Assembly Biosciences Inc (NASDAQ:ASMB)

Assembly Biosciences, $ASMB, started up out of consolidation late last year. It took a couple of steps up before settling into another consolidation in March that lasted until the end of August. The move higher from there met resistance in October and pulled back then reversed and is back at the prior high coming into the week. The RSI is rising and bullish and the MACD moving up. Look for a push to a new high to participate…..

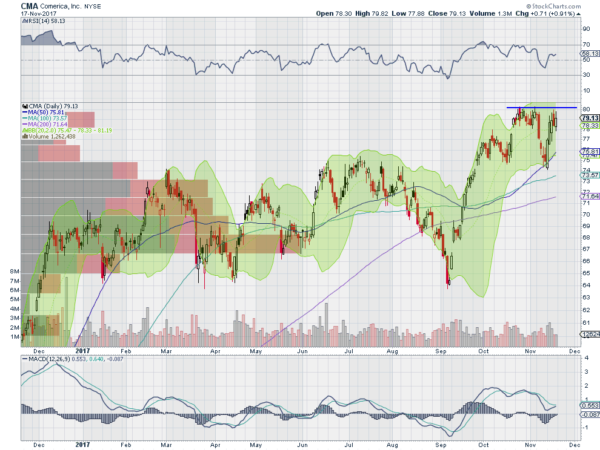

Comerica (NYSE:CMA)

Comerica, $CMA, started higher off of a low in September. It paused as it hit a new high in October and then jumped again. It met resistance and pulled back in November to the 50 day SMA and then reversed higher. Now it is back at the high coming into the week. The RSI is rising and the MACD is about to cross up, supporting more upside. Look for a push higher to participate…..

Marathon Oil (NYSE:MRO)

Marathon Oil, $MRO, made a high in December and then pulled back for the next 6 months. It had a failed bounce in July and then made a lower low in August, before rising in a move that is sticking. It started to pullback from a top earlier this month and then reversed to close the past week. The RSI is reversing higher as well and the MACD is slowing its descent and leveling. Look for continuation to participate higher…..

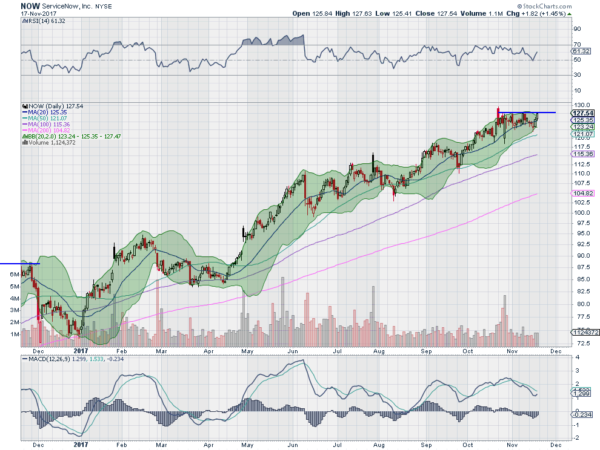

ServiceNow Inc (NYSE:NOW)

ServiceNow, $NOW, started higher off of its 200 day SMA at the beginning of the year. The initial move failed in February and it pulled back to a low in April. From there is has steadily trended higher. In the short term, it enters the week consolidating under resistance with tight Bollinger Bands®. The RSI has turned higher and the MACD is trying to cross up. Look for a push over resistance to participate…..

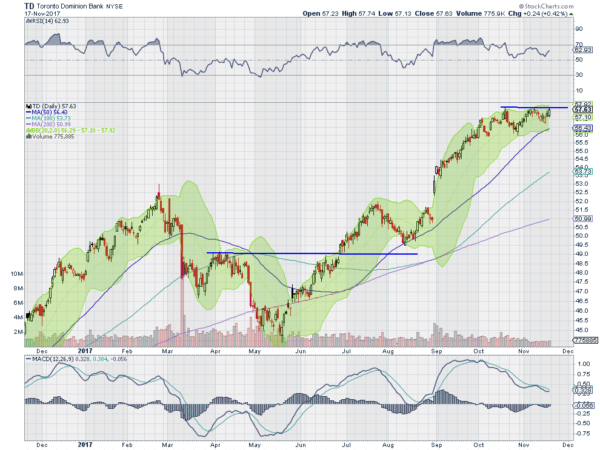

Toronto Dominion Bank (NYSE:TD)

Toronto-Dominion Bank, $TD, started moving higher in May, breaking a downtrend in June. It had an interim peak in July before a mild pullback and a new run higher that stalled in October. Since then it has been consolidating as it draws to the rising 20 day SMA. The RSI is bullish and the MACD trying to turn up. Look for a push to a new high to participate…..

Up Next: Bonus Idea

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with November options expiration behind sees the markets driving into the shortened Thanksgiving week with a changing of the guard to the small caps.

Elsewhere look for Gold to continue in its uptrend while Crude Oil works through short term resistance. The US Dollar Index pauses in its short term uptrend while US Treasuries consolidate. The Shanghai Composite is taking a breather in its uptrend and Emerging Markets are consolidating their move higher.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). On the shorter timeframe the IWM is now taking the lead as the SPY and QQQ consolidate. In the longer frame they still need to prove themselves a leader as the QQQ and SPY mark time. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.