Last week, we asked the question, “Is the bear market over?

Our answer was simple: “The ‘Bear Market’ won’t be over until the credit markets get fixed.”

On Monday, the market sold off to new lows, forcing the Federal Reserve to inject more liquidity to try and stabilize the “broken” credit market. Then on Tuesday, before the markets opened, we wrote:

“From a purely technical basis, the extreme downside extension, and potential selling exhaustion, has set the markets up for a fairly strong reflexive bounce. This is where fun with math comes in.

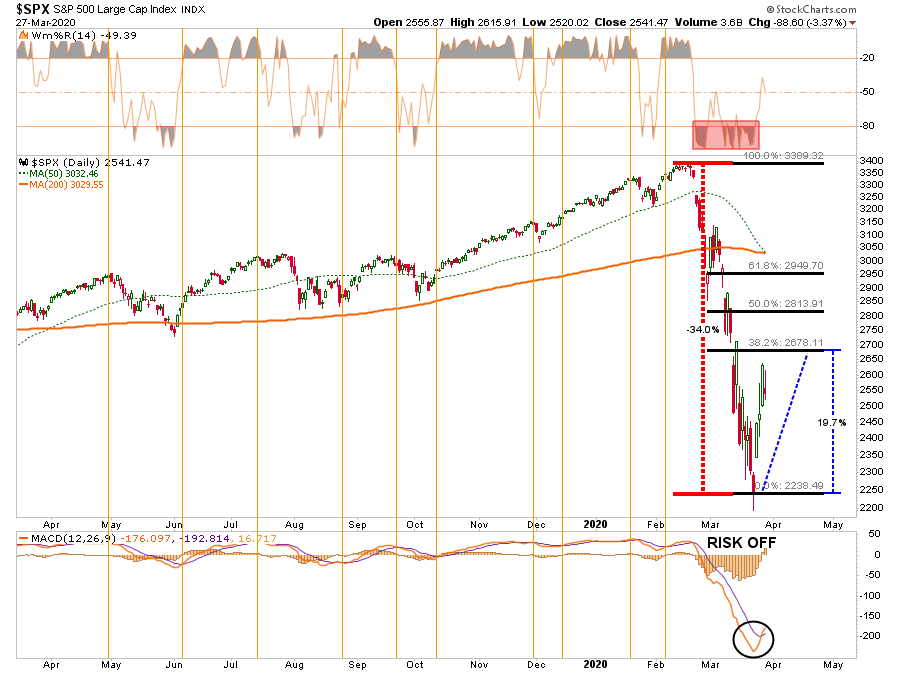

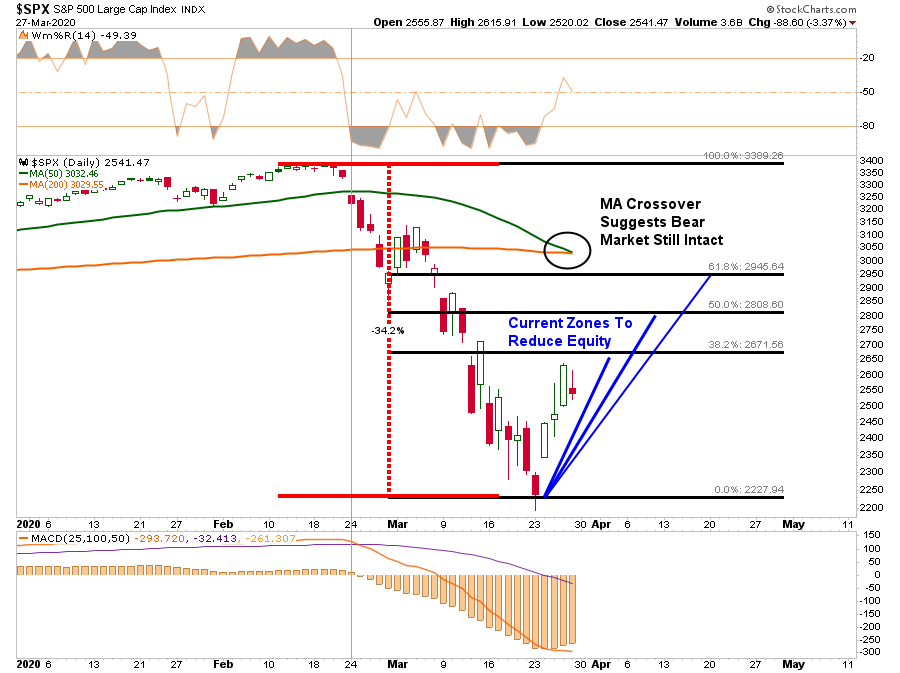

As shown in the chart below, after a 35% decline in the markets from the previous highs, a rally to the 38.2% Fibonacci retracement would encompass a 20% advance.

Such an advance will ‘lure’ investors back into the market, thinking the ‘bear market’ is over.”

Chart Updated Through Friday

Not surprisingly, here were the headlines, almost exactly as we wrote them:

Well, you get the idea.

While it was indeed a sharp “reflex rally,” and expected, “bear markets” are not resolved in a single month. More importantly, “bear markets” only end when “NO ONE wants to buy it.”

Fed Can’t Fix It

As noted above, the “bear market” will NOT be over until the credit market is fixed. We are a long way from that being done, given the blowout in yields currently occurring.

