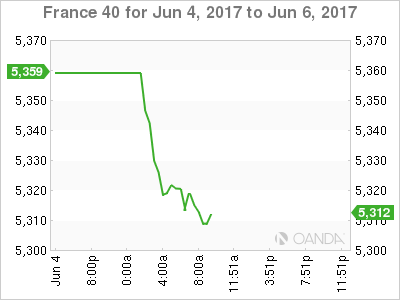

The French stock market has ticked lower in the Monday session, and the CAC index has dropped 0.68 percent. Currently, the CAC is trading at 5,307.80 points. On the release front, there was mixed news from the services sector, as French and Eurozone PMIs continue to point to expansion. French Services PMI improved to 57.2, but this missed the estimate of 58.0 points. Eurozone Services PMI edged lower to 56.3, above the forecast of 56.2 points. On Tuesday, the Eurozone releases Sentix Investor Confidence and Retail Sales.

It was a quiet week for the French stock markets, but that could change, with French voters going back to the polls on June 11. In two rounds of voting, the French electorate will choose the 577 members of the National Assembly. French President Emmanuel Macron’s LREM party is on track to win the first round, with the latest polls giving Macron’s party 31 percent of the vote, well ahead of the conservative Republicans, who are at just 22 percent. If Macron can translate this lead into a strong showing in the second round, the LREM could form a majority in parliament, which would mark a major victory for Macron.

The US labor markets has been performing well, so the markets were all the more surprised at the dismal Nonfarm Payroll report, which was released on Friday. The economy produced just 131 thousand jobs in May, well short of the forecast of 181 thousand. Wage growth remains soft, and edged down from 0.3% to 0.2%. The unemployment rate dropped to 4.3%, but this reading can be largely explained by a decline in the participation rate. The disappointing employment reports are unlikely to alter the Fed’s plan to raise rates next week, but policymakers remain cautious, and if upcoming data misses expectations, additional rate hikes could be in jeopardy.

Despite some disappointing US job numbers, the odds of a rate hike have climbed to 96%, according to the CME Group (NASDAQ:CME), up from 88% just a week ago. Traders should note that ahead of the March hike, the odds of a rate hike were also close to 100%, and the dollar actually lost ground after the Fed followed through with a quarter-point increase. Although an increase in interest rates would mark a vote of confidence in the US economy, the Fed continues to have its concerns. Inflation remains stubbornly low, despite a labor market that remains close to capacity. Fed policy makers are also scratching their heads over soft consumer spending, which has not kept pace with high levels of consumer confidence. As for additional rate hikes in the second half of 2017, the markets are skeptical, with the odds of a September rate hike at just 26%.

Economic Events

Monday (June 5)

- 3:50 French Final Services PMI. Estimate 58.0. Actual 57.2

- 4:00 Eurozone Final Services PMI. Estimate 56.2. Actual 56.3

Tuesday (June 6)

- 4:10 Eurozone Retail PMI

- 4:30 Eurozone Sentix Investor Confidence. Estimate 27.6

- 5:00 Eurozone Retail Sales. Estimate 0.2%

*All release times are EDT

*Key events are in bold

CAC, Monday, June 5 at 8:35 EDT

Open: 5338.65 High: 5343.35 Low: 5305.80 Close: 5307.80