Digital cloud creative software company Adobe (NASDAQ:ADBE) stock has been on a tear blowing through its pre-COVID highs. The creative software developer was a pioneer in cloud computing and the software as a service (SaaS) subscription model.

It revolutionized software company operating models when it provided its expensive Photoshop software suite at a monthly subscription rate rather than a one-time purchase price. Since then, the Company has built out its library of creative software offerings with a robust portfolio segmented in Adobe Creative Cloud, Document Cloud, Experience Cloud as well as Publishing and Advertising products.

The Company continues to score large wins including Nike (NYSE:NKE), Meta (NASDAQ:FB), and the U.S. Department of Interior. The recent price dive is presenting prudent investors with opportunistic pullbacks to gain exposure by scaling in a position patiently.

Fiscal Q3 2021 Earnings Release

On Sept. 21, 2021, Adobe released its fiscal third-quarter 2021 results for the quarter ended August 2021. The Company reported earnings-per-share (EPS) profit of $3.11 versus $3.03 consensus analyst estimates, a $0.09 beat.

Revenues grew 22% year-over-year (YoY) to $3.94 billion, beating analyst estimates for $3.9 billion. The digital media segment grew 23% YoY to $2.87 billion, its creative revenue rose 21% and Document Cloud revenues grew 31% YoY.

Adobe CEO Shantanu Narayen commented,

“Adobe had another outstanding quarter as Creative Cloud, Document Cloud and Experience Cloud continue to transform storytelling, learning and conducting business in a digital-first world.”

Adobe CFO John Murphy commented,

“We drove record revenues and strong profitability in the quarter, demonstrating our ability to succeed in a dynamic environment. Our operational rigor and data-driven insights enable us to execute while we continue to invest across massive market opportunities.”

Upside Q4 2021 Guidance

Adobe raised fiscal Q4 2021 EPS to $3.18 versus $3.09 consensus analyst estimates. The Company raised Q4 2021 revenue guidance to $4.07 billion versus $4.05 billion and sees its Q4 Digital Media segment growing 20% YoY while Digital Experience is expected to grow 22% YoY.

Conference Call Takeaways

CEO Narayen set the tone:

This quarter we delivered significant new product innovations, announced the exciting acquisition of frame.IO and continued to increase customer engagement across an ever-expanding customer base. We're executing on our strategy of unleashing creativity for all accelerating document productivity and powering digital businesses as reflected in our strong performance. In Q3, Adobe achieved 3.94 billion in revenue, representing 22% year-over-year growth.

"The combination of our leading video editing offerings, including Photoshop, Premiere Pro, and after-effects with frame.io’s cloud-based review and approval functionality will radically accelerate the creative process and deliver an end-to-end video platform. The addition of frame.io creates an opportunity for Adobe in conjunction with the partner ecosystem to expand beyond video editors to a broader set of customers, teams, and enterprises. We hope to close the frame.io transaction in Q4 and look forward to welcoming the team to Adobe.

"Next month, we will host Adobe MAX, the world's largest creativity conference. Max has always been the place to be inspired, connect with the creative community and experience the latest Creative Cloud innovations. Our programming will feature iconic speakers, including Oscar-winning winning writer, director, producer Chloe Zhao, actress Tilda Swinton, and SNL star and executive producer Kenan Thompson. This year's fully digital experience allows us to expand our reach and engage with more people across our global creative community than ever before. Max will be hosted on Adobe’s custom digital event platform built on Adobe Experience Cloud.

"In Q3, we achieved Creative revenue of 2.37 billion with strong new user acquisition, engagement, and renewal across all creative products and geographies with particular strength in our Creative Cloud for Teams offering.

“Digital experienced platforms and achieving the highest score of all participating vendors for current offering. Adobe was also named a leader in the 2021 Gartner Magic Quadrant for personalization engines and a leader in the Gartner (NYSE:IT) Magic Quadrant for digital commerce.

"Strong customer adoption of Adobe Sensei-powered capabilities in the Adobe Experience Cloud as over 80% of customers now rely on our AI-powered capabilities to drive data insights and optimization. Key customer wins at Accor (OTC:ACCYY), the Australian government, Bertelsmann (D:BTGGga), Capital One Financial (NYSE:COF), CVS Pharmacy (NYSE:CVS), Daimler (OTC:DMLRY), Facebook, Ford Motor Company (NYSE:F), Fidelity Brokerage Services (NYSE:FNF), Honeywell (NASDAQ:HON), Real Madrid, and the Gap (NYSE:GPS).

"Adobe strength has always come from our most important asset, our people. We want to thank our 25000-plus employees for their dedication and resilience. Our customers and partners for their trust, as we continue to navigate a dynamic external environment. I'm proud of the continued industry recognition we received as a great and equitable place to work.“

ADBE Opportunistic Pullback Levels

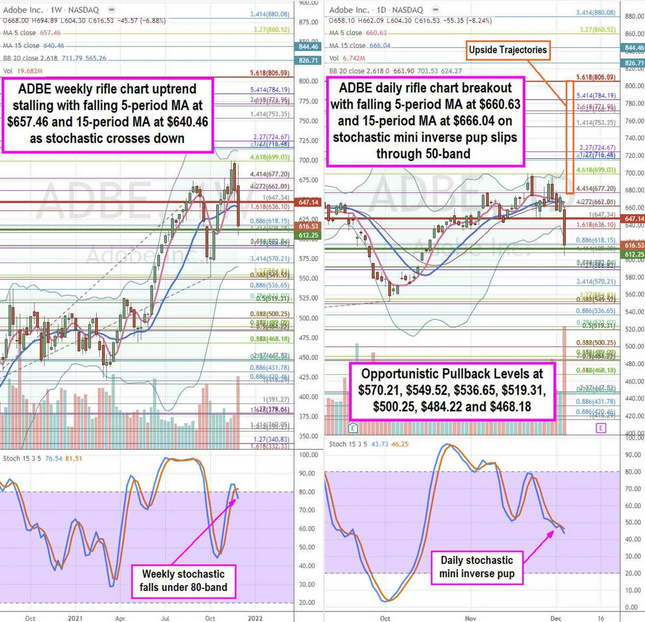

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for ADBE stock. The weekly rifle chart peaked at the $699.03 Fibonacci (fib) level. Shares collapsed quickly to overshoot the $608.38 fib causing the weekly 5-period moving average (MA) to stall out at $657.46 and 15-period MA at $640.46.

The weekly stochastic crossed down back under the 80-band. The weekly market structure high (MSH) sell triggered on the $647.17 breakdown. The weekly lower Bollinger® Bands (BBs) sit at $565.26. The weekly market structure low (MSL) buy triggers above $612.25. The daily rifle chart formed a rapid breakdown as the 5-period MA at $660.63 crossed down through the 15-period MA at $666.04 as shares leaned through the daily lower BBs at $624.27.

Prudent investors can monitor for opportunistic pullback levels at the $570.21, $549.52, $536.65, $519.31, $500.25, $484.22, and the $468.18 fib level. Upside trajectories range from the $677.20 fib up towards the $805.59 level.