You are not at the bottom of a #bearmarket when this is going on in #credit. pic.twitter.com/LQS2oerd50

— Lance Roberts (@LanceRoberts) March 25, 2020

However, the Fed is throwing the proverbial “kitchen sink” at the issue. As Jim Bianco noted on Friday:

“In just these past few weeks:

- The Fed has cut rates by 150 basis points to near zero and run through its entire 2008 crisis handbook.

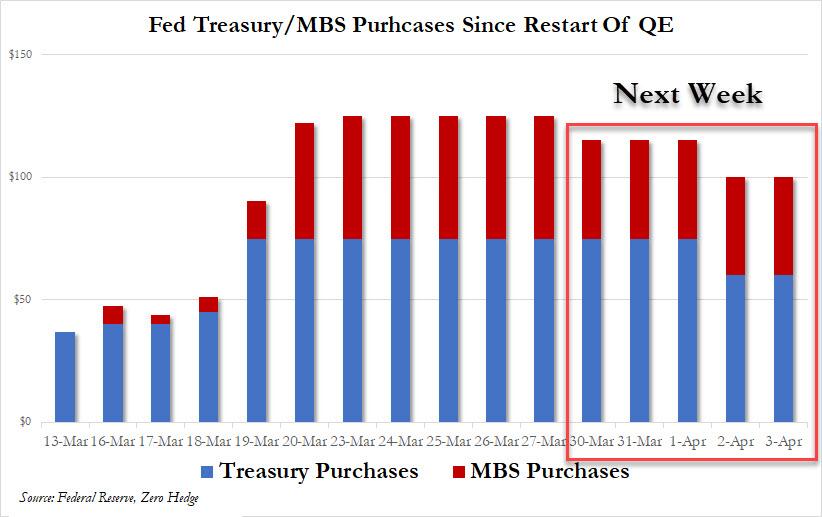

- That wasn’t enough to calm markets, though — so the central bank also announced $1 trillion a day in repurchase agreements and unlimited quantitative easing, which includes a hard-to-understand $625 billion of bond-buying a week going forward. At this rate, the Fed will own two-thirds of the Treasury market in a year.

But it’s the alphabet soup of new programs that deserve special consideration, as they could have profound long-term consequences for the functioning of the Fed and the allocation of capital in financial markets. Specifically, these are:

- CPFF (Commercial Paper Funding Facility) – buying commercial paper from the issuer.

- PMCCF (Primary Market Corporate Credit Facility) – buying corporate bonds from the issuer.

- TALF (Term Asset-Backed Securities Loan Facility) – funding backstop for asset-backed securities.

- SMCCF (Secondary Market Corporate Credit Facility) – buying corporate bonds and bond ETFs in the secondary market.

