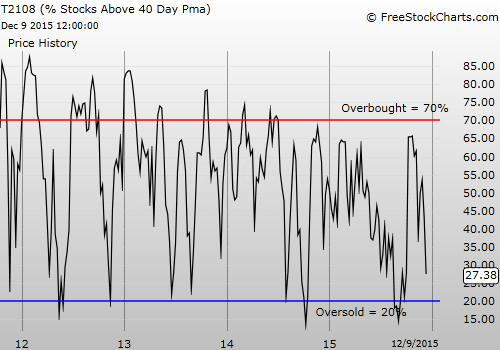

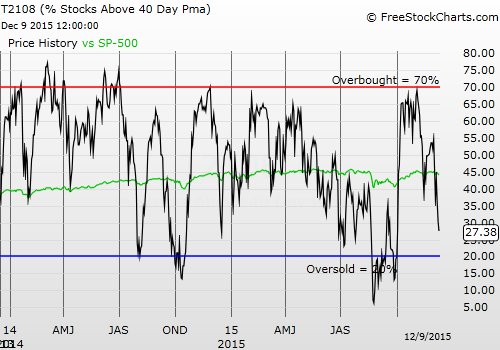

T2108 Status: 27.4%

T2107 Status: 27.6%

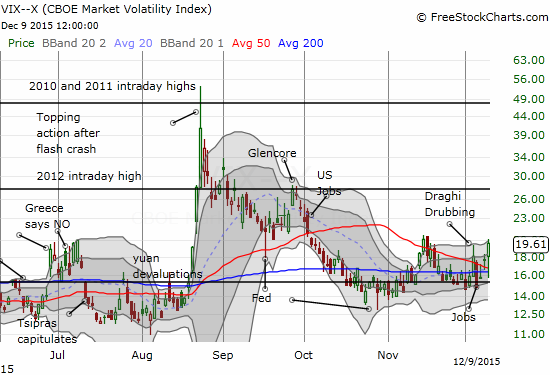

VIX Status: 19.6

General (Short-term) Trading Call: neutral – bullish bias

Active T2108 periods: Day #47 over 20% (overperiod), Day #1 under 30% (ending 45 days over 30%) (underperiod), Day #3 under 40%, Day #6 below 50%, Day #20 under 60%, Day #361 under 70%

Commentary

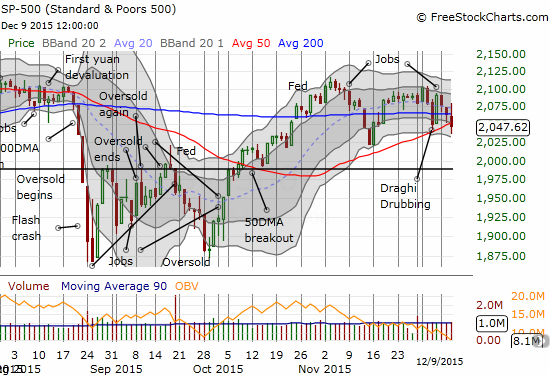

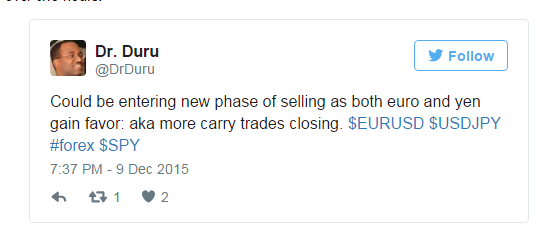

After a brief stumble yesterday, the S&P 500 (SPDR S&P 500 (N:SPY)) sprinted higher from the open. Shortly after the U.S. oil inventory report, trading quickly changed. The index dropped straight down for over two hours. I tweeted:

The currency markets caught my eye before stocks because of the synchronized gains in the euro (Guggenheim CurrencyShares Euro (N:FXE)) and the yen (Guggenheim CurrencyShares Japanese Yen (N:FXY)) which suggested a major “risk off” move was underway. It took longer than I expected, but the euro made a definitive continuation move from last week’s Draghi Drubbing. With EUR/USD at 1.10 I sold my fist full of FXE call options for a 33% gain.

