The FOMC meeting is scheduled for Wednesday, and the markets are likely to remain flat in the near term. The economic calendar was light yesterday. In the UK, politics continued to bring uncertainty to the markets, which kept the British pound subdued.

Looking ahead, alot of economic releases lined up for today. This includes the UK inflation figures, which is expected to show that consumer prices rose 2.7% in May. Germany's ZEW economic sentiment will also be released which is expected to show a modest increase to 21.6 on the index. In the U.S. producer price index is expected to remain flat following a 0.5% increase.

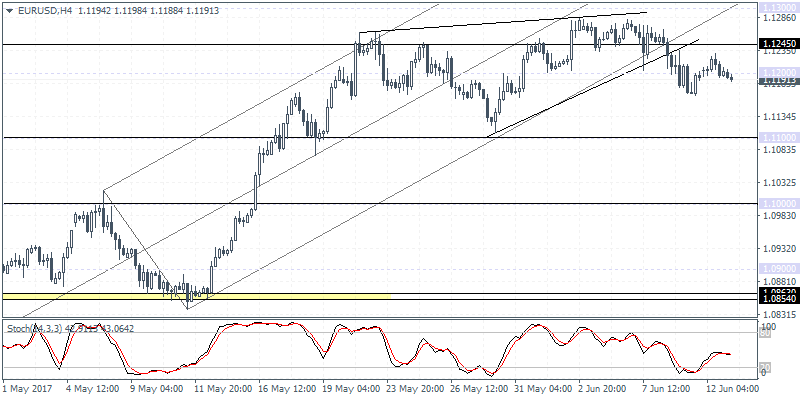

EUR/USD intraday analysis

EUR/USD (1.1191) closed with a doji candlestick yesterday, and the price action is likely to push lower ahead of the FOMC meeting. On the 4-hour chart, the retracement seen yesterday saw price action retesting the break-out level from the rising wedge pattern.

This puts EUR/USD in place to post declines down to 1.1100 in the near term. We expect this to occur towards mid-week with the FOMC meeting in focus. To the upside, any retracement is likely to test the resistance level at 1.1245. Failure to reverse gains here will put EUR/USD on a bullish trajectory with further gains likely if we see a daily close above 1.1245.

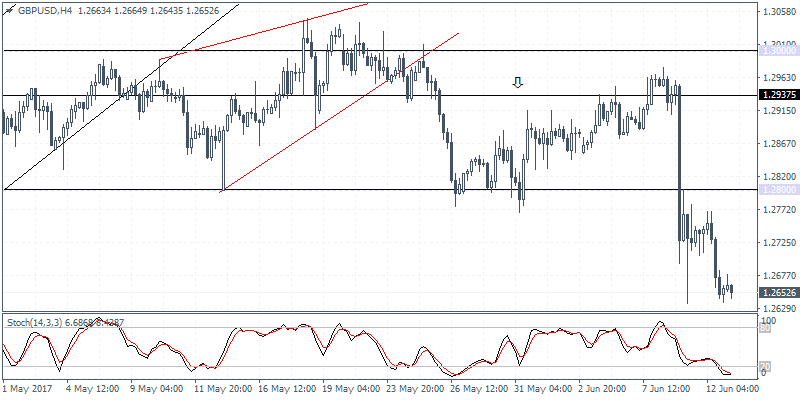

GBP/USD intraday analysis

GBP/USD (1.2652) continued to extend the declines, and now the support at 1.2600 will be likely tested in the near term. This completes the break-down of the head and shoulders pattern. Price action could possibly find support at 1.2600 with a little retracement likely although price action is likely to remain flat within 1.2600 and 1.2800.

In the event of a continued bearish momentum, GBP/USD will test the lower support at 1.2400. However, with the Stochastics currently overbought, we could see some near-term upside at 1.2800.

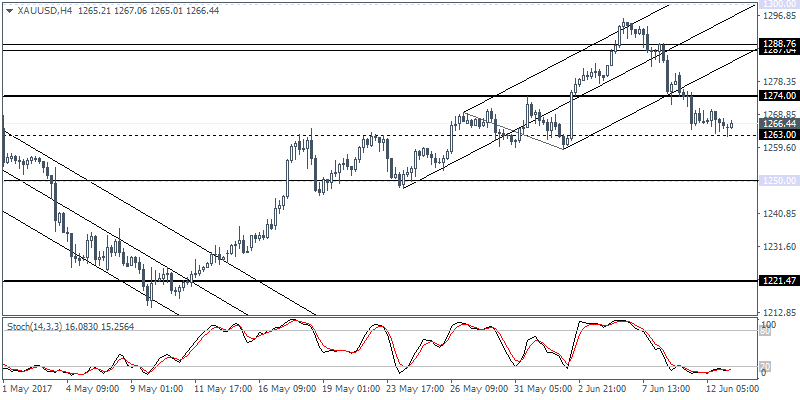

XAU/USD intraday analysis

USD/JPY (1266.44) Gold price remains rather subdued yesterday after posting strong declines for nearly three days at a stretch. Support on the daily chart is seen at 1250.00. On the 4-hour chart, price tested the support at 1263 closing with a doji. A near-term upside move could see gold prices retest 1274 where resistance could be established.

Thus, gold could remain range bound within 1274 and 1263. Below 1263, the support at 1250 remains to the downside, while above 1274, gold prices could test 1287 - 1288 resistance level.