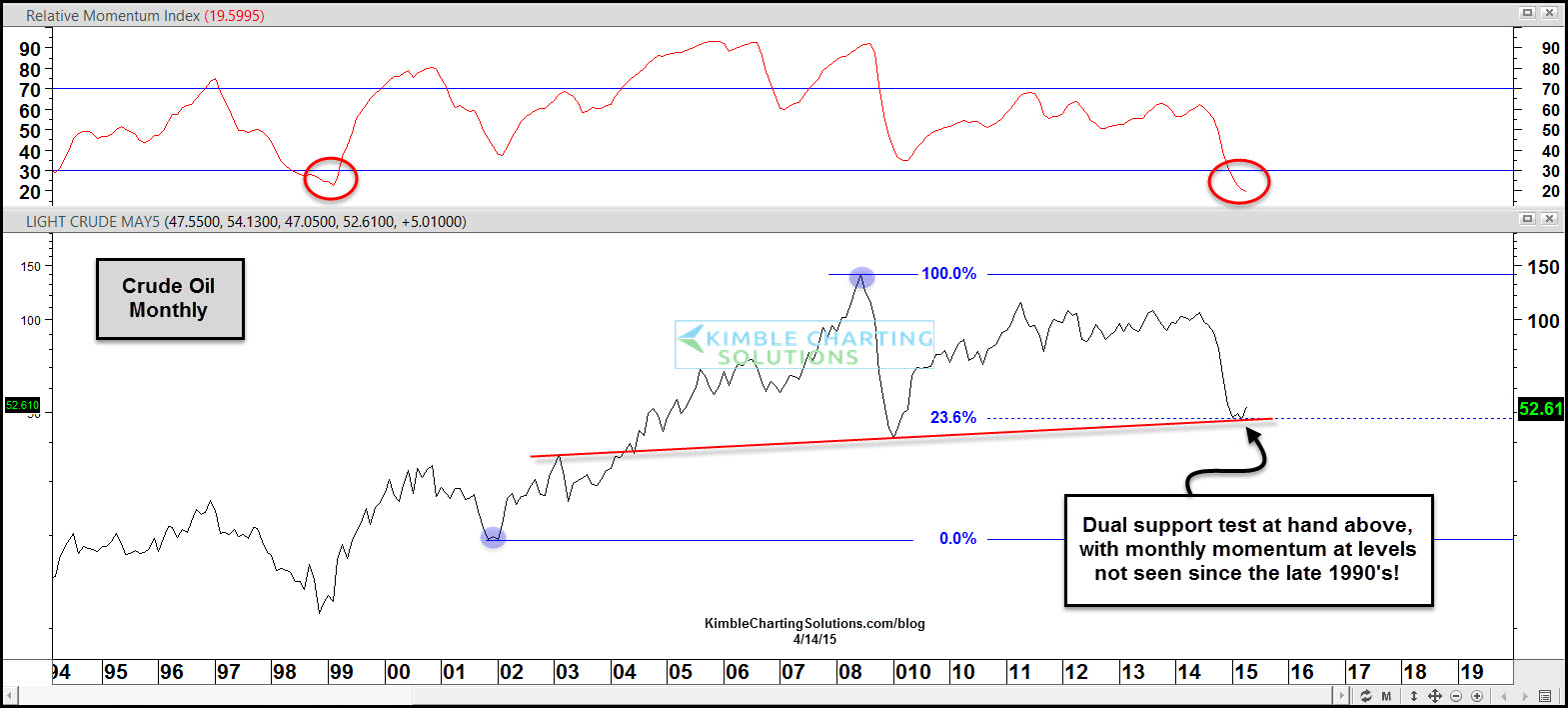

This chart looks at crude oil over the past couple of decades, on a monthly basis.

Crude oil's large decline over the past 8 months took it down to its Fibonacce 23% retracement level and a support line at the same time. The large decline has driven monthly momentum down to levels not seen since the late 1990’s.

