1. Matter of time rising Mortgage and Personal Loan EMI will start eating into household incomes. I expect Mortgage rates to easily cross 9% so that will be the additional burden on household finances. This in my view will start impacting Urban consumption.

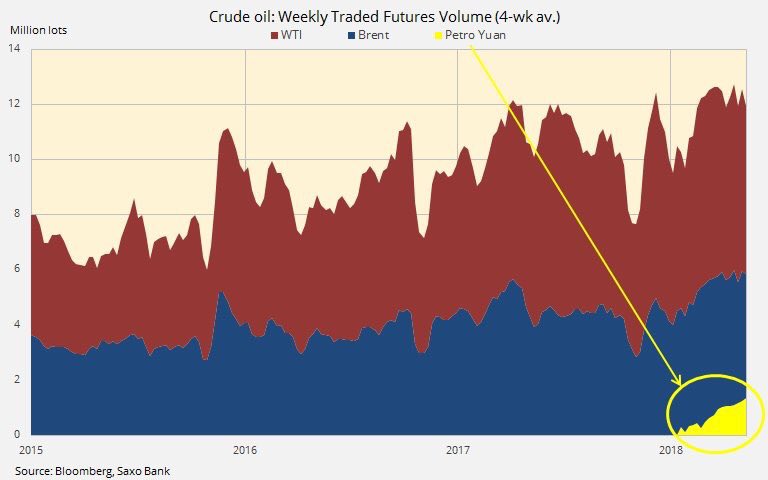

2. The Petroyuan… Tiny, Irrelevant, Nothing. Right? But who would have thought OIL will start getting priced in YUAN. China can just bypass IRAN sanction by pricing OIL traded in chinese currency known as PETROYUAN

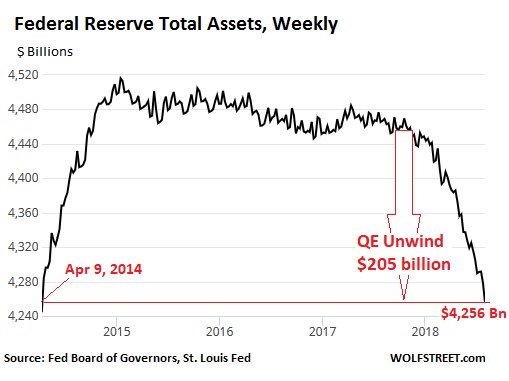

3. The Fed Accelerates its QE Unwind. Mopping up liquidity. Shedding Treasuries and Mortgage Backed Securities and one thing I have learned hard way. Liquidity creates fundamentals not the other way around and FED is shrinking Liquidity

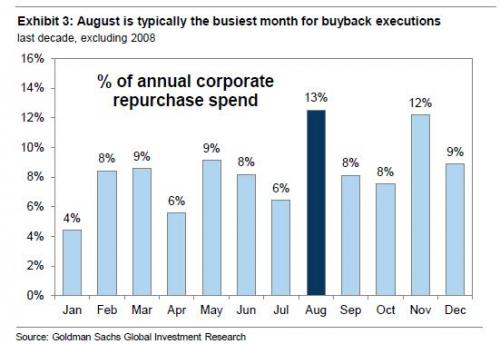

4. Anybody will get bearish after seeing the above chart of shrinking FED balance sheet but here is the kicker: whereas some traders have voiced caution that August has in recent years been the month with the highest seasonal volatility, and could therefore surprise to the downside, especially with virtually non-existent liquidity…… Goldman has a far more optimistic take on what’s in story: “August is the most popular month for repurchase (Buybacks) executions, accounting for 13% of annual activity.”So liquidity is still ample for time being