European shares gained yesterday after China announced that they are planning to remove several COVID-related restrictions, with the appetite rolling into the Asian trading today. Today, investors will pay attention to the Eurozone inflation data for May, as they can reshape bets around the ECB’s future course of action. Canada’s GDP data are also on the agenda, just a day after the Loonie rallied on upbeat current account data and a day before the BoC interest rate decision.

Equities Gain on Positive News from China, EZ CPIs to Reshape Bets on ECB Hikes

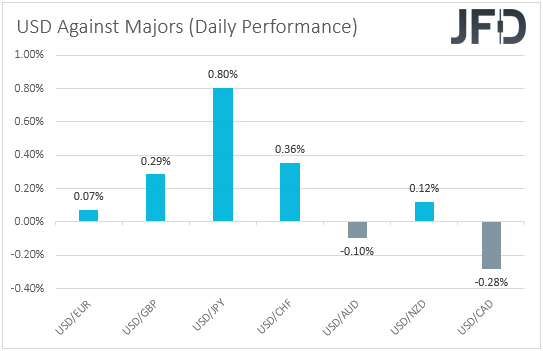

The US dollar traded higher against most of the other major currencies on Monday and during the Asian session Tuesday. It lost ground only versus CAD and AUD, while it gained the most versus JPY, CHF, and GBP. The greenback was found nearly unchanged against EUR.

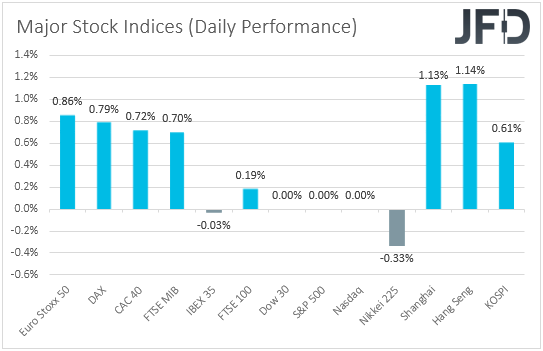

The strengthening of the risk-linked Loonie and Aussie, combined with the weakening of the safe-haven yen, suggests that market participants may have opened the week in a risk-on fashion, and indeed, taking a look at the performance of the equity world, we see that this was the case.

All but one of the European indices under our radar traded in the green, with the only exception being Spain’s IBEX 35. The positive appetite rolled over into the Asian session today. Among the indices we monitor, only Japan’s Nikkei slid. Markets in the US remained closed yesterday in celebration of Memorial Day.

The further improvement in investors’ appetite during the European session yesterday may have been the result of news that Chinese authorities are planning to remove several COVID-related restrictions on businesses on Wednesday, easing the lockdown measures adopted around two months ago, and that they are also preparing to introduce new policies to support the wounded economy.

With that in mind, PMI data today revealing another month of contraction for the world’s second-largest economy did very little to hurt morale. Investors now see the prospect of improvement in case more restrictions are lifted, and that’s why they decided to keep adding to their risk exposures.

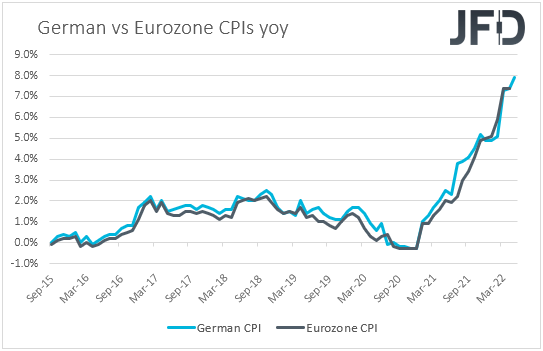

However, although we see the case for equities to keep climbing north, for now, we are reluctant to call for a long-lasting recovery. Yesterday, the preliminary CPIs for Germany came in much higher than expected, suggesting that Eurozone’s inflation rates may have also risen by more than anticipated during May.

