropping in all sectors, consumer confidence bounced back slightly. The overall indicator is at its lowest since 2013. Price expectations are down to stable, most notably lower expectations in durable goods.

Scandi markets

Norway. We expect Norges Bank to raise the policy rate by 25bp to 1.25% today, in line with consensus. The new rate path needs to balance increasing domestic upside risks against higher global downside risks. Until the global deterioration starts to affect the domestic economy, or the NOK appreciates significantly, Norges Bnak needs to continue the normalisation of rates. Hence, we expect the rate path to be largely unchanged through to summer 2020 and indicate a very high probability of a further hike this year. Further out, the rate path will point to a slower normalisation process compared to the March report.

Fixed income markets

A dovish Federal Reserve sent bond yields lower, driven from the short end, where 2Y Treasury yields fell some 16bp, while 10Y yields fell some 7bp. The message from the Federal Reserve was as soft as it could be without cutting rates. The market is also pricing cuts of 50bp. We stick to our view that the Federal Reserve will cut by 75bp in 2019.

In Europe, fixed income markets bounced back yesterday, but with the positive reaction in the US market, Europe should open in positive territory, where we expect the periphery will gain the most.

In Scandinavia, all eyes are on Norges Bank and whether it will hike or not in the coming months. We still expect a rate hike of 25bp and that is more to come. See more here.

FX markets

EUR/USD tested the 1.1250 level on a dovish Fed, which justified the dovish pricing heading into the meeting. Fed Chair Powell stressed that the Fed is monitoring the trade talks and needs to see more weak data to pull the trigger. It means that the upcoming G20 meeting, along with upcoming key data releases, i.e. PMIs, ISM, non-farm payrolls etc., will be particularly important for the pricing of upcoming Fed meetings and hence for the direction of the USD. We do not see data turning around for the better and see a risk of no breakthrough in trade talks before the next Fed meeting, which means that there is still upside potential for EUR/USD. After two days of dovish central banks, we still see a strong case for a higher EUR/USD as the Fed is set to ease more than the ECB. We keep still look for EUR/USD to rise to 1.15 in 3M (NYSE:MMM), although we note that despite large movements in rate markets, EUR/USD has so far had a difficult time breaking out of its long-held range close to 1.12.

USD/JPY crossed 108 into 107 territory as Mr. Powell is leaning against the poor cyclical backdrop. We extrapolate: data is likely to continue showing that a cyclical slowdown is still with us but we expect to meet it by adjusting US yields and the dollar, appropriately. This is exactly what global macro needs to avoid a more gloomy path. Our 3M forecast is 107 but there's clearly downside risk to(wards) 105, as highlighted here.

In the Scandies, it’s a significant session for the NOK. While Norges Bank is widely expected to hike policy rates by 25bp, there’s a large discrepancy between analyst and rates markets’ expectations for the rate path and forward guidance. The latter expect today’s hike to be the last in the cycle whereas analysts including ourselves expect Olsen and Co to signal yet another hike this year and close to another one in 2020. If we are right in our call (see above), we see potential for a move lower in EUR/NOK; especially if NB signals a 100% probability of another 2019 hike, as this makes the September meeting “live”. Also, the aftermath of yesterday’s FOMC meeting will be important given the NOK’s high sensitivity to the global environment including US inflation expectations. Overall, we expect a strong NOK session.

EUR/SEK – Higher-than-expected unemployment and weak survey data from the NIER had EUR/SEK drifting slightly upwards during the day. For today, the NB rate decision is likely to set the tone for the Scandies in general. As for the Riksbank, yesterday we published the latest issue of our FX Thermometer, where we, among other things, asked the respondents to rate their respective central banks and a steep 75% rated the Riksbank’s performance as ”Bad” or even ”Really bad”. This is a clear signal of discontent from Swedish investors.

EUR/GBP went lower by 0.4% to 0.887, a fairly large move and contrarian to the past month’s momentum. UK inflation came in slightly weaker than expected but the GBP nonetheless rallied in the late session, ahead of the FOMC meeting. We think the cross will move higher over the summer (targeting 0.9) as UK data is still deteriorating after a strong Q1. Nonetheless, a dovish FOMC makes it less likely that we should target 0.91. Part of a potential BoE reaction to weak domestic data is now being handled by Fed loosening global financial conditions.

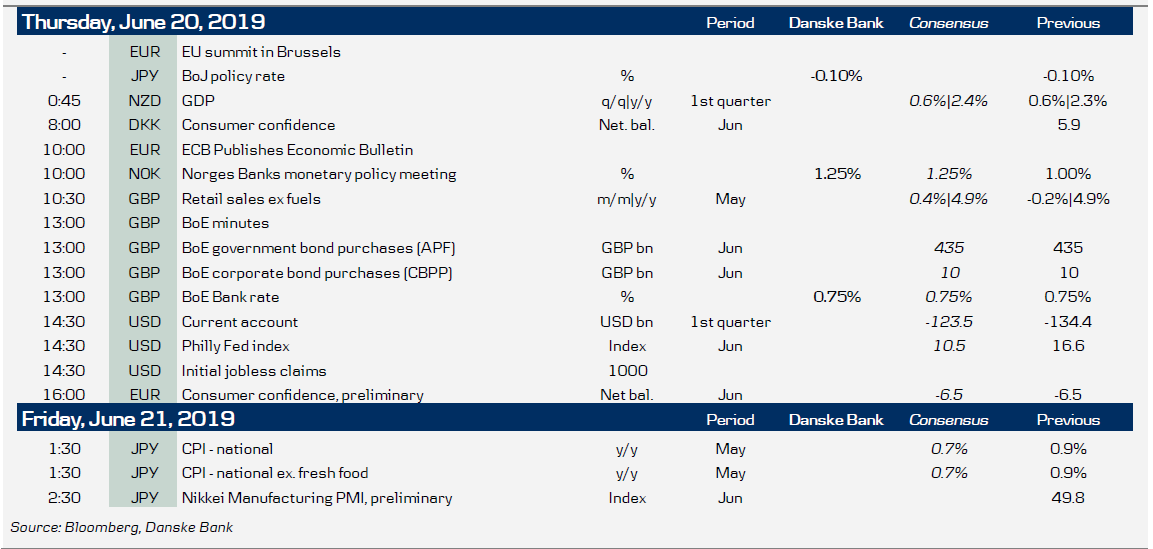

Key figures and events