Stock markets were closed here in the US but open everywhere else on Monday, May 30. The S&P 500 futures as of this writing were up around 30 bps and were as high as 4,200.

Additionally, the VIX index was trading higher Monday to 26.45. The VIX may hold the key to how the week’s trading goes because the VIX closed at a pretty critical level on Friday, just below 26.

That level has been crucial over the past few weeks. A break below the 25 to 26 zone will likely cause a further meltdown for implied volatility and push back towards the low 20s.

1. S&P 500

A VIX pushing to the low 20s would be very bullish for stock and help push the S&P 500 much higher. There wouldn’t be much keeping the S&P 500 futures from rising to 4,300.

But for that to happen, several factors need to go right for the market this week. Most notably is the slew of economic data starting on Wednesday, with the ISM manufacturing PMI, followed by the employment report on Friday.

Additionally, several Fed governors will be talking this week, which may be working hard to correct any misconceptions the equity market may have taken away from the Fed minutes. I covered the topic in this article which should be free to read QQQ: The Stock Market Gains May Melt Away Quickly

2. Yields on the rise

The economic data and central bankers pose one risk for stocks, and it may work to keep a lid on prices, preventing the VIX from dropping significantly.

The other risk is that yields may find themselves starting to rise again. The spreads between US and German yields have contracted considerably over the past few weeks and now find themselves at the lower end of the historical trading range at 1.7%.

This tells us that if rates in Germany continue to rise, as they have recently, they are likely to drag US rates higher. Additionally, it is possible that the spread between US and German yields also begins to widen again.

The narrowing of this spread is one reason why the dollar has weakened materially against the euro in recent weeks.

A combination of rates starting to move higher again, the dollar strengthening, and economic headlines likely keep the VIX moving much lower. Additionally, if the Fed’s intention is not to pause come this September, and Bostic’s comments were only meant to slow the pace of financial conditions tightening, then the steady stream of governors this week will likely correct that message.

These factors are likely to keep this market contained, and now that the holiday weekend is over, news flow and events should start to pick up once again.

I think we will see much of last week’s gains reverse. The rally structure is fragile, on big vertical moves higher. We have seen these moves multiple times, even going back to March, and each time the big moves have returned to their origin.

I don’t think this time will be different. I think the S&P 500 futures will drop back to 3,980, which is where technical support is, and potentially as low as 3,885 before it is all said and done.

3. 10-Yr

Additionally, a falling wedge pattern is now present in the US 10-Yr, which could indicate that yields are also due to rise, potentially back to around 3%.

4. 2-Yr

A similar pattern has also formed in the US2-Yr yield, and this too would indicate that rates are likely to push higher, potentially back to 2.75%.

5. Dollar Index

The dollar index also has the same falling wedge pattern and suggests the recent dollar softness is over, with a big push higher likely to come.

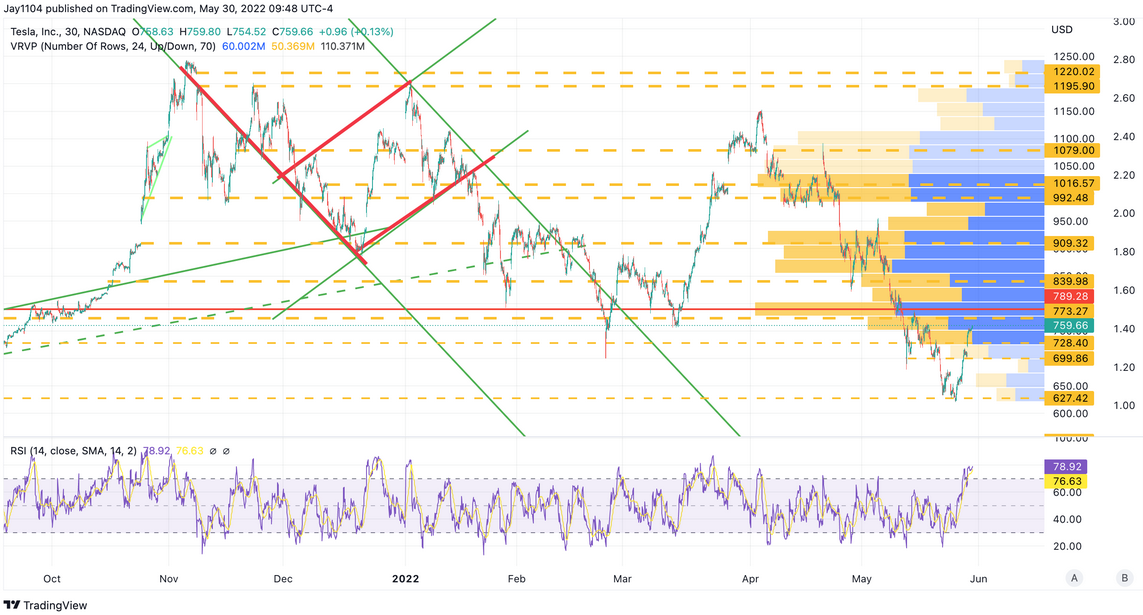

6. Tesla

Tesla (NASDAQ:TSLA) shares have risen sharply, but it is about to encounter a zone with great resistance, around $775. I think that price point will be challenging for Tesla to get through and will likely result in the shares moving back into the low $600.