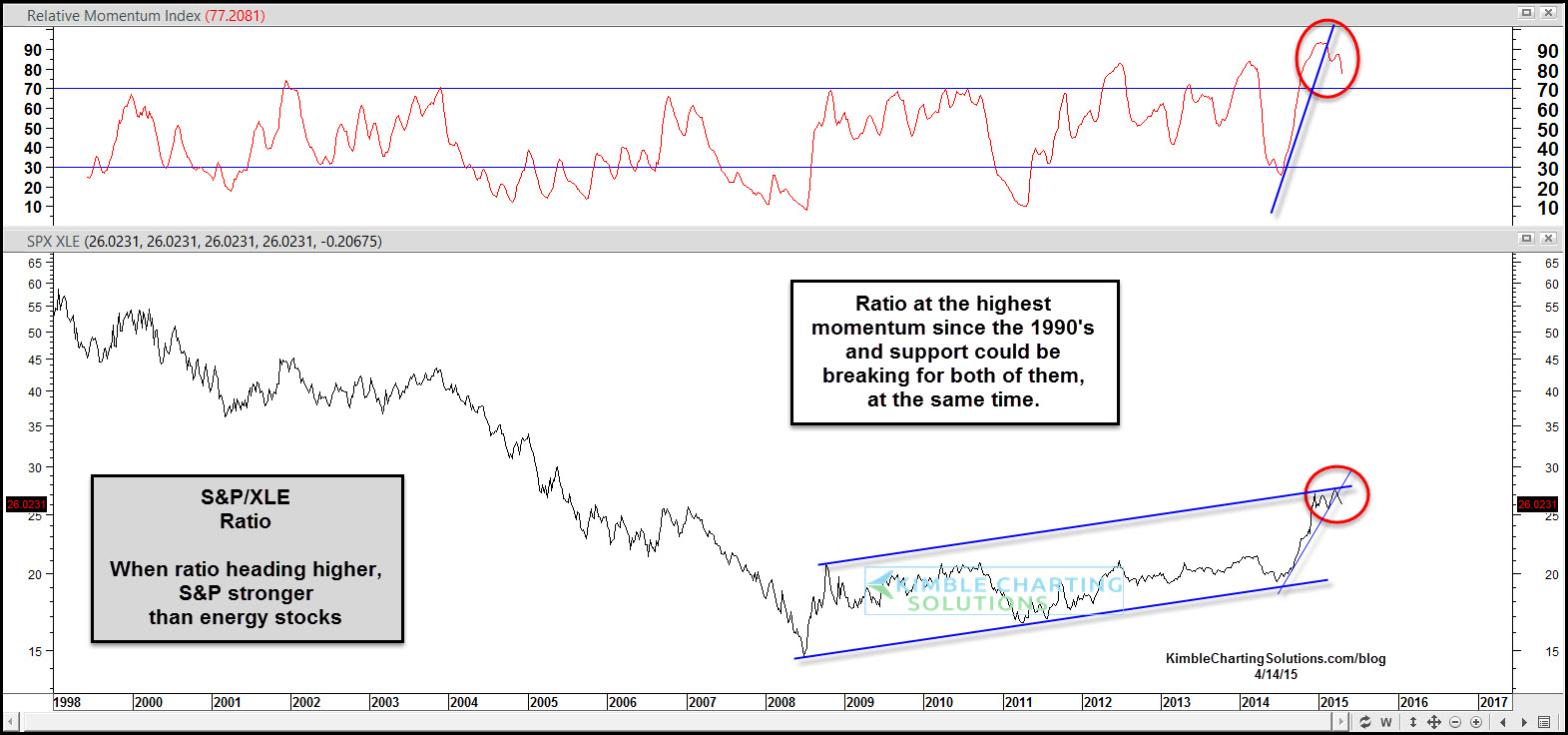

This chart compares the S&P 500 to Energy ETF (ARCA:XLE). When the ratio is heading higher, the S&P 500 is reflecting strength over XLE. As you can see the ratio has just experienced one of its sharpest 9 month rallies in the past 20 years. This rally drove the ratio to the top of a rising channel and momentum recently reached the highest level ever.

Now the ratio and momentum could be breaking support. If this is a new trend by the ratio, being long XLE and Short the S&P 500 could pay off, just as the opposite trade has paid off for the past nine months.