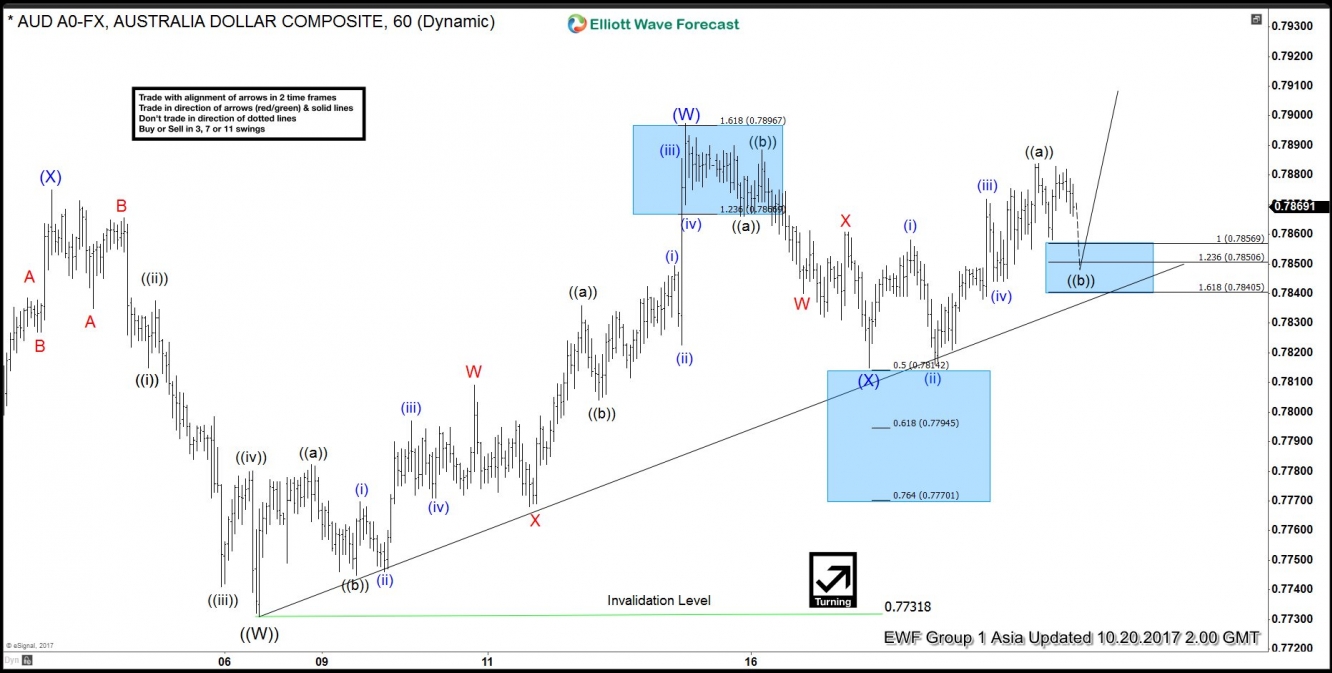

AUD/USD Short Term Elliott Wave view suggests that the decline to 0.7731 ended Primary wave ((W)) on October 6th low. Primary wave ((X)) is currently in progress as a double three Elliott Wave structure. Up from 0.7731, Intermediate Wave (W) of ((X)) ended at 0.7807 and decline to 0.7815 ended Intermediate wave (X) of ((X)). Near term, while pullbacks stay above 0.7815, but more importantly above 10/6 low at 0.7731, expect pair to extend higher. We still need the pair to break above Intermediate wave (W) at 0.7815 to add more validity to this view. Until then, we can’t rule out a double correction in Intermediate wave (X). If pair breaks below 0.7815, then it should open extension lower to 0.778 – 0.78 area where buyers should appear for at least a 3 waves bounce.

AUD/USD 1 Hour Elliott Wave Chart