Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Tired of following experts or 'gurus' that consistently provide after-the-fact and non-actionable interpretations? Follow the message of the market instead. Markets are either focused bull or bear opportunities, or consolidation/profit-taking (CP) against them.

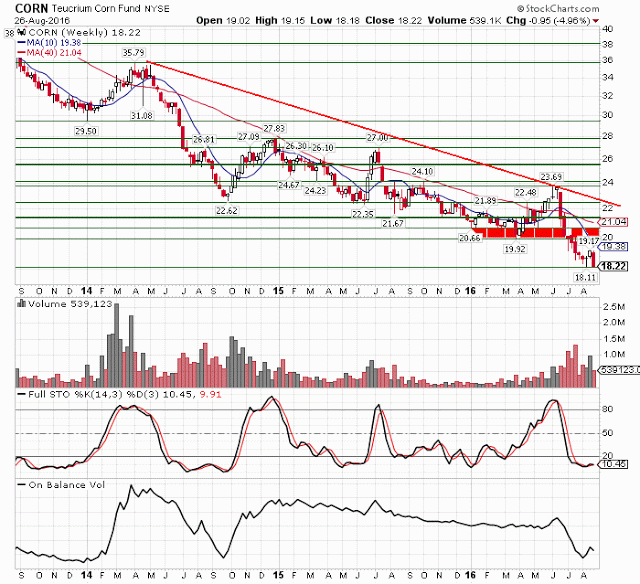

Corn's focused bear opportunity has produced an impressive 94% annualized gain for the bears since the second week of August. The message of patience, urged just two weeks ago, has rewarded the bears. Disciplined bears are booking partial profits and reducing risk into support.

A weekly close below 18.11 maintains the down impulse, while a close above resistance from 19.92 to 20.66 (red zone) pauses it and favors at least a retest of overhead resistance.

On Balance Volume (OBV), a crude measure of trend energy, suggests distribution. This favors the bears.