What’s more, Fed Governor Christopher Waller said he is advocating for 50bps hikes on the table every meeting until we see a substantial reduction in inflation, pouring cold water on speculation that the Fed may pause after summer.

He added,

“Until we get that, I don’t see the point of stopping,”

Now back to the Eurozone CPIs, the headline rate is expected to have risen to +7.7% YoY from +7.4%, but the HICP excluding food and energy is forecast to have ticked down to +3.8% YoY from +3.9%. However, as we already mentioned, following the upside surprise in the German data yesterday, we expect a similar outcome here as well.

Last week, ECB President Christine Lagarde said that the ECB is likely to take its deposit interest rate out of the negative territory by the end of September and could lift it further if needed. Given that the deposit rate is at -0.50%, we initially believed this meant two quarter-point liftoffs, one in July and one in September. Some other ECB officials also supported that view.

So, with all that in mind, we believe that a strong acceleration in inflation could cement the case for a rate increase in July, but it could also increase speculation that the size of the hike could be 50bps rather than 25bps.

This could keep the euro supported against most of its major peers, even against the US dollar for now. However, we are reluctant to call for a longer-term trend reversal in EUR/USD. After all, the Fed is still expected to continue hiking faster than the ECB. Even if participants see the ECB accelerating its process, we doubt that Euro-area policymakers will adopt a path similar to the Fed.

After all, the US economy is in a better shape than the Eurozone, which could allow Fed officials to keep delivering double hikes, despite some fears over a slowdown recently. Fed Governor Waller is one of those willing to continue doing so, and more of his colleagues supporting that view could eventually help the US dollar recover at some point.

Now, flying to Canada, the Loonie was the leading gainer among the majors, boosted by data showing that the nation’s current account balance turned positive, marking the widest surplus since the second quarter of 2008. In our view, this solidifies the case for another double hike by the BoC tomorrow and increases the chances for another hawkish narrative.

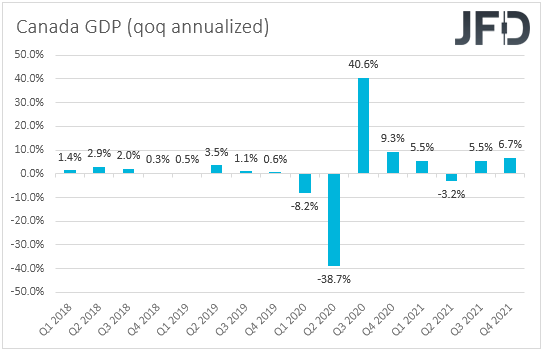

Before the meeting, we get the nation’s GDP data for Q1 later today. The annualized QoQ rate is forecast to have declined to +5.4% from +6.7%, but to be honest, we doubt that this could derail BoC officials from delivering a 50bps hike tomorrow.

After all, the data refer to the first quarter of the year, and we are already well into the second. The BoC itself appeared very optimistic at its latest gathering, which was held on Apr. 13, still after the first quarter was over. On top of that, monthly data concerning months of the second quarter justify the case for another double hike. The unemployment rate slid further, while inflation kept accelerating in both headline and core terms.

As for tonight, during the Asian session, Australia’s GDP for Q1 is due to be released. The QoQ rate is forecast to have slid to +0.7% QoQ from +3.4%, which will take the YoY rate down to +3.0% from +4.2%.

