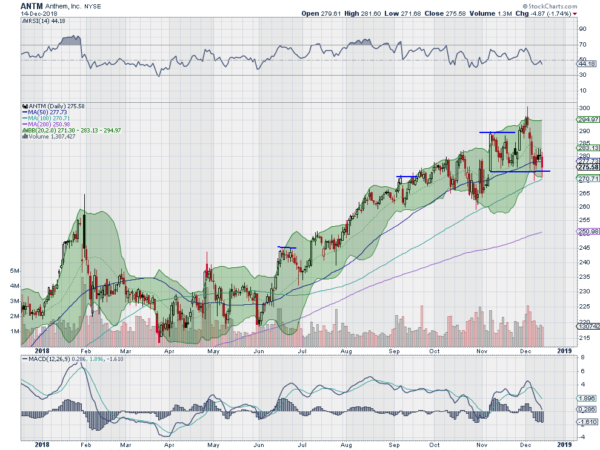

Anthem Inc (NYSE:ANTM) rose out of consolidation in June and has continued to make higher highs and higher lows until last week. Now it is at support, with the RSI pushing toward the bearish zone and the MACD about to turn negative. Look for a push through support to participate.

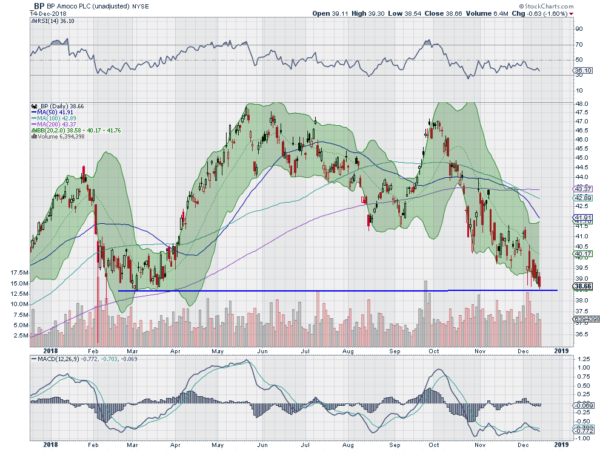

BP

BP (NYSE:BP) bottomed in March and then reversed to a higher high in May. It pulled back from there to an August low under the 200-day SMA and bounced, nearly making it back to the prior high. The drop from the October high has continued and is now back at the March low. The RSI is falling in the bearish zone with the MACD crossed down. Look for a break of support to participate.

CME Group Inc (NASDAQ:CME) rose up out of consolidation in August, and continued to the most recent top in November. It has consolidated against support since then and is now close to having the 50-day SMA join it. The RSI is bouncing off of the mid line with the MACD driving lower. Look for a break of support to participate.

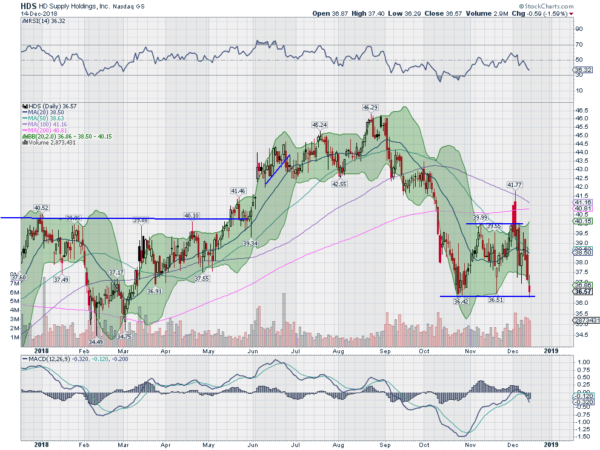

HD Supply Holdings Inc (