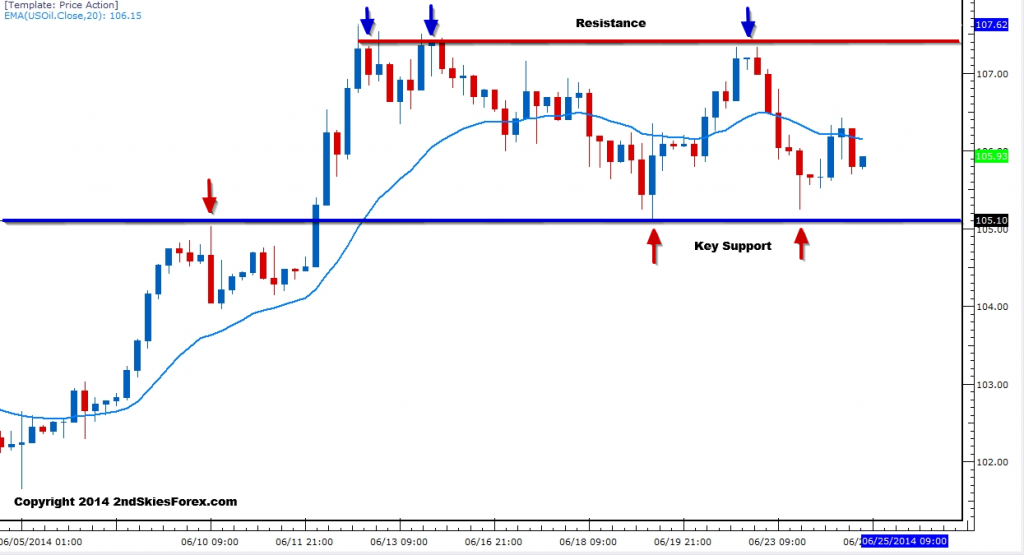

Crude Oil – Still Holding at 105 Support

Last week we talked about buying on a pullback to the 105.21 – 104.75 area. This trade setup worked out gaining over +150 points in the process before pulling back. In this weeks market commentary, we suggested looking for buying opportunities near the same role reversal level, and for a second time, the commodity has bounced off this support zone.

This suggests the bulls are willing to hold the line for now, so we will maintain a bullish bias while above this support zone. If the level holds this week, then the commodity should retest the recent highs around 107.30 before sellers will consider entering again.