- Best Buy has outlasted its competitors throughout its 50-year history

- Raised full-year forecasts Normalization has returned heading into the holiday shopping season

- Resumed its $1 billion stock buyback program in November 2022

Consumer electronics retailer Best Buy (NYSE:BBY) is the last and the largest pure-play electronics big box store. They’ve outlasted prior competitors like Circuit City, CompUSA, The Wiz, Erol’s, Best Products, Radio Shank, H.H. Gregg, and Sam Goody’s just to name a few. Its main competitors nowadays are either privately held like Microcenter or carry basic electronics along with other consumer products like Walmart (NYSE:WMT), Costco Wholesale (NASDAQ:COST), and Target (NYSE:TGT).

Expectations were low heading into its Q3 2022 earnings report especially since 2021 was such an outlier year for PC and TV sales. They beat their own lowered Q3 2022 guidance which enabled them to raise estimates for full-year 2023. The combination one-two punch caused shares to surge and breakout through the downtrend channel on strong volume. While the consumer electronics segment was in high demand from the pandemic, investors have been concerned about what the picture would look like upon normalization. Since Best Buy is literally the last man standing, besides regional player Conns (NASDAQ:CONN), they act as a bell weather for the consumer electronics segment. The Company has indicated that normalization is returning this holiday shopping season with concentrated buying during Black Friday through Cyber Monday and the two weeks leading up to Dec. 25. The Company has also resumed its $1 billion stock buyback program in November 2022.

Lowered Expectations Amplify a Strong Earnings Beat

On Nov. 22, 2022, Best Buy released its fiscal third-quarter 2022 results for the quarter ending October 2022. The Company reported earnings-per-share (EPS) of $1.38 excluding non-recurring items versus consensus analyst estimates for a profit of $1.02, a $0.36 beat. Revenues fell (-11.1%) year-over-year (YoY) to $10.59 billion, beating consensus analyst estimates for $10.30 billion. Domestic revenues fell (-10.8%) YoY driven by comp sales decline of (-10.5%), when the street expected (-12%). While they showed negative YoY metrics like consumer electronics sales falling (-12.8%), computing and mobile falling (-11.4%) and appliance sales falling (-9.6%), the market gave it a pass due to the exceptional comps in 2021 due to pandemic triggered pent up demand. Best Buy was able to handily beat its own lowered bar which enabled it to raise full-year 2023 guidance. It’s worth noting that BBY was proficient in cost-cutting, right-sizing inventory, and workforce reductions to be able to bolster promotions to help beat estimates. Its SG&A fell almost (-9%) through cost-cutting to $1.77 billion.

Holiday Season Normalization

CEO Corie Barry makes specific remarks about the upcoming holiday shopping season:

“We expect shopping patterns will look more similar to historical holiday periods than what we have seen in the last 2 years. Specifically, we expect there will be more customer shopping activity concentrated on Black Friday week, Cyber Monday, and the two weeks leading up to December 25.”

Analysts Are Still Not Convinced

Investors want to know what happens beyond Christmas. Many analysts have voiced some skepticism as the Company basically beat its own lowered Q3 2022 guidance. The heavy promotional and discounting push took its toll on domestic gross margins by (-150 basis points) to 21.9% YoY and non-GAAP operating margins fell by (-190 basis points) 3.9%. Margin compression was one of the factors in its adjusted EPS fall (-34%) YoY. UBS analyst Michael Lasser kept his Hold rating on Best Buy shares with a $76 price target, which is below where it traded in the $80 after the earnings release. Truist analyst Scot Ciccarelli also kept his Hold rating on Best Buy with a $69 price target as he indicated that perhaps the worst of the sales declines may be in the past as markdown risk stabilizes heading into holiday sales.

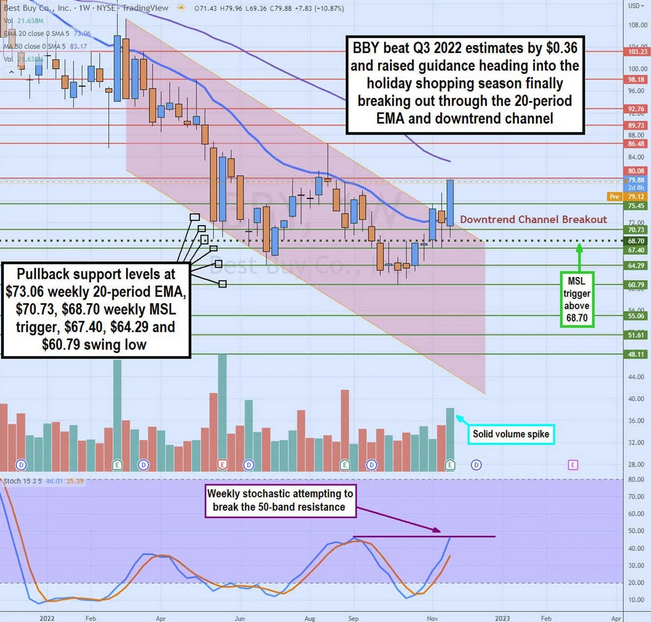

Weekly Reversal of Downtrend

The weekly candlestick chart on BBY has been in a downtrend channel since peaking in March 2022 just above $109. This was followed lower by the downtrend in the weekly 20-period exponential moving average (EMA) which was last at the upper channel of the downtrend at $73.13. The falling 50-period MA sits at $83.19. The downtrend finally put in a swing low on Oct. 10, at $60.79 and formed a market structure low (MSL) buy trigger above $68.70. The weekly stochastic finally bounced up through the 20-band on a strong mini-pup formation that caused shares to breakout through the weekly 20-period MA and upper trendline of the downtrend channel near 73.20 on heavy volume following its strong Q3 2022 earnings report. The weekly stochastic is now pushing through the 50-period resistance level as shares set up to retest the weekly 50-period MA at $83.19. Pullback support areas sit at $73.06 near the weekly 20-period EMA, $70.73, $68.70 weekly MSL trigger, $67.40, $64.29, and the $60.79 weekly swing