Now just shy of 7,000, bulls finally managed to break the index above the financial crisis highs.

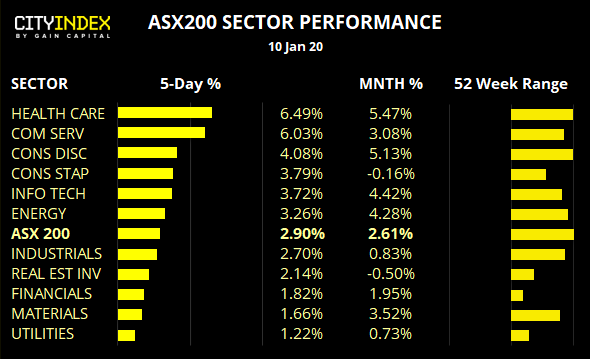

- Healthcare and consumer discretionary sectors have continued to lead the way these past 52-weeks (and obviously the ASX 200). Although it is Health care and consumer service stocks which have outperformed this week. In fact, even energy has outperformed, despite oil prices falling as geopolitical tensions receded.

Back in July we saw an intraweek test of the GFC (global financial crisis) highs. Yet it was short-lived. Instead, a bearish hammer closed below 6,800 and marked the beginning of a 7% decline. Since then, price action has been choppy on the weekly chart, but today’s thrust higher is a clear victory for the bulls; not only was it the most bullish week since February, but it comfortably cleared the GFC high. Overall, it looks very bullish.

There’s clearly demand around 6,700 as price action rebounded from the 26-week (6-month) moving average. Furthermore, the candles have left a double bottom / tweezer bottom formation.

Switching to the four-hour chart, we can see the final candle was relatively small heading into the close. We can take our direction from US market on Monday morning but, unless they push to new highs later today, we could expect a little mean reversion on Monday.