The euro leaps above 50DMA resistance against the U.S. dollar

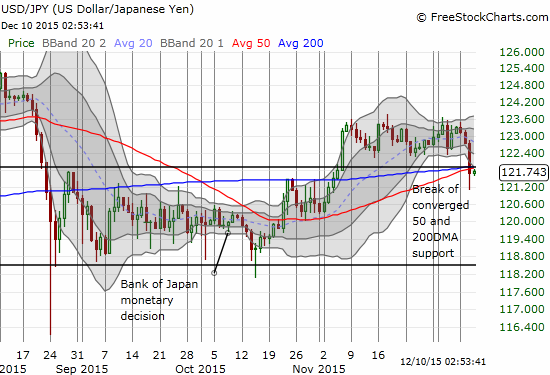

I am still overall bearish on the Japanese yen, especially against the U.S. dollar, so I used the dip in USD/JPY as an entry to my next trade. However, USD/JPY made an important break of support, so I am more wary than usual. The breakout from November is already over now.

The Japanese yen pushes through converged support from the converged 50 and 200DMAs versus the U.S. dollar. This brings the breakout on Nov 6th to a quick end as no follow-through ever materialized.

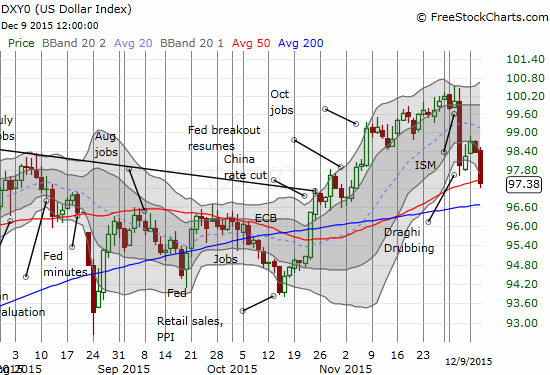

The overall impact on the U.S. dollar left a lot of bruises. The U.S. dollar index is now staring down an important test of 50DMA support. Just last week the index was pushing against 12+ year highs and trading above 100.

The U.S. dollar took a beating. The March, 2015 and 12-year high now stands out as firm resistance.

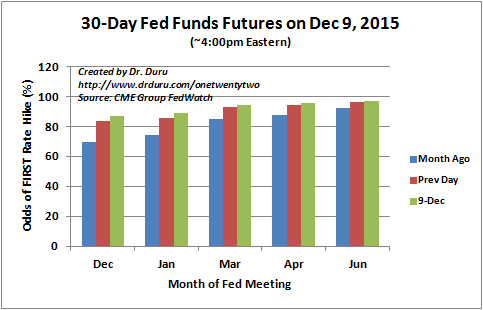

Note well that this sudden weakness in the U.S. dollar is unfolding despite the steady march toward near certainty in a Fed rate hike next week.

The odds of rate hike next week are now at 87%. Up from 83% the previous day.

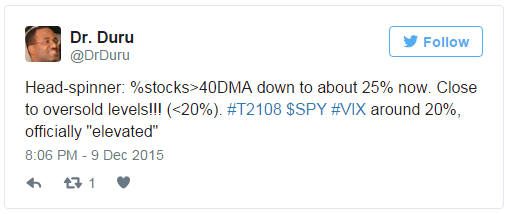

As euro and yen strength appeared to suck the buying wind out the market, I checked on T2108. Much to my surprise, T2108 was hurtling toward oversold conditions. Such a move was NOT on my radar. In fact, in my last T2108 Update, I was bracing for another quick bounce back from recent selling even as I see an overall weakening of underlying technicals. Oversold trading conditions would substantially raise the stakes of the Fed’s big rate decision in a week!

