Shipping fleet operator Castor Maritime (NASDAQ:CTRM) stock has been on a rollercoaster ride this year as sinks through a steady wave of dilution. The Cyprus-based company has acquired 20 vessels in 2021, mostly funded by raising cash through share offerings resulting in further dilution. It executed a 1-for-10 reverse stock split to meet the NASDAQ $1 price compliance mandate. The Company has been aggressive in acquiring new ships as it grows its fleet to 26 vessels. The Company currently has nearly 90 million outstanding shares post-reverse split. While bears attack from all angles citing dilution, speculative longs see this stock as a potential short squeeze play especially with the reverse split as dry bulk shipping rates are booming and the Company has swung into profitability. The Company is pursuing a dilution-based method of raising cash to grow its fleet via an acquisition strategy. Currently, the Company holds twice as much cash as debt and fundamentals appear to be improving as the post-pandemic reopening is surging dry bulk shipping rates. This is a micro-cap stock that is only suitable for speculators looking for an outsized return accompanied by high risk on deep opportunistic pullback levels.

Q1 FY 2021 Earnings Release

On June 3, 2021, Castor Maritime released its fiscal first-quarter 2021 results for the quarter ending March 31, 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.02 or net income of $1.1 million compared to a net lost of (-$0.68) for same period year ago. Revenues rose 159% year-over-year (YoY) to $7 million versus $2.7 million in Q1 2020. The Company generated $2.6 million EBITDA in Q1 2021 versus $0.9 million in Q1 2020. Cash and restricted cash was $64.2 million at the end of the quarter compared to $9.4 million at the end of December 2020. As of the beginning of 2021, Castor announced the acquisition of 20 vessels across the dry bulk and tanker segments consisting of: 1 Capesize, 7 Kamsarmax, and 4 Panamax dry bulk carriers as well as 1 Aframax, 5 Aframax/LR2 and 2 MR1 tankers. As of June 2, 2021, the Company has taken delivery of 14 vessels with 6 expected to be delivered by the fourth quarter of 2021. On a fully diluted basis, the Company will own 26 vessels in its fleet with a capacity of 2.2 million dwt. Castor Maritime CEO Petros Panagiotidis stated:

“The first five months of 2021 was a transformational period for our Company, as we were able to raise $252.2 million of equity and $33.3 million of debt and grow our fleet from 6 vessels, at the end of 2020, to 26 vessels on a fully delivered basis and once we complete all of our announced acquisitions. On a fully delivered basis, our fleet will consist of 18 dry bulk carriers and 8 tankers, allowing us to benefit from the ongoing strong demand for dry bulk transportation services as evidenced by the recent charter fixtures of a number of our dry cargo vessels, as well as from a potential future recovery in the tanker market.”

Updates

The vessel acquisitions in the quarter enabled charter revenues to increase to $7 million in Q1 2021.It enabled Available Days to increase from 214 to 596 in the three months ended in Mar. 31, 2021. Dry bulk shipping rates were strong ranging from $18,500 gross per day to $27,500 gross per day as the Company expects 9 of its vessels to continue benefitting from the higher prices. The Company ended the quarter with $33.2 million in outstanding debt.

Offerings

The Company raised $125 million in proceeds on Apr. 7, 2021, with a direct 19.230 million share offering priced at $6.50 which included one common share and one warrant. No warrants were yet exercised as of the earnings release. The Company took delivery of 2011 Japanese Panamax dry bulk vessel, M/V Magic Eclipse and commenced employed on June 9, 2021, under a time chart contract for 105 days at a daily gross rate of $26,500. On June 17, 2021, Castor took delivery of M/T Wonder Musica and inks charter agreement for M/V Magic Rainbow at a gross daily rate of $25,000 per day with a lease term between 7 to 9 months.

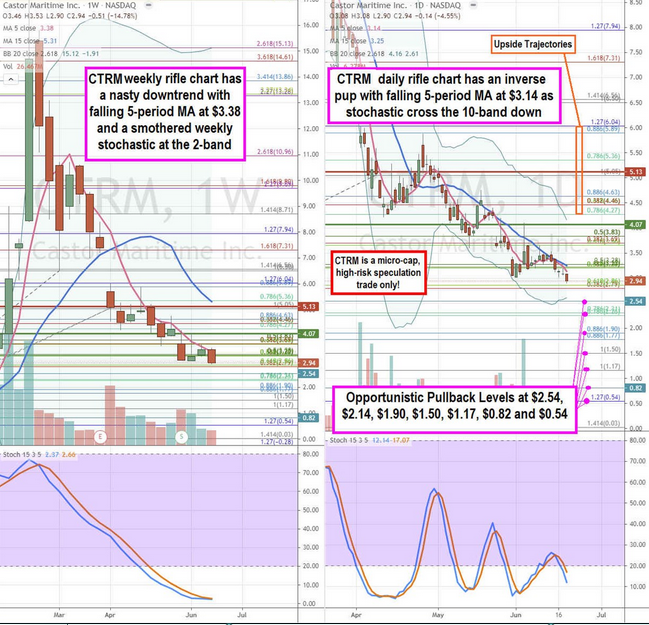

CTRM Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the landscape for CTRM stock. The weekly rifle chart is in a downtrend with a falling 5-period moving average (MA) at $3.38. The weekly stochastic is extremely oversold at the 2-band. The daily rifle chart has an inverse pup breakdown with the 5-period MA at $3.25 and 15-period MA falling at the $3.34 Fibonacci (fib) level. The daily market structure high (MSH) sell triggered on the breakdown below $5.13. The daily lower Bollinger Bands (BBs) are at $2.61. The daily stochastic took a bearish mini inverse pup through the 20-band down. The daily can form a market structure low (MSL) buy trigger above $4.07 but it will need to coil the daily stochastic back up. Speculators can monitors for opportunistic pullback levels at the $2.54 stinky 2.50s levels/daily lower BBs, $2.14 fib, $1.90 fib, $1.50 fib, $1.17 fib, $0.82 fib, and the $0.54 fib. Upside trajectories range from the $4.27 fib up towards the $6.04 fib level.