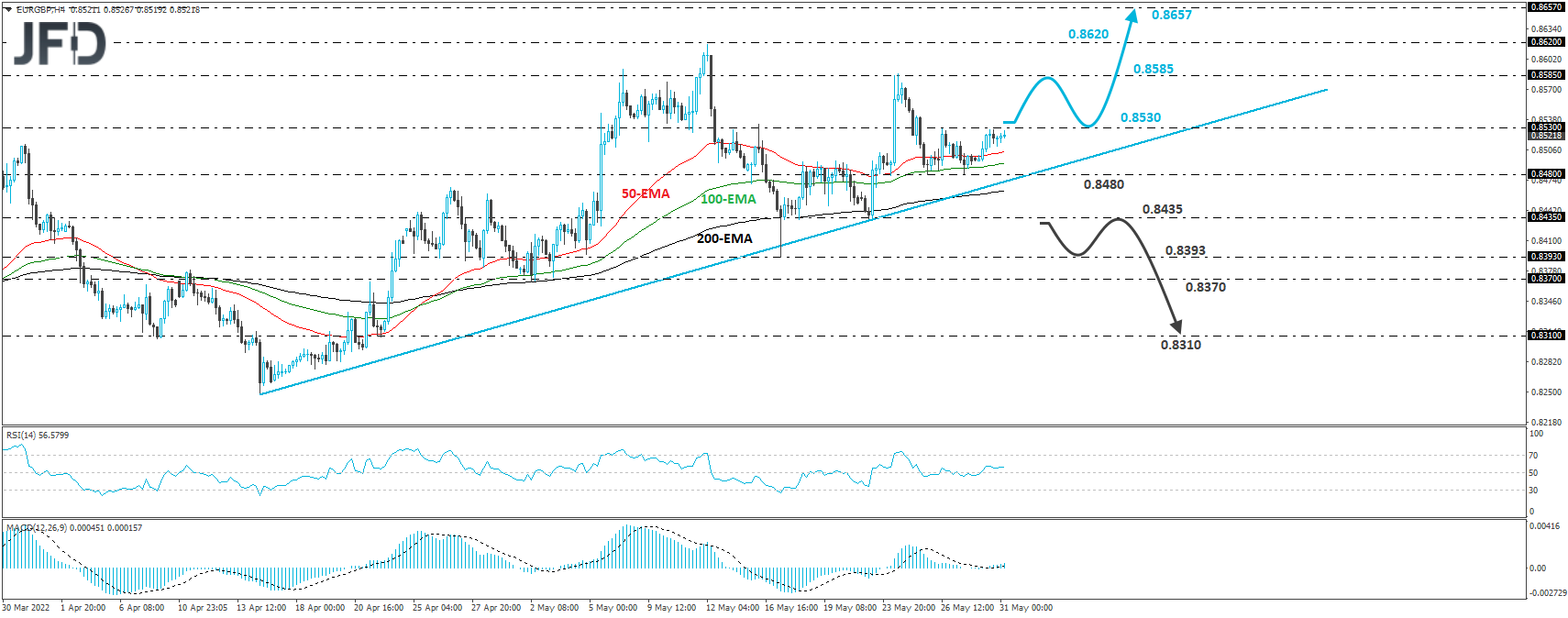

EUR/GBP – Technical Outlook

EUR/GBP traded in a consolidative manner yesterday, staying slightly below the 0.8530 zone, marked by the high of May 26. Overall though, the pair remains above the upside support line drawn from the low of Apr. 14, and thus, we will maintain the view that the short-term picture is positive.

A clear and decisive break above 0.8530 could confirm the case for further advances and may initially pave the way towards the peak of May 24, at around 0.8585. Another break above 0.8585 could aim for the 0.8620 barrier, marked by the high of May 12, and if the bulls are not willing to stop there either, we could see them targeting the peak of Sept. 29, at 0.8657.

On the downside, we would like to see a decisive dip below 0.8435, marked by the low of May 23, before we abandon the bullish case. The rate will be well below the aforementioned upside line, and we may see the bears initially targeting the 0.8393 barrier, marked by the low of May 17, or the 0.8370 zone, marked by the lows of May 2 and May 3.

Another break, below 0.8370, could extend the fall towards the 0.8310 territory, defined as a support by the low of Apr. 21.