- MSBLP (Main Street Business Lending Program) – Details are to come, but it will lend to eligible small and medium-sized businesses, complementing efforts by the Small Business Association.

To put it bluntly, the Fed isn’t allowed to do any of this.”

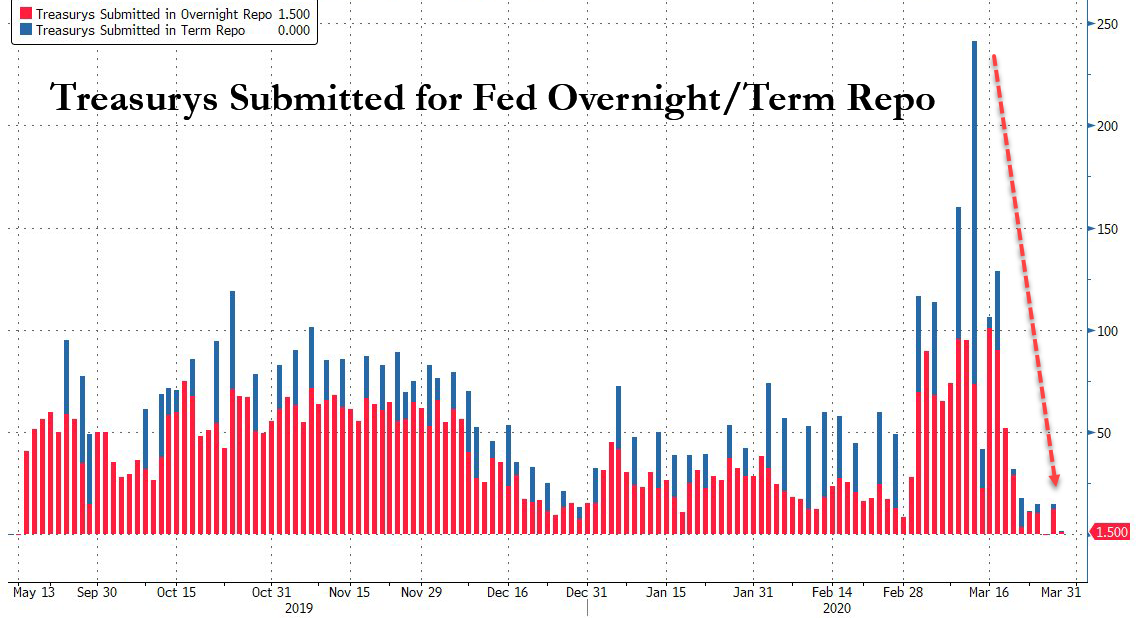

However, on Friday, the Federal Reserve ran into a problem, which could poses a risk for the markets going forward. As Jim noted, the mind-boggling pace of bond purchases quickly hit the limits of what was available to pledge for collateral.

Or rather, the Fed’s “unlimited QE,” may not be so “unlimited” after all.

The consequence is the Fed is already having to start cutting back on its QE program. That news fueled the late-day sell-off Friday afternoon. (Charts courtesy of Zerohedge)

While Congress did pass the “CARES” act on Friday, it will do little to backstop what is about to happen to the economy for two primary reasons:

- The package will only support the economy for up to two months. Unfortunately, there is no framework for effective and timely deployment; firms are already struggling to pay rents, there are pockets of funding stress in credit markets as default risks build, and earnings guidance is abandoned.

- The unprecedented uncertainty facing financial markets on the duration of social distancing, the depth of the economic shock and when the infection rate curve will flatten, and there are many unknowns which will further undermine confidence.

