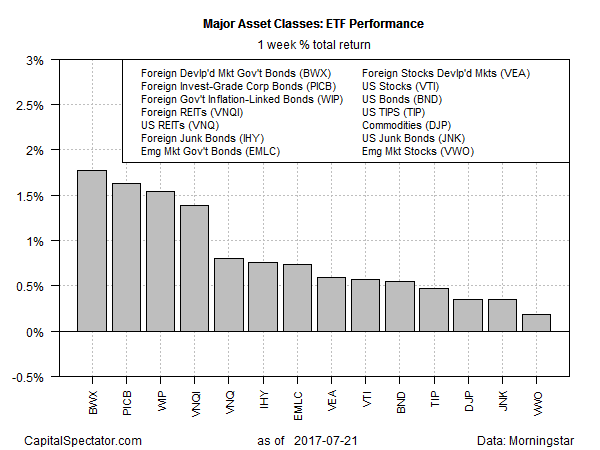

For a second week in a row, all the broad categories of global markets posted gains. Led by a sharp advance in foreign government bonds in developed markets, the major asset classes dispensed a clean sweep of price increases, based on a set of exchange-traded products.

The top performer for the five trading days through July 21: SPDR Barclays International Treasury Bond (NYSE:BWX) (BWX), which climbed 1.8%. The advance lifted the ETF to a nine-month high.

A key driver of BWX’s recent rally is the ongoing slide in the US dollar. The US Dollar Index slumped to its lowest close in more than a year on Friday. “A weaker dollar seems to be the path of least resistance given the soft data coming out of the US and the political uncertainty,” noted Michael Hewson, chief markets strategist at CMC Capital Markets.

Last week’s biggest relative loser: Vanguard FTSE Emerging Markets (NYSE:VWO), which climbed 0.2%. The increase was the smallest gain among the major asset classes, although the weekly advance was enough to keep the fund close to its highest close in nearly three years.

“Whatever is dampening US dollar and the US rates, it has been very positive for emerging markets,” Ken Peng of Citi Private Bank tells the Economic Times.

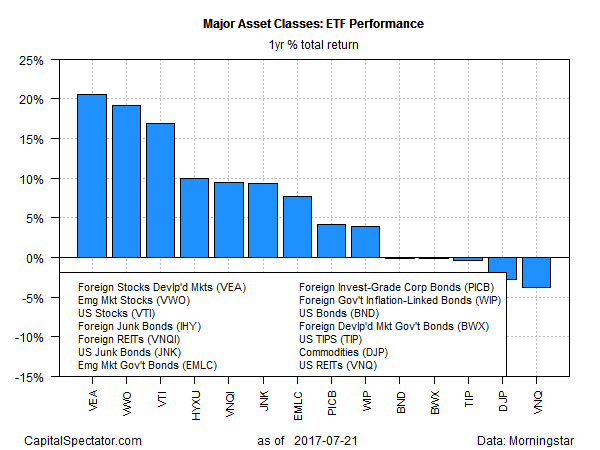

For one-year performances, foreign stocks in developed markets continue to hold the top spot. Vanguard FTSE Developed Markets (NYSE:VEA) inched higher for a second week in a row, boosting the ETF’s one-year return to 20.6%. Here, too, a weak dollar has been a bullish factor.

On the flip side, US real estate investment trusts (REITs) have slipped into last place for one-year results. Vanguard REIT (NYSE:VNQ) is off 3.8% for the 12 months through July 21, the worst performance among the major asset classes. Despite weakness relative to the year-earlier price, VNQ still closed last week near its highest price for the year to date.