The last time the Russell 2000 (IWM) closed out a month above the Bollinger Band we like to use, was in March 2021.

So, there is poetic justice to the anniversary date of the downtrend reversing to an uptrend exactly 3 years later.

The first quarter of 2024 also saw IWM close at the highest price level since it began its huge descent in January 2022.

We take that as a good sign for more rally.

Also noteworthy is the ratio between growth and value reached a resistance level.

Whether one wants to argue soft landing, no landing, recession, stagflation, higher for longer, rate cuts-the fact remains that a rotation into small caps for us who invented the Economic Modern Family, is a good thing.

Granddad Russell represents the small-cap companies within the US.

IWM tells us that the economy is in good shape.

Great shape? Well, we are always climbing the wall of worry.

Just listen to the pundits.

“The economy is up because of government spending and loose monetary conditions.”

Maybe.

But for now, both Gramps and Granny are happier.

And remember, narratives are not very meaningful if the price says something different.

We have seen narratives change on a dime as price rules.

Granny XRT also closed this quarter on price levels not seen since early 2022.

Our sector rotation model tells us that XRT has risen in trend strength as well, climbing the ranks to number 3!

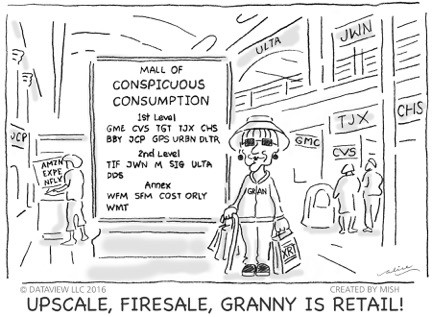

The consumer is not dead; however, we do see a shift in spending.

The “vanity” trade we have commented on February 26th, Is Granny Retail Set-up for Further Gains? mentions why the theory was born and what instruments to watch for setups.

We have seen consumers go from “All about We” to “All About Me.”

Looking at the monthly chart, the price cleared over the Bollinger band last month.

Granny is a bit stronger than Gramps and is in some ways more important.

The consumer is 70% of the US GDP.

Can XRT make it to 90?

I mean the price, not her age-she is way older than that!

As we start Q2 and go into earnings, we could see surprises in both small-cap and retail companies, like the surprises we saw in large-cap earnings in Q1-way better than expected.

What could ruin the party?

We think “ruin” is strong as the trend of anti-obesity drugs will continue to bring in new consumers to the vanity space.

Nonetheless, as I wrote about the last few weeks, inflation is hardly dead.

So, love the rally, but also keep your eyes peeled on oil, grains, gold, silver, and gold miners-all which did very well last week.

ETF Summary

- S&P 500 (SPY) 520 pivotal

- Russell 2000 (IWM) 212 next resistance

- Dow (DIA) 385 support 400 resistance

- Nasdaq (QQQ) 440 the pivotal area

- Regional banks (KRE) 45-50 range

- Semiconductors (SMH) 223 support near term

- Transportation (IYT) 68 area support

- Biotechnology (IBB) 140-142 resistance 135 support

- Retail (XRT) 77 now support

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 77 big number to hold. Over 78 risk ON