Both of these points are addressed in this week’s Macroview but here are the two salient points to support my statement:

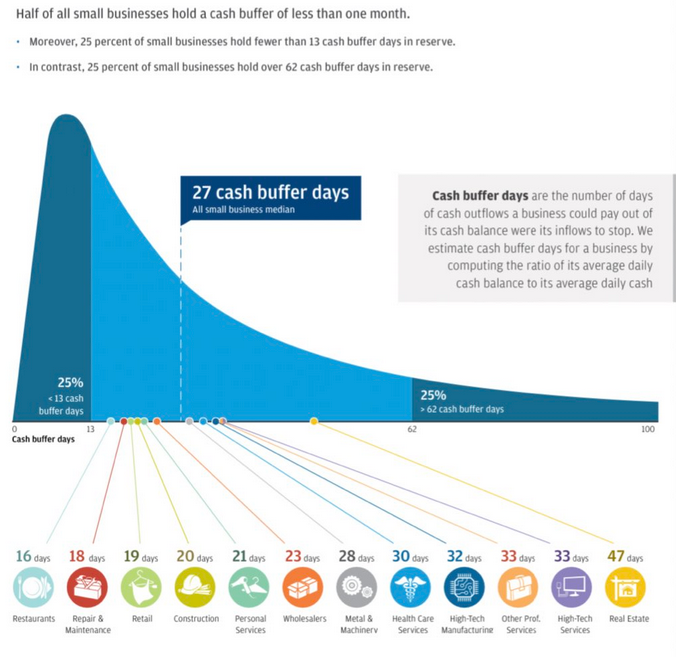

“Most importantly, as shown below, the majority of businesses will run out of money long before SBA loans, or financial assistance, can be provided. This will lead to higher and longer-duration of, unemployment.”

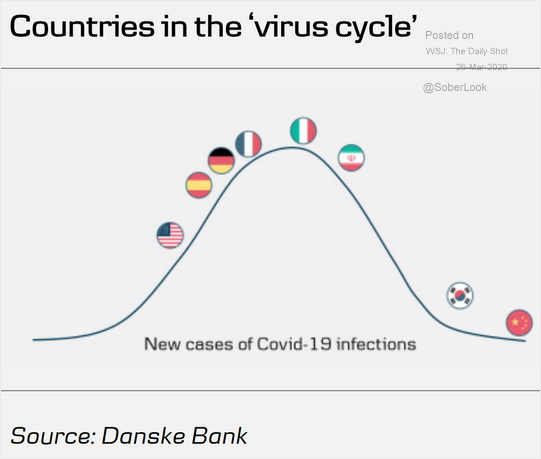

“While there is much hope that the current ‘economic shutdown’ will end quickly, we are still very early in the infection cycle relative to other countries. Importantly, we are substantially larger than most, and on a GDP basis, the damage will be worse.”

What the cycle tells us is that jobless claims, unemployment, and economic growth are going to worsen materially over the next couple of quarters.

The problem with the current economic backdrop, and mounting job losses, is the vast majority of American’s were woefully unprepared for any type of disruption to their income going into the recession. As job losses mount, a virtual spiral in the economy begins as reductions in spending put further pressures on corporate profitability. Lower profits leads to higher unemployment and lower asset prices until the cycle is complete.

The Bear Still Rules

This past week, we published several pieces of analysis discussing why this was a “bear market rally” to be sold into. On Friday, our colleague, Jeffery Marcus of TP Analystics, penned the following:

