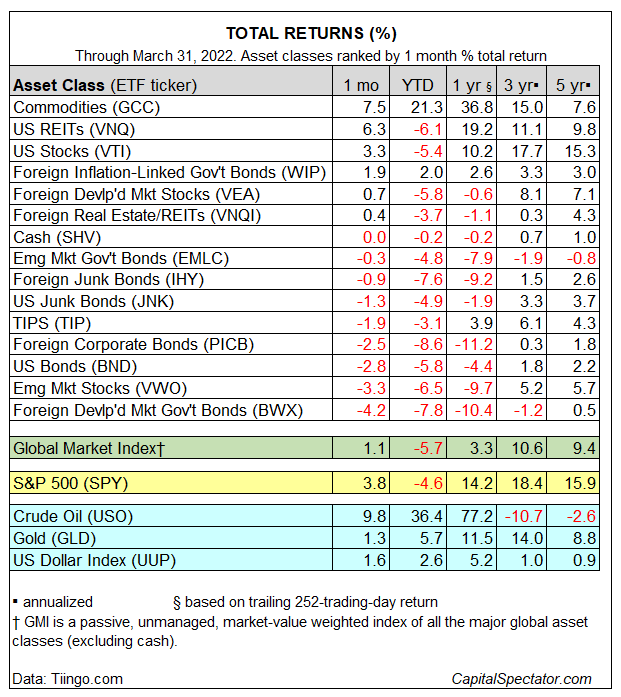

Commodities continued to top monthly returns for the major asset classes in March. The leadership marks the third straight month that raw materials outperformed the rest of the field by a wide margin, based on a set of proxy ETFs.

WisdomTree Continuous Commodity Index Fund (NYSE:GCC), a broad measure of raw materials, rose 7.5% last month. Year to date, GCC is up 21.3%, marking a large upside outlier performance so far this year for the major asset classes.

A strong second-place performance in March: US real estate investment trusts (REITs), which rebounded after a weak start to the year. Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) jumped 6.3%, the first monthly gain for the ETF in 2022.

US stocks also posted a solid gain in March via Vanguard Total US Stock Market (NYSE:VTI), which climbed 3.3% for the month just ended.

Overall, most of the major asset classes lost ground — again — last month. The biggest loser: foreign government bonds in developed markets. SPDR Bloomberg Barclays International Treasury Bond ETF (NYSE:BWX) tumbled 4.2% in March.

The Global Market Index (GMI) rebounded in March. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rose 1.1% — the first monthly gain this year.

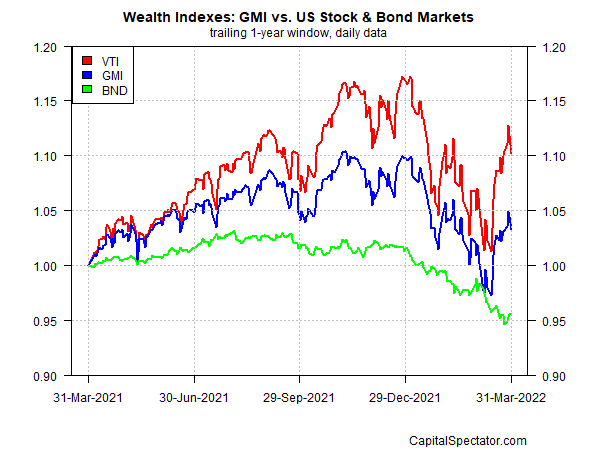

Reviewing GMI’s performance relative to US stocks and bonds over the past year continues to reflect a solid middling performance for this multi-asset-class benchmark (blue line in chart below). US stocks (VTI) earned a bit more than 10% for the trailing one-year window. By contrast, a broad measure of US bonds — Vanguard Total US Bond Market (NASDAQ:BND) — fell 4.4%. GMI earned 3.3% for the year ended Mar. 31.