The internet mafia is becoming increasingly aggressive.

If you’re a company operating online, you can either pay the mafia or suffer the consequences.

How bad are the consequences?

Well, based on what just happened to Netflix (NASDAQ:NFLX), let’s just say the wise “business move” might be to pay up.

You see, near the end of last year, Netflix began to experience rapidly declining download speeds.

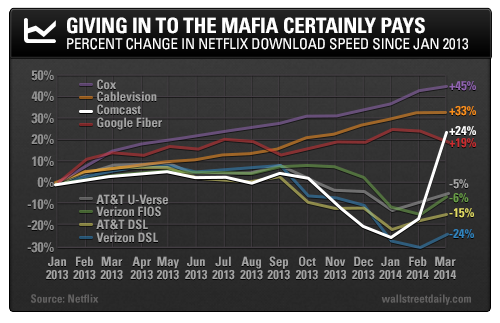

According to Netflix, streaming speeds had dropped by a significant margin on the major ISPs, Comcast (NASDAQ:CMCSA) and Verizon (NYSE:VZ). Yet download speeds remained steady on other ISPs during that time period.

Strangely suspicious, wouldn’t you agree? Well, wait until you see this chart…

As it turns out, Netflix’s traffic had been running through Comcast’s network via third parties, such as Cogent Communications (NASDAQ:CCOI).

The result was dreadfully slow download speeds for Netflix customers, who were offloading their frustrations on the company.

To get itself back in the internet fast lane, Netflix had to pay the mafia (ahem, Comcast) an exorbitant fee.

Now Netflix feeds Comcast its videos directly.

Since agreeing to pay up, streaming speeds for Comcast users jumped nearly 50% from 1.51 in January to 2.5 megabits per second, according to the latest data.

Netflix accused Comcast of resorting to bullying tactics in order to get a piece of the action.

Of course, now Verizon wants Netflix to pay up, too.

But the situation is about to get even uglier.

More than likely, we’re going to lose the internet to the mafia in the months ahead.

The FCC is reported to be considering a new rule that will permit ISPs to offer content providers a faster track to send content.

Unless something drastic happens, it’s going to pass.

The ripple effects will be far-reaching, even hitting us here at Wall Street Daily.

Under the new rule, the speed at which you’ll be able to watch our rich media content, like videos, will depend on how much we’re paying ISPs like Comcast and Verizon.

If Wall Street Daily wants to put its best foot forward, which we always do, we’ll be forced to pay up, just like Netflix did.

You can see the viral video that inspired today’s feature here.

Onward and Upward,

Urgent Update on Puerto Rico…

On May 19, 2014, I told you that something happened in Puerto Rico that demanded our closest investment attention.

Puerto Rico’s mid-March bond issue had just become the largest U.S. municipal junk bond sale in history.

I also told you that billionaire hedge fund manager, John Paulson, was among those extremely bullish on Puerto Rico, saying that “Puerto Rico will become the Singapore of the Caribbean.”

On such merits, you asked to receive news of any investment opportunities in Puerto Rico the moment I finished my research.

Well, Wall Street Daily’s top analyst just returned from Puerto Rico and briefed me on the situation, and it isn’t compelling.

Although Puerto Rico has nicely restructured its debt to make the latest bond an attractive investment, the nation is a long way from economic prosperity.

My analyst didn’t see a single crane or construction effort.

Some of the hotels were even mothballed.

As our analyst said, “The economy has turned the corner, but is in early stages of recovery. There’s lots of property available for sale. Many investors just walked away, leaving huge mortgages that will have to be written down. Banks on the island are not doing well because of huge loans outstanding, many of which are unlikely to be paid back in full.”

In light of this news, I will not be recommending any investment in Puerto Rico at this time.

Thank you for your interest.

BY Robert Williams