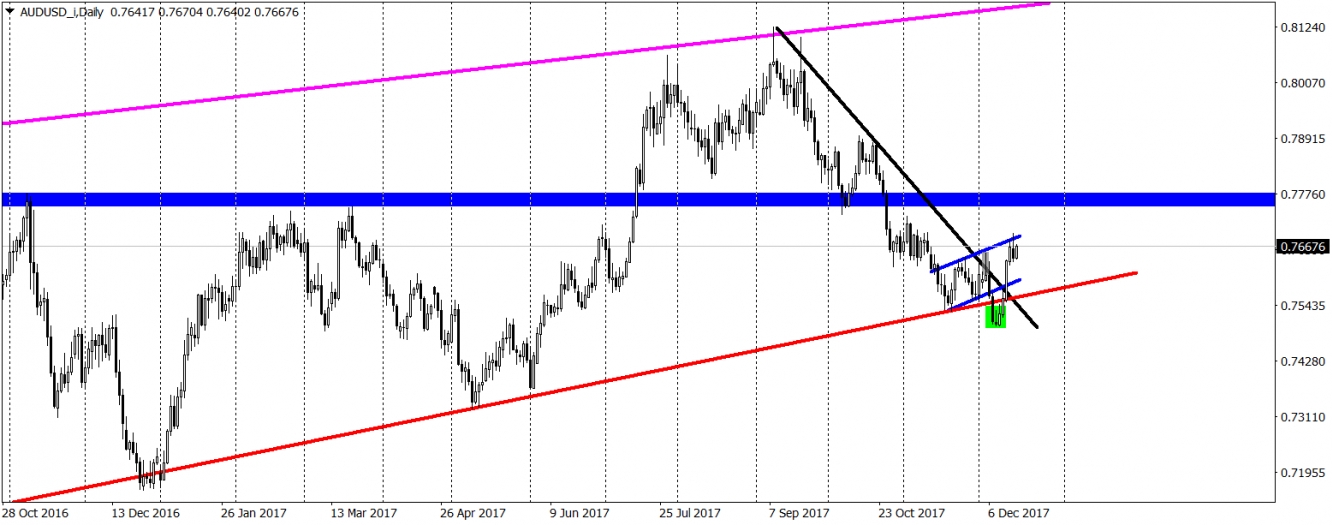

Since the beginning of September, AUDUSD is in a strong downtrend. After making the new yearly highs, the price created a head and shoulders pattern which technically triggered a sell signal. AUDUSD was nicely going down, the price was making lower lows and lower highs and on the 7th of December, we broke the long-term up trendline (red). In theory, that was a major sell signal. Just in theory though. After few days we can see that bullish movement is more probable here.

What happened? Not much, that is a typical false breakout pattern (green) here. After breaking the lower line of the flag (blue) and the trendline, the price did not continue to go down, leaving all new sellers with losses. The price reversed sharply, broke all new resistances (created from the previous supports) and broke the mid-term down trendline (black). Last week was pretty successful here, AUDUSD edged higher, maybe apart from the Friday when the price created a shooting star candlestick. We should not put too much attention into that candle though. Today, the optimism is continued and traders are not following this sentiment from the bearish Friday.

As for the closest target, in our opinion it is the 0.776 (blue) so a resistance from the November 2016 and March this year. Our positive outlook for the Aussie will be denied once the price will break the red line again, which for now is less likely to happen.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUDUSD continues the upswing after the major false breakout pattern.

Published 12/18/2017, 03:59 AM

Updated 05/14/2017, 06:45 AM

AUDUSD continues the upswing after the major false breakout pattern.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.