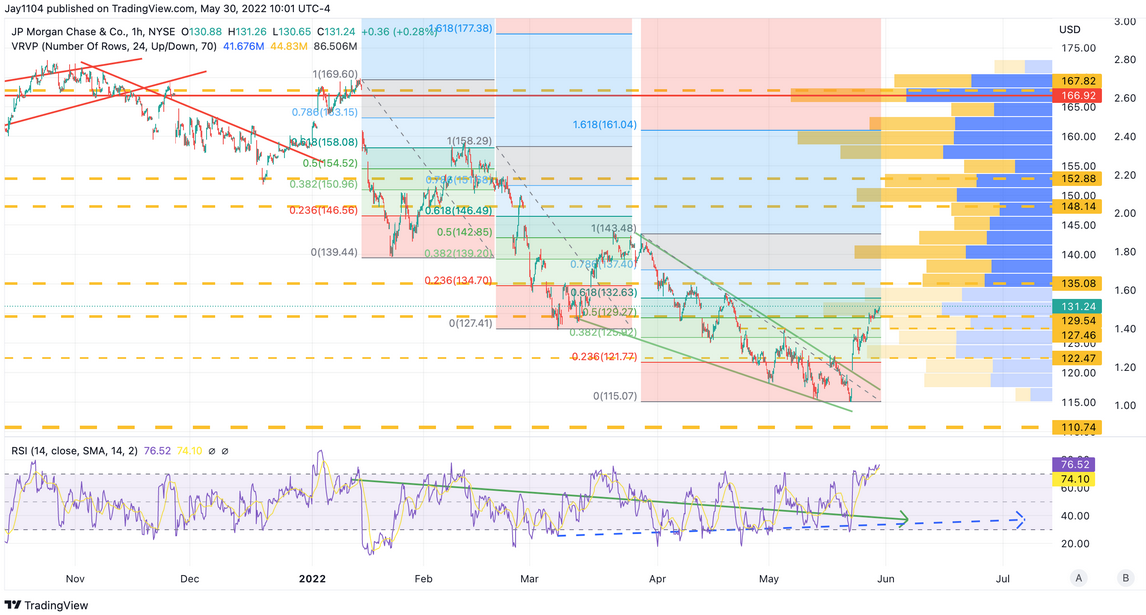

7. JPMorgan

JPMorgan Chase & Co (NYSE:JPM) was one of the stocks that helped to turn the market tide last week, after its investors’ day.

But that move-up has probably run its course and nearing its end as it approaches its 61.8% retracement level from its drop that started on Mar. 29.

That 50 to 61.8% retracement zone has been resistance on two prior rally attempts.

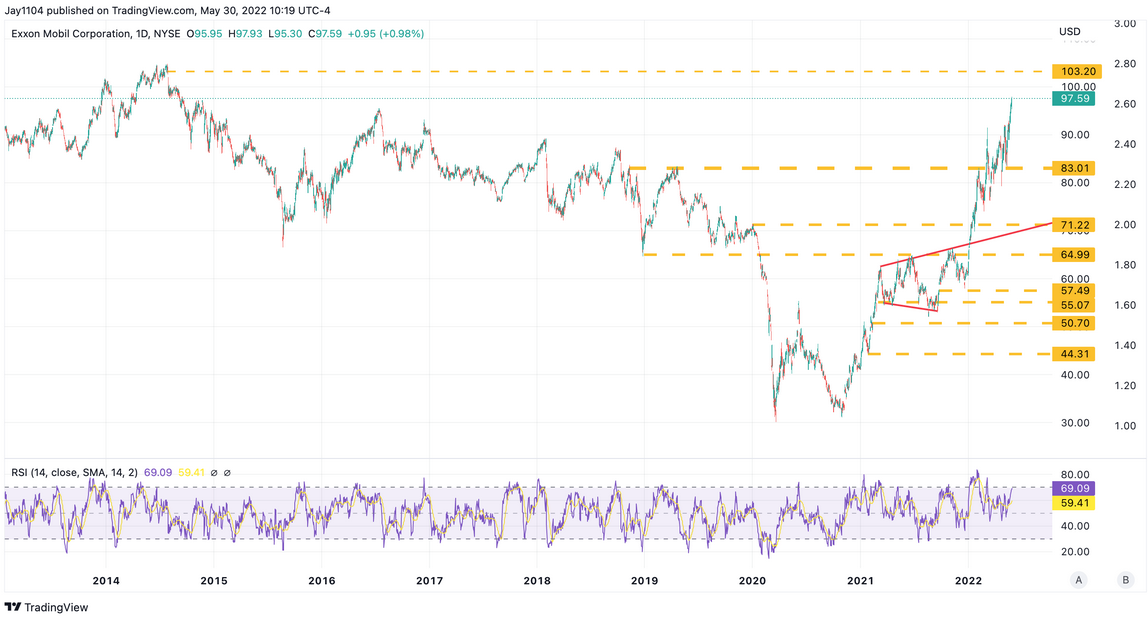

8. Exxon

Exxon Mobil (NYSE:XOM) has been quietly moving higher as oil prices have been moving higher. Exxon has a giant gap that lives around the $103 price level.

Given the steep ascent in the stock, that appears to be a nice spot for the stock to gravitate towards.

9. Chevron

Chevron (NYSE:CVX) has already reached its all-time highs, and after three months of consolidation, the shares appear to be breaking out. If the pattern proves to be a bull flag, then a measured move may result in the share climbing significantly higher.

This week’s free YouTube video:

Have a good day! See you tomorrow.