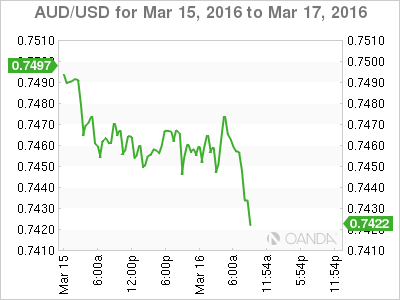

The Australian dollar continues to lose ground on Wednesday, as the pair trades at 0.7430 early in the North American session. On the release front, today’s highlight is the Federal Reserve rate announcement and policy statement. US consumer inflation indicators were mixed. CPI declined by 0.2%, matching the forecast. Core CPI looked stronger, posting a gain of 0.3%, edging above the estimate of 0.2%. Building Permits came in at 1.20 million, within expectations. Later in the day, Australia releases Employment Change, with the markets expecting a strong gain of 11.6 thousand.

The RBA released the minutes of its most recent policy meeting, in which the RBA held rates at the round figure of 2.00%. The central bank is maintaining its easing bias, as inflation is mired at low levels. RBA members took note of the recent easing by other central banks, as the BoJ adopted negative rates in January and the ECB lowered rates to zero last week. The RBA statement took note of the BoJ move, stating that had created “more uncertainty about the direction and potency of monetary policy in the major jurisdictions“. The Aussie has sparkled in March, despite the current slide since late last week. A strong employment report on Wednesday could help the Australian dollar reverse directions and move higher.

The Federal Reserve will be on center stage on Wednesday, as the Fed will set interest rates and issue a policy statement. Most experts are expecting the Fed to remain on the sidelines and not raise rates, given current economic conditions. Although the US economy continues to expand, growth has been softer in 2016 compared to the red-hot pace which marked the economy in the second half of 2015. The primary trouble spot in the economy is the inflation picture, as inflation levels remains very low, a result of weak global demand and low oil prices. Fed policymakers are divided on how to respond to persistently low inflation. Some FOMC members favor preempting inflation with a rate hike, while others feel that the economy is currently too fragile for such a move.

The markets are not anticipating any rate move at the upcoming meeting, but there is intense interest in the Fed’s “dot plot” (a chart of rate hike expectations released each quarter). When the Fed raised interest rates in December, the dot plot called for four hikes in 2016 and projected rates would be between 1.25% and 1.50% by the end of 2016. Many experts have argued that the dot plot is not in sync with market projections of rate increases, and the December dot plot releases appears to bolster their argument. With the cooling off of the US economy early in 2016, the March dot plot is likely to project two or three rate moves in 2016, but many market players see the Fed opting not to raise rates again until next year.

AUD/USD Fundamentals

Wednesday (March 16)

- 8:30 US Building Permits. Estimate 1.20M. Actual 1.17M

- 8:30 US CPI. Estimate -0.2%. Actual -0.2%

- 8:30 US Core CPI. Estimate 0.2%. Actual 0.3%

- 8:30 US Housing Starts. Estimate 1.15M. Actual 1.18M

- 9:15 US Capacity Utilization Rate. Estimate 76.9%

- 9:15 US Industrial Production. Estimate -0.2%

- 19:30 US Crude Oil Inventories. Estimate 2.9M

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 14:30 US FOMC Press Conference

- 18:05 RBA Assistant Governor Guy Debelle Speaks

Upcoming Key Events

Thursday (March 17)

- 8:30 US Philly Fed Manufacturing Index. Estimate -1.4

- 8:30 Unemployment Claims. Estimate 267K

- 20:30 Australian Employment Change. Estimate 11.6K

- 20:30 Australian Unemployment Rate. Estimate 6.0%

- 20:30 Australian RBA Bulletin

*Key releases are highlighted in bold

*All release times are DST

AUD/USD for Wednesday, March 16, 2016

AUD/USD March 16 at 8:55 DST

AUD/USD Open: 0.7461 Low: 0.7437 High: 0.7476 Close: 0.7423

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7100 | 0.7213 | 0.7385 | 0.7472 | 0.7560 | 0.7678 |

- AUD/USD was uneventful in the Asian session. The pair posted losses in European trade and the downward movement has continued in the North American session.

- 0.7472 has switched to a resistance role following losses by AUD/USD on Wednesday.

- 0.7385 is under pressure in support.

- Current range: 0.7385 to 0.7472

Further levels in both directions:

- Below: 0.7385, 0.7213 and 0.7100

- Above: 0.7472, 0.7560, 0.7678 and 0.7796

OANDA’s Open Positions Ratio

The AUD/USD ratio is not showing much movement. Short positions currently have a strong majority (54%), indicative of trader bias towards AUD/USD continuing to move lower.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.