I quickly went to the trading rule book and placed an order for shares in ProShares Short VIX Short-Term Futures (N:SVXY). That order filled quickly. The volatility index, the VIX, ended the day with an 11.4% gain after trading down toward recent lows. The VIX stopped just short of “elevated” levels starting at 20.

The volatility index, the VIX, is on the move again. It is now setup for a very important breakout.

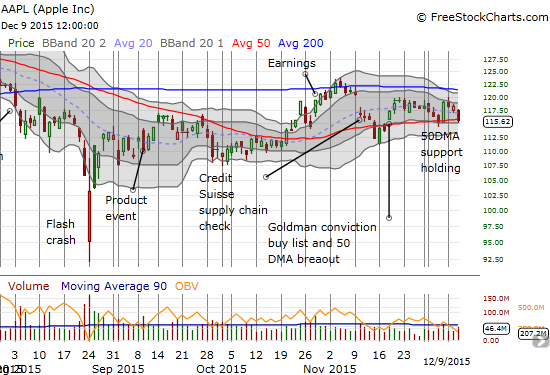

Next up, was Apple (O:AAPL). As a member of the privileged few leading the market higher, I liked the retest of the 50-day moving average support as a buying point. I ended up with two tranches of call options.

Apple (AAPL) clings to critical 50DMA support.

I did not reach for Netflix (O:NFLX) this time. It IS still on my radar of course, especially after the 20DMA uptrend held up for the second day in a row.

The S&P 500 ended the day yesterday with another modest loss. However, it closed marginally below its 50DMA support.

The lows from November are now in play. Given December is typically a mild month – Fed rate hike notwithstanding – I am VERY intrigued by the possibilities of aggressively buying oversold conditions if they arrive. Fading pre-Fed volatility could be particularly lucrative this time around as well.

With a first tranche of shares in SVXY in hand, my next trade will be to grab call options on ProShares Ultra S&P500 (N:SSO) as cheaply as I can. I am now on alert for an intraday trigger of oversold trading conditions – see my StockTwits and/or Twitter feeds for a near real-time alert.

The S&P 500 is on the edge of breaking down again.

Finally, two last charts.

Wynn Resorts (O:WYNN) gapped up higher on news that the CEO loaded up on 1M shares in the open market between December 4th and the 8th. This purchase ups his stake by about 10% – a substantial move. With 23% of the float sold short, this event could begin an important sentiment shift. Yesterday was a good start with a 13% gain and a gap up that used the 50DMA as support. The stock still needs to clear recent highs in order to put an end to the most recent downtrend. I will interpret a close of this gap as a very bearish event and confirmation that the downtrend remains well intact.

Wynn Resorts (WYNN) tries to change the bearish narrative…

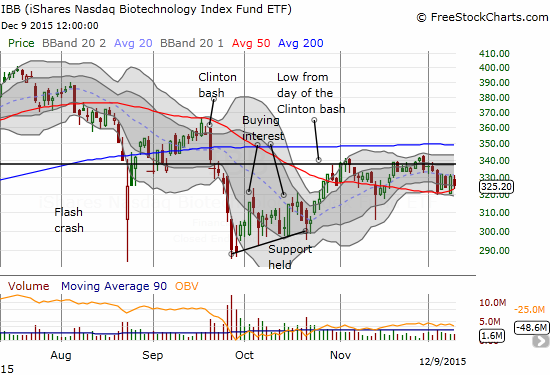

The iShares Nasdaq Biotechnology (O:IBB) has held up better than the overall market in recent days. For five straight days, IBB has churned right above 50DMA support. After twice failing in November to finish a reversal of the Clinton Bash, this battle at support becomes very important. A clean breakdown would be very bearish and would put the lows of September and October back into play.

Can iShares Nasdaq Biotechnology (IBB) survive this critical test of 50DMA support?

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SVXY shares, net long the U.S. dollar index, net short the euro, long and short various positions against the Japanese yen, long IBB call options