We expect Castlight Health Inc. (NYSE:CSLT) to beat earnings expectations when it reports first-quarter 2017 earnings results on Apr 26.

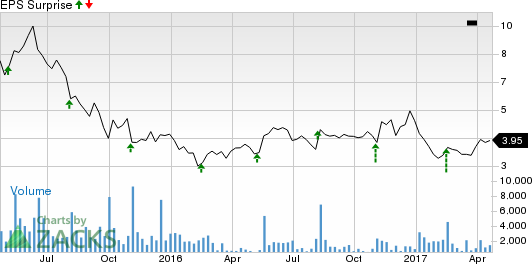

Last quarter, the company posted a positive earnings surprise of 36.36%. Castlight boasts a solid earnings track record, having beaten estimates in each of the trailing four quarters. The average earnings surprise over the last four quarters is a positive 22.56%.

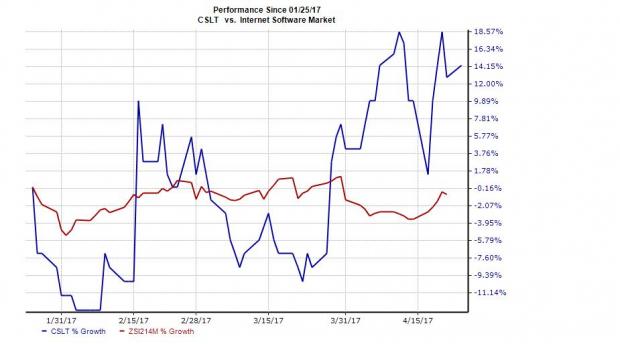

We also note that shares of Castlight outperformed the Zacks categorized Internet - Software industry in the last three months. While the stock recorded growth of 14.3%, the industry lost 0.9%.

Why a Likely Positive Surprise?

Our proven model shows that Castlight is likely to beat on earnings because it has the right combination of two key ingredients.

Zacks ESP: The Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is pegged at +11.11%. This is very meaningful and a major indicator of a likely earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Castlight Health carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 have significantly higher chance of beating earnings estimates.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

The combination of Castlight’sZacks Rank #3 and ESP of +11.11% makes us confident of an earnings beat in the upcoming report.

Factors to Consider

Castlight’s cloud-based software platform enables enterprises to gain control over their rapidly escalating health care costs. Reduction in operating expenditure led to the narrower loss in the fourth quarter. We believe that stringent cost control will continue to improve the bottom line.

Furthermore, significant investments in growth areas for improving implementation timelines are a positive. The company’s platform has been selected by the likes of CSM Bakery, HUB International and more recently by the George Washington University. Its growing customer base is a positive.

Castlight Health, inc. Price and EPS Surprise

Stocks to Consider

Here are some stocks that you may want to consider as our model shows these have the right combination of elements to post a positive earnings surprise:

Square, Inc. (NYSE:SQ) , with an Earnings ESP of +12.50%, and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Western Digital Corporation (NASDAQ:WDC) with an Earnings ESP of +2.16% and a Zacks Rank #1.

Seagate Technology plc (NASDAQ:STX) , with an Earnings ESP of +3.77%, and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Western Digital Corporation (WDC): Free Stock Analysis Report

Seagate Technology PLC (STX): Free Stock Analysis Report

Square, Inc. (SQ): Free Stock Analysis Report

Castlight Health, inc. (CSLT): Free Stock Analysis Report

Original post

Zacks Investment Research