S&P 500 at 8,000, gold at $5,400, Tesla to double: Here are top trades for 2026

The half-yearly results of Crypto Briefing’s CB10 index are out.

Key Takeaways

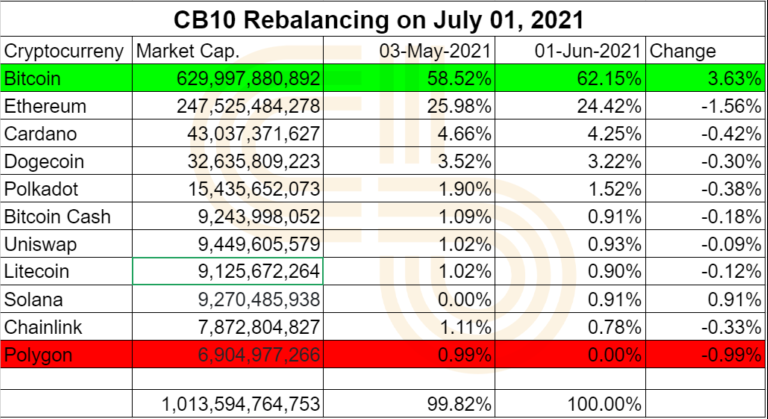

- The sixth rebalancing of Crypto Briefing’s CB10 was carried out at 10:00 EST on July 1.

- Bitcoin was the only cryptocurrency to see a positive allocation during this month’s rebalancing.

- Solana replaced Polygon in the top ten index.

The half-yearly gains of Crypto Briefing’s CB10 index have outperformed Bitcoin despite the market’s negative trend in the last two months.

CB10’s Performance In The Crypto Market

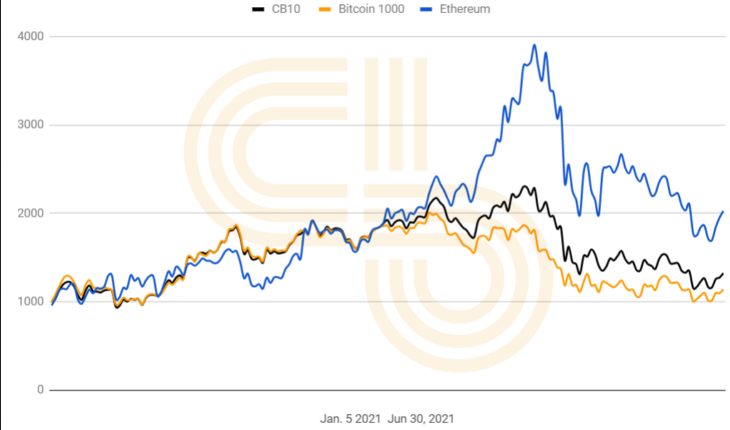

Crypto Briefing’s experimental index of the top ten cryptocurrencies by market capitalization closed in the red for a second consecutive month. The six-month gain of the index was 27.7%—2.7 times higher than Bitcoin.

BTC has yielded only 10% so far since the inception of the CB10 Index in January. Ethereum’s gains continued to surpass Bitcoin and CB10 at 102.2%.

The CB10 crypto market index implements the S&P 500’s strategy of investing in top 500 stocks based on percentage weight distribution by market capitalization. It comprises the top ten tokens by market capitalization (according to CoinGecko) that are available to trade on U.S.-based exchanges. The index is rebalanced on a monthly basis.

By June end, the earnings from a $1,000 portfolio in CB10 invested at the beginning of this year stood at $277, down from $489 last month.

With a total percentage share of 84.5%, Bitcoin and Ethereum were the top performers of the index last month. Chainlink and Polygon were the top losers, with a downside move of more than 40%. The net loss in June was 14.2%.

Rebalancing For Second Half of 2021

The rebalancing for the month of July saw some reshuffling between the percentage weights of the existing cryptocurrencies. The number of cryptocurrencies with less than 1% allocation has increased from one to five since last month. Ethereum’s share saw the biggest drop of all at -1.56%. Together, Bitcoin and Ethereum now command 86.57%.

Apart from that, Solana replaced Polygon, placing ninth on the index with a 0.9% share.

Dogecoin’s price failed to revive despite positive engagement from Elon Musk. DOGE fell one place from position three to four during this month’s redistribution. Cardano is now the third-largest cryptocurrency of the index.

The market capitalization of CB10’s last five tokens was in a tight range of around $7.5-9.5 billion. These cryptocurrencies—Bitcoin Cash, Uniswap, Litecoin, Solana, and Chainlink—could witness multiple ranking changes over the course of this month. Moreover, an evenly balanced portfolio across these assets provides a better risk:reward ratio than investing in one alone.

Crypto Briefing readers who copy CB10 may choose to realize their half-yearly gains and reinvest the original amount for the next half of the year. The process of rebalancing and compounding options is outlined in the first distribution schedule after the January launch.

Visible Market Trends

One of the clearest trends in June was the rising dominance of Bitcoin. Last month, Bitcoin’s price dropped by 10%, whereas the price of all other cryptocurrencies in the index slumped between 20% and 50%. This inflow from the lower cap tokens to Bitcoin is characteristic of a bear trend when investors seek refuge in a comparatively less volatile asset.

While Ethereum benefits from higher gains than Bitcoin from earlier this year, its percent weight in the index dropped by 1.5%, following a negative month. The ETH:BTC ratio dropped by 4% in June. ETH struggled to break above the resistance at 0.065 BTC, with support at 0.055 BTC.

In the DeFi spectrum, the total liquidity of the pool and the price of governance tokens continue to feel the pressure of the market.

Bitcoin’s price rose up to $40,000 and Ethereum surpassed $2,800 for a short period in the first half of the month. However, the market continued to face hurdles, particularly from global regulatory oversight. The effects of China’s severe crackdown were visible across the market with a near 50% hashrate decline in Bitcoin’s mining network. The largest crypto exchange in the world, Binance, is also facing regulatory troubles in multiple countries.

Positive adoption of these blockchain projects seems to be the only way out of this downtrend.