Stock prices went lower again – is a short-term bottom in?

The S&P 500 index lost 0.90% on Monday, as it further extended its last week’s decline following Wednesday’s FOMC interest rate hike. On Friday the index lost 1.1% and on Thursday it sold off by 2.5%. Yesterday the broad stock market index reached its new local low of 3,800.04.

Today the S&P 500 opened 0.2% lower after an overnight Bank of Japan’s monetary policy release. The markets were very volatile, but the European stock indexes bounced from their local lows.

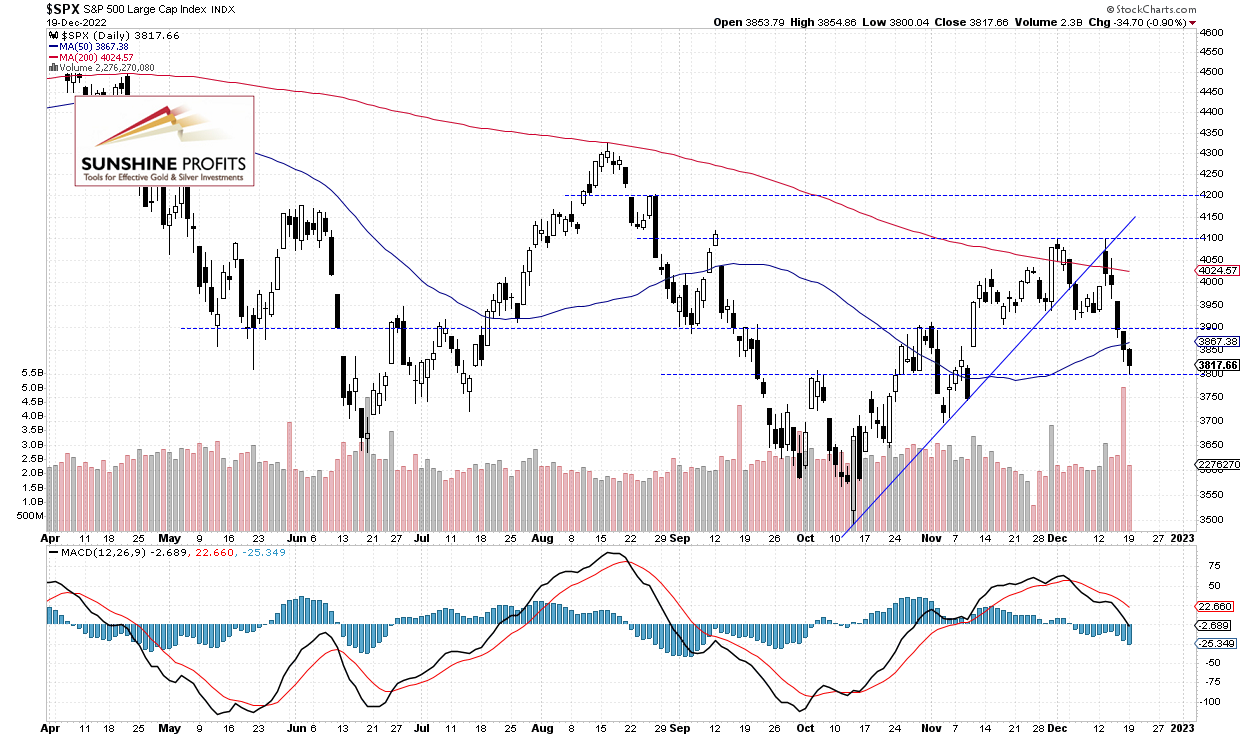

Recently the S&P 500 index broke below its two-month-long upward trend line and moved sharply lower after getting back to that line last week, as we can see on the daily chart:

Futures Contract Trades Closer to 3,800

Let’s take a look at the hourly chart of the S&P 500 E-mini futures contract. Today it reached new local low of around 3,804. The resistance level remains at 3,900-3,950. There have been no confirmed positive signals so far. However, there are some clear short-term oversold conditions that may lead to a bounce or an upward reversal at some point.

Conclusion

The S&P 500 index is expected to open slightly lower this morning and it may see an attempt at retracing some of the recent sell-off. For now, it looks like a temporary bottom before an upward correction.

Here’s the breakdown:

- The S&P 500 index went to the 3,800 level yesterday

- Today it will likely go sideways or bounce despite an initial bearish reaction to the important Bank of Japan release.

* * * * *

The information above represents analyses and opinions of Paul Rejczak & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Paul Rejczak and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Rejczak is not a Registered Securities Advisor. By reading his reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.