The Loonie weakened yesterday, as the BoC remained dovishly on hold at +1.75%. The bank abandoned any rate-hike plans for the near future as it “judges that an accommodative policy interest rate continues to be warranted”. On the other hand, BoC sees increasing growth in household spending and growth picking up pace in the second half of 2019. In the following press conference, BoC governor Poloz, said that he expects the slowdown to be temporary and that the setting of rates will give the bank a positive outlook with stronger growth ahead.

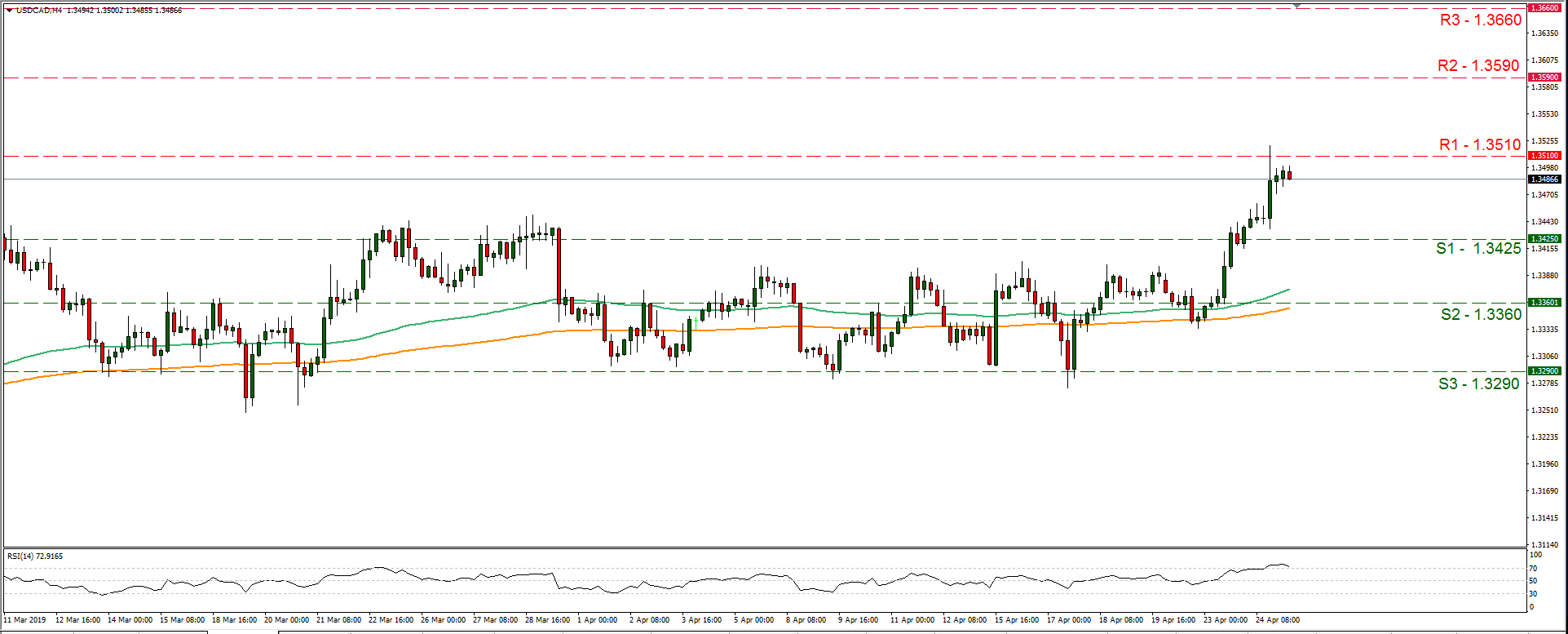

We expect the decision to continue to weigh on the Loonie for the next couple of days, unless there is a positive surprise in the oil market. USD/CAD rose yesterday as the Loonie weakened, testing the 1.3510 (R1) and later correcting lower. We could see the pair continue to rise today, as the US financial releases could be providing another boost for the USD side of the pair. Also the pair may prove sensitive to any developments in the oil market. Please note that the pair’s RSI indicator in the 4-hour chart has surpassed the reading of 70, implying a rather overcrowded long position. Should the pair find fresh buying orders along its path, we could see it breaking the 1.3510 (R1) resistance line and aim for the 1.3590 (R2) resistance level. Should on the flip side, the pair come under the selling interest of the market, we could see it breaking the 1.3425 (S1) support line and aim for lower grounds.

EUR Weakens On Weak German Prospects

German business climate worsened in April as it was evident by the drop of the Ifo business climate indicator, released yesterday, hence the common currency weakened. Against the USD, the EUR hit a 22 month low suffering the biggest daily loss since early March when the ECB delayed plans for a rate hike near the end of the year. Worries about the prospects of the German economy and their effect regarding a possible slowdown in the Eurozone have increased. On the flip side, analysts point out that the weak economic performance of the euro area and other countries, tends to underscore the dominance of the US economy at least at the current stage.

