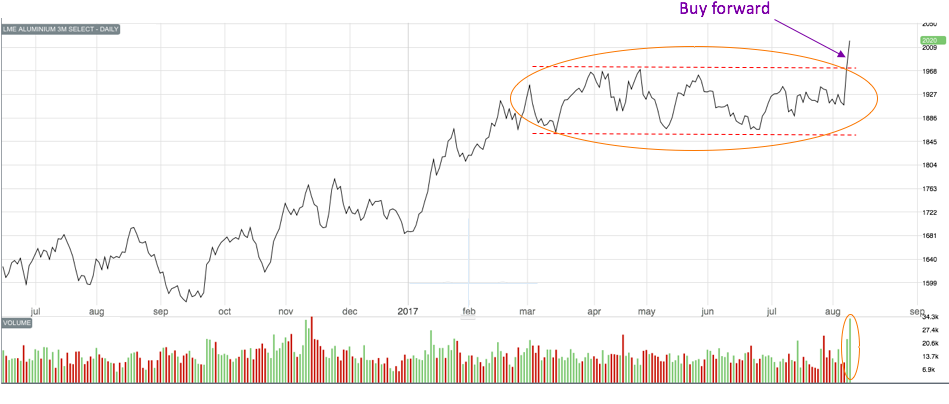

For three months, MetalMiner has claimed a sideways trend for aluminum. This sideways trend could both signal a market top or a price consolidation, and a continuation pattern of the bullish market that started last year.

The price increase in aluminum has coincided with heavy trading volume, signaling a breakout of a price consolidation. Thus, we could see a bullish uptrend for aluminum, which means increasing aluminum prices.

Source: MetalMiner analysis of FastMarkets

As previously explained by MetalMiner, buying in a bullish market means buying organizations will want to identify opportunities to buy forward (hedge).

This new price increase, together with other strength in LME base metals (such as copper), may be the start of a new uptrend for aluminum.

The U.S. dollar has also continued to show weaknesses this year, providing a lift to base-metal prices. The CRB index is still in a long-term downtrend, but has shown a slight recovery in the short-term trend. The DBB index is currently in an uptrend, both for the long- and short-term.

Buying organizations may want to buy forward given aluminum price dynamics, together with trading volume.