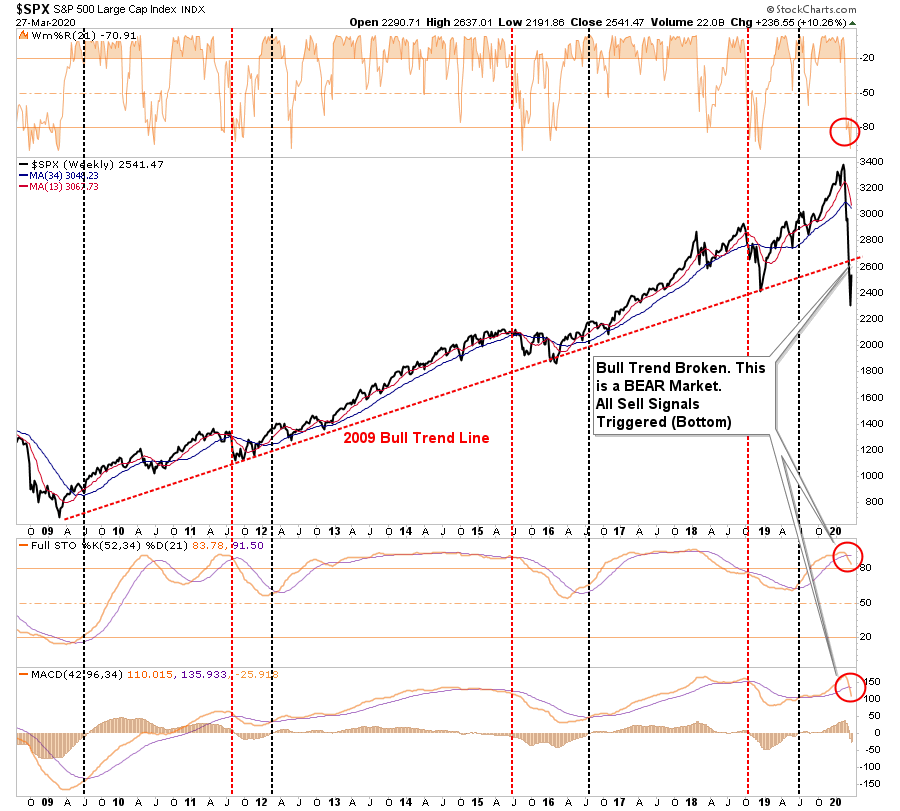

- The long term bull pattern that existed since the 3/9/09 is over. That means the pattern of investors confidently buying every decline is over.

- The market became historically oversold on 3/23 using many metrics, and that oversold condition coincided with the long term support area of S&P 500 2110-2180.

- The short-covering and rebalancing had a lot to do with the size and speed of the 3-day rally. Also, we know the lack of ETF liquidity played a huge role as well as algorithmic trading.

- Technically the market can still go up 6.9% higher from here to hit the 50% retracement level (3386 – 2237 = 1149/2 = 574 + 2237 = 2811….2811/2630 = +6.9%.) I would not bet on it.

- The market only sustains a rally once there is light at the Coronavirus tunnel.

- I do not think the S&P 500 will hit a new high this year. Maybe not in 2021, either.

His analysis agrees with our own, which we discussed with you last week.

“The good news is the markets are now more extremely oversold on a variety of measures than at just about any other point in history.

Warning: Any reversal will NOT BE the bear market bottom. It will be a ‘bear market’ rally you will want to ‘sell’ into. The reason is there are still many investors trapped in ‘buy and hold’ and ‘passive indexing’ strategies that are actively seeking an exit. Any rallies will be met with redemptions.

Most importantly, all of our long-term weekly ‘sell signals’ have now been triggered. Such would suggest that a rally back to the ‘bullish trend line’ from 2009 will likely be the best opportunity to ‘sell’ before the ‘bear market’ finds its final low.”

Last week’s chart updated through Friday’s close.

While the recent lows may indeed turn out to be “the bottom,” I highly suspect they won’t. Given the sell signals have been registered at such high levels, the time, and distance, needed to reverse the excesses will require a deeper market draw.