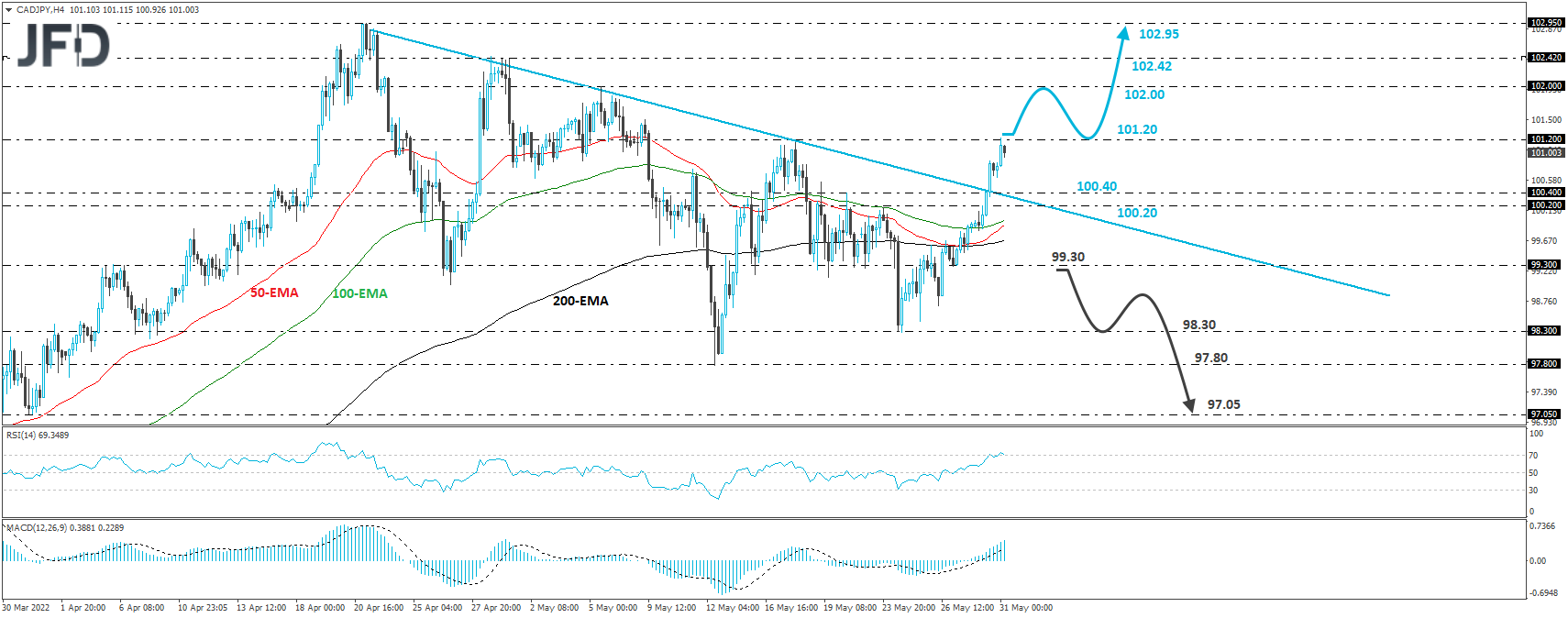

CAD/JPY – Technical Outlook

CAD/JPY traded higher yesterday, breaking above the downside resistance line taken from the high of Apr. 21. That said, the advance was stopped near the 101.20 zone, slightly above the peak of May 18. We believe that the break above the aforementioned downside line has turned the outlook positive, and thus, we see decent chances for more advances.

A break above 101.20 could trigger extensions towards the peak of May 5, at around 102.00, which could target the 102.42 zone, marked by the peaks of April 28th and 29th. If the bulls don’t stop there either, we may see them pushing towards the peak of Apr. 21, at around 102.95.

We will start examining the bearish case again, only if we see an apparent dip back below 99.30, which is near the low of May 27. The rate will be back well below the pre-discussed downside line, and thus, such a break could pave the way towards the low of May 24, at 98.30, or the low of May 12, at 97.80. Another break, below 97.80, could extend the slide towards the low of Mar. 31, at 97.05.