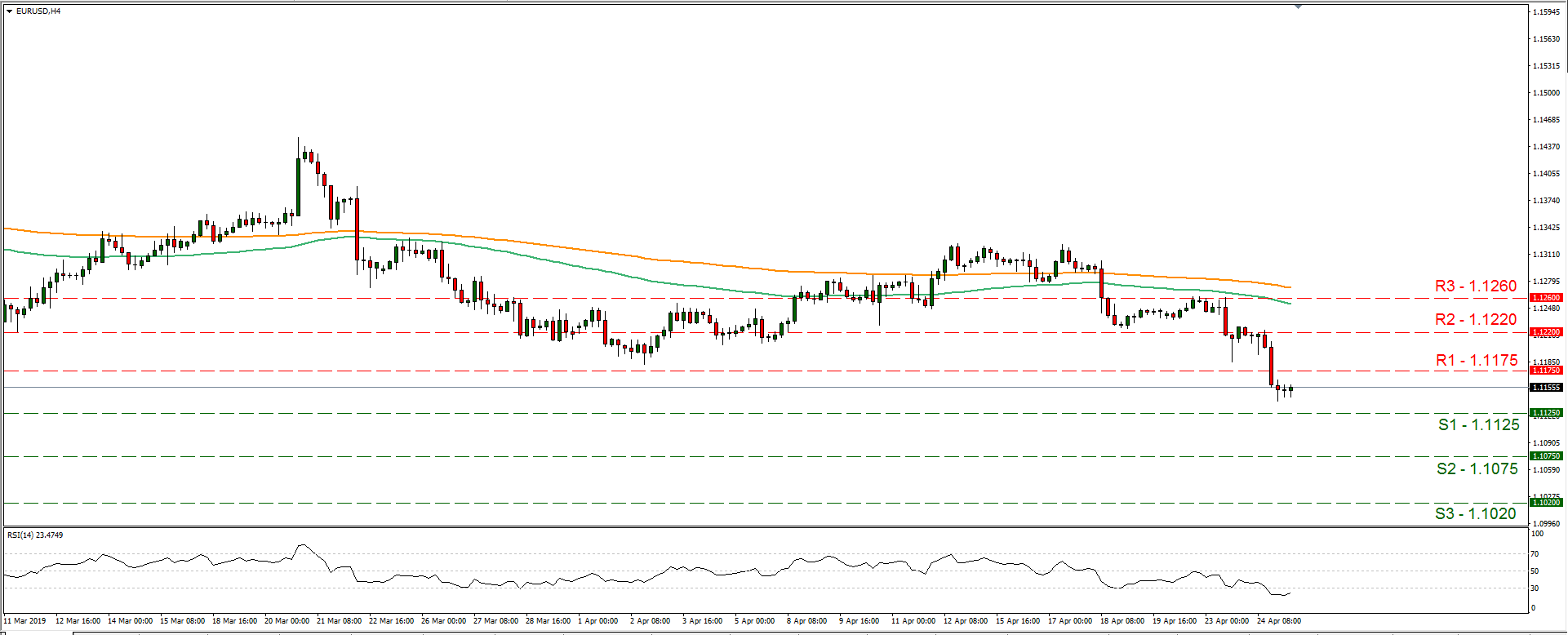

We see the case for the growth in the area picking up pace the second half of 2019, to be dependent on the global trade conditions and especially the trade conditions of various economies (including the Eurozone) with the US. We expect the common currency to remain data depended in the near term and worries about growth in the Eurozone could weigh on its direction. EUR/USD dropped yesterday, breaking the 1.1175 (R1) support line (now turned to resistance). We could see the pair dropping even lower should investor sentiment continue to weigh on the EUR. Please note that the RSI indicator in the 4 hour chart, has dropped below the reading of 30, implying a rather overcrowded short position for the pair. Should the bears continue to dictate the pair’s direction, we could see it breaking the 1.1125 (S1) support line and aim for the 1.1075 (S2) support barrier. Should the bulls take over, we could see it breaking the 1.1175 (R1) resistance line and aim for the 1.1220 (R2) resistance hurdle.

Other Economic Highlights, Today And Early Tomorrow

Today during the European session we get Riksbank’s interest rate decision, which is expected to remain on hold at -0.25%. Should the bank decide to postpone its rate hike which is planned later this year or expand its QE program, we could see the SEK weakening. Also during the European session, we get from Turkey CBRT’s interest-rate decision. In the American session, we get the US durable goods orders growth rates for March. In the early Asian session tomorrow we get New Zealand’s trading data and later on, from Japan, Tokyo’s Core CPI rate for April, the unemployment rate for March, the preliminary industrial output growth rate for March and the retail sales growth rate for March. Be advised that also during tomorrow’s Asian session, we get Australia’s PPI rate for Q1. As for speakers, BoJ’s governor Kuroda will be giving a press conference during the European session today regarding the bank’s decision to remain on hold earlier today, while later ECB’s De Guidos will also be speaking.

•Support: 1.1125 (S1), 1.1075 (S2), 1.1020 (S3)

•Resistance: 1.1175 (R1), 1.1220 (R2), 1.1260 (R3)

•Support: 1.3425 (S1), 1.3360 (S2), 1.3290 (S3)

•Resistance: 1.3510 (R1), 1.3590 (R2), 1.3660 (R3)