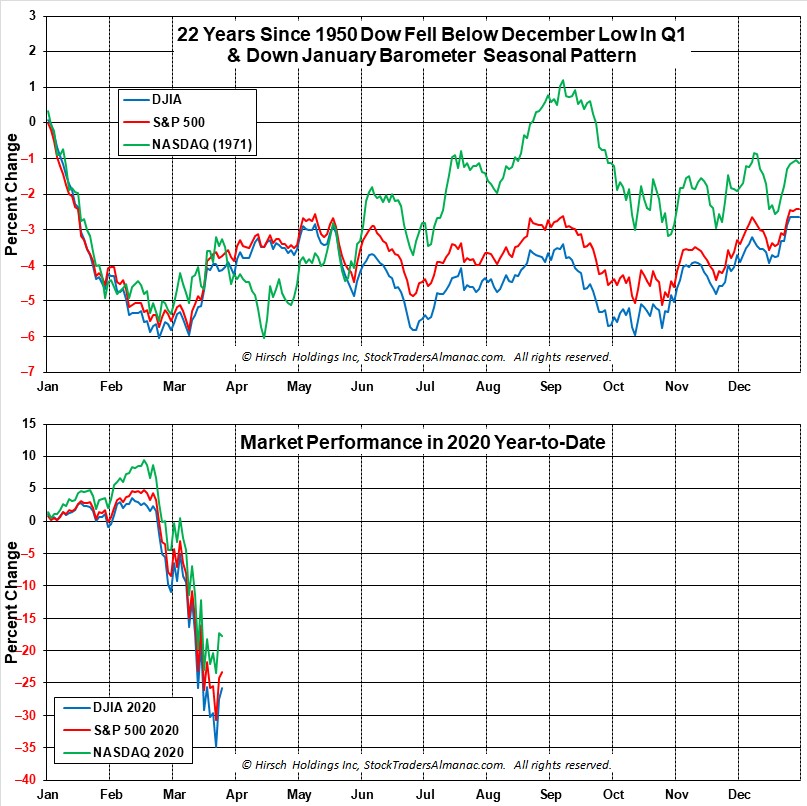

As Jeff Hirsch from Stocktrader’s Alamanc noted:

“While we are all rooting for the market to find support here so much damage has been done. A great deal of uncertainty remains for the economy and health crisis. This looks like a bear market bounce.

History suggests that we are in for some tough sledding in the market this year with quite a bit of chop. When the January Barometer came in with a negative reading, our outlook for 2020 began to diminish as every down January since 1950 has been followed by a new or continuing bear market, a 10% correction, or a flat year. Then another warning sign flashed when DJIA closed below its December closing low on February 26, 2020 as the impact of this novel coronavirus began to take its toll on Wall Street.

In the March Outlook, we presented this graph of the composite seasonal pattern for the 22 years since 1950 when both the January Barometer as measured by the S&P 500 were down, and the Dow closed below its previous December closing low in the first quarter. Below is a graph of DJIA, S&P 500 and NASDAQ Composite for 2020 year-to-date as of the close on March 25. Comparing 2020 market action to these 22 years, suggests a choppy year ahead with the potential for several tests of the recent low.”

“The depth of this waterfall decline may be too deep for the market to rebound quickly. This bear market also put this year’s Best Six Months (November-April) at risk of being negative. The record of down Best Six Months is not encouraging and it reminds us of a salient quote from the Almanac from an old market sage,

‘If the market does not rally, as it should during bullish seasonal periods, it is a sign that other forces are stronger and that when the seasonal period ends those forces will really have their say.’— Edson Gould (Stock market analyst, Findings & Forecasts, 1902-1987)'”

On a short-term basis, the market is also suggesting some risk. The daily chart below shows the market rallied to, and failed at, the first level of the Fibonacci retracement we outlined last week, suggesting profits be taken at this level. While there are two remaining targets for the bear market rally, the probabilities weigh heavily against them. (This doesn’t mean they can’t be achieved, it is “possible,” just not “probable.”)

Furthermore, with the “Death Cross” triggering on Friday (the 50-dma crossing below the 200-dma), this will put further downside pressure on any “bear market” advance from current levels.

Given the magnitude, and multiple confirmations, of these signals, it is far too soon to assume the “bear market” is over. This is particularly the case, given the sell-off is less than one-month-old.

Bear markets, and recessions, tend to last 18-months on average.

The current bear market and recession are not the results of just the “coronavirus” shock. It is the result of many simultaneous shocks from:

- Economic disruption

- Surging unemployment

- Oil price shock

- Collapsing consumer confidence, and

- Most importantly, a “credit event.”

We likely have more to go before we can safely assume we have turned the corner.

In the meantime, use rallies to raise cash. Don’t worry about trying to “buy the bottom.” There will be plenty of time to see “THE” bottom is in, and having cash will allow you to “buy stocks” from the last of the “weak hands.”