- Biogen stock is getting favorable ratings after successful trial results for its latest Alzheimer's treatment

- Lecanemab is Biogen's latest attempt to cure the disease after its failed rollout of another drug last year

- This time, the company seems to have a better shot at achieving a breakthrough

If you got burned in last year's boom-and-bust cycle, you are probably hesitant to jump into Biogen (NASDAQ:BIIB) shares again. However, the past two months' rally that sent the stock up around 50% feels different this time around.

The current bullish trend started after Japan-based Eisai Co (OTC:ESALY), and Biogen announced in late September that their experimental Alzheimer's disease drug significantly slowed the progression of the brain disorder in a large study.

The companies said their drug "lecanemab" reduced cognitive and functional decline by 27%, compared with a placebo, over 18 months in a phase-3 study of 1,800 patients with early-stage Alzheimer's. The drug was also linked to higher rates of brain swelling and small bleeds, though the company said they were rarely symptomatic.

Lecanemab is the Cambridge, Massachusetts-based Biogen's latest attempt to cure Alzheimer's after its failed rollout of another experimental drug, "Aduhelm," last year. Despite getting regulatory approval from the U.S. Food and Drug Administration, Aduhelm faced several setbacks.

The agency's outside scientific advisers said that clinical trial data didn't clearly show that the drug worked as intended. Insurers also refused to pay for it, while the U.S. proposed tight limitations on who would be eligible to have Medicare cover its cost.

For all of 2021, Biogen had just $3 million in Aduhelm revenue after spending a huge sum on its commercialization. As a result, its stock plunged to a 10-year low in May.

But this time, the company seems to have a better shot at achieving a breakthrough. This week, a potential competitor, Roche (OTC:RHHBY), said its Alzheimer's experimental treatment failed to slow cognitive decline significantly. After this failure, the only competition left in the market is Eli Lilly's (NYSE:LLY) "donanemab," with results from clinical trials scheduled to be released next year.

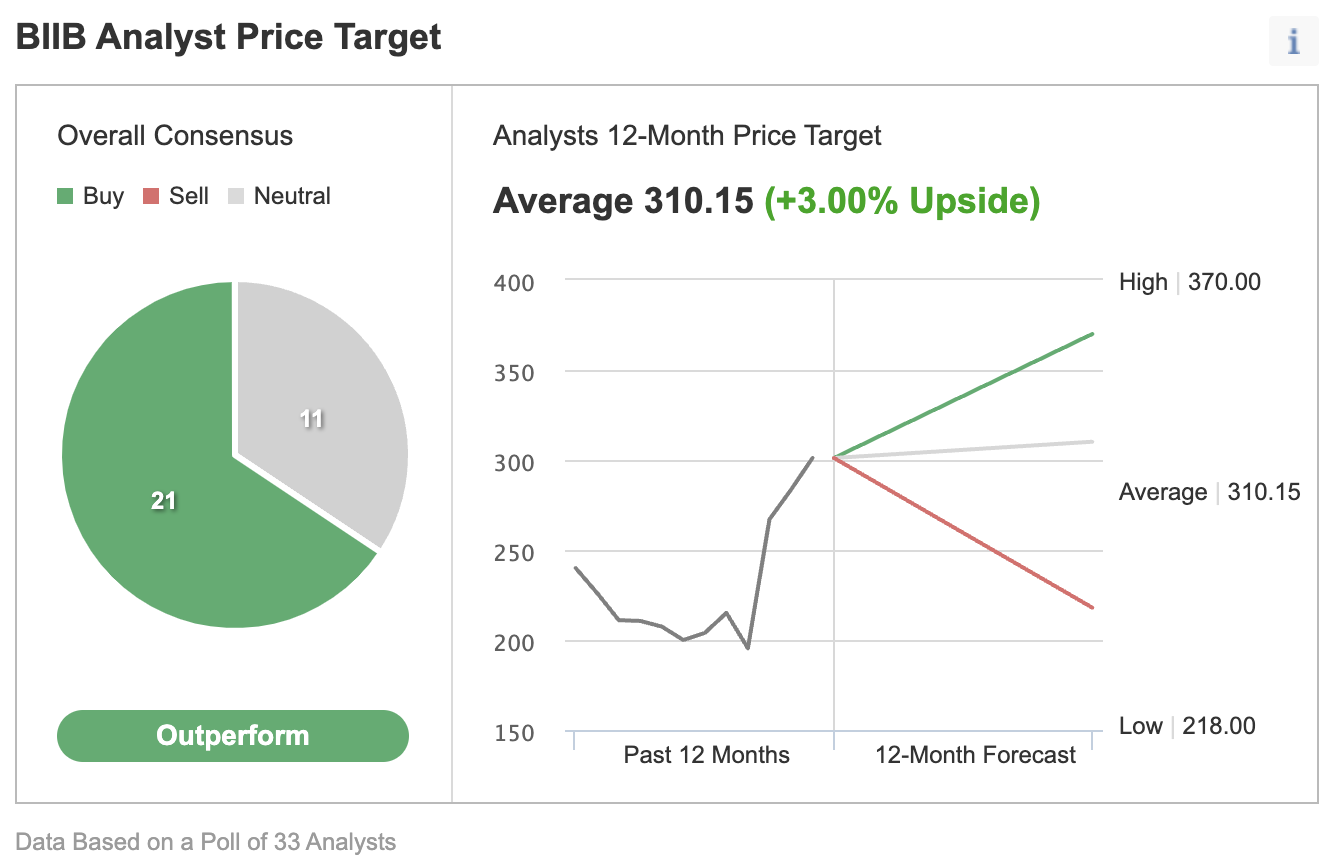

Less competition and the vast revenue opportunity have prompted many analysts to upgrade Biogen stock in recent weeks. In a recent Investing.com poll, most analysts rated Biogen as a buy.

Source: Investing.com

In a recent note to clients, Goldman Sachs raised its price target on shares to $370, a 23% upside where the stock traded on Wednesday. The investment bank also raised its revenue estimates for the drug to $14 billion in 2035, compared with prior estimates of $2 billion.

GS's note added:

"The company is now poised to address the early Alzheimer's disease market in 2023+ following the recent topline lecanemab Ph3 (CLARITY-AD) data.

Our discussions with leading neurologists and management lead us to believe that the results are clinically meaningful (given the benefit across multiple endpoints, the positive trend over time, and the safety profile)."

Biogen's Japanese partner Eisai plans to submit for full approval in the U.S., European Union, and Japan in the first quarter of next year, and Goldman anticipates it will be successful.

Despite this optimism, there are still plenty of risks that investors should take into account. While there is a good possibility that the FDA will approve the drug following its go-ahead of Aduhelm last year, there is no guarantee that Medicare will agree to pay for the drug, given its decision to impose restrictive reimbursement conditions for all anti-amyloid drugs—which target an unusual buildup of the protein in patient's brains.

Moreover, even if all goes well, there is little consensus on how much this treatment will bring in revenue for Biogen and its Japanese partner. According to a report in the Wall Street Journal, analyst estimates for the drug's peak sales range from a few hundred million dollars to billions.

Bottom Line

Biogen stock is offering a much better risk-reward proposition after the success of its latest trials to treat Alzheimer's disease. Its 50% jump during the past two months reflects the optimism that the treatment will receive FDA approval and insurers will reimburse for the treatment.

That said, Biogen stock is for high-risk takers, given the possibility of a negative outcome.

Disclosure: As of the time of writing, the author doesn't own stocks mentioned in this report. The views expressed in this article are solely the author's opinion and should not be taken as investment advice.