The Australian dollar has started off the week quietly, as AUD/USD trades just below the 0.76 line in the North American session. On the release front, US Existing Homes was unexpectedly weak, coming in at 5.08 million. Later in the day, Australia releases the Housing Price Index, with the markets bracing for a negligible gain of 0.1%.

It’s been a superb March for the Aussie, which has surged over 400 points so far this month. On Friday, AUD/USD touched a high of 0.7681, the pair’s highest level since early June 2015. Last week, Australian Employment Change posted a small gain of 0.3 thousand, nowhere near the forecast of 11.6 thousand. The unemployment rate dropped to 5.8 percent, down from 6.0 percent. However, analysts attributed this to the participation rate falling, as more unemployed people stopped looking for work. The Aussie took advantage of the dovish Federal Reserve statement last week, jumping 100 points after the statement.

There were no surprises from the widely-anticipated Federal Reserve rate announcement on Wednesday. The Fed opted to remain on the sidelines and did not raise interest rates, maintaining the benchmark rate at 0.25%. The Fed statement noted that the US economy remains vulnerable to an uncertain global economy, but expects to raise rates later in the year due to moderate growth and “strong job gains”. The statement was dovish in tone, a clear departure from the December meeting, when the Fed raised rates for the first time in nine years and talked about four rate hikes over the course of 2016. In just a short three months, global demand has weakened, precipitated by the Chinese slowdown, and US numbers have cooled in comparison to the economy’s torrid pace in the second half of 2015. If inflation and employment numbers push higher in next several months, a rate hike in mid-2016 seems a good bet.

AUD/USD Fundamentals

Monday (March 21)

- 10:30 US Existing Home Sales. Estimate 5.32M. Actual 5.08M

- 20:30 Australian House Price Index. Estimate 0.1%

- 20:45 RBA Assistant Governor Malcolm Edey Speaks

*Key releases are highlighted in bold

*All release times are DST

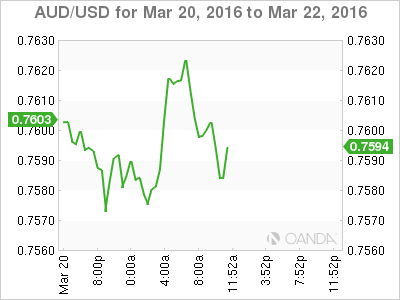

AUD/USD for Monday, March 21, 2016

AUD/USD March 21 at 11:10 DST

AUD/USD Open: 0.7593 Low: 0.7567 High: 0.7626 Close: 0.7582

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7385 | 0.7472 | 0.7560 | 0.7678 | 0.7796 | 0.7913 |

- AUD/USD was flat in the Asian session. The pair has showed some volatility in the European and North American sessions.

- 0.7560 is weak support line and could break in the North American session

- There is resistance at 0.7678

- Current range: 0.7560 to 0.7678

Further levels in both directions:

- Below: 0.7560, 0.7472, 0.7385 and 0.7213

- Above: 0.7678, 0.7796 and 0.7913

OANDA’s Open Positions Ratio

The AUD/USD ratio is showing short positions with a strong majority (55%), indicative of trader bias towards AUD/USD breaking out and moving lower.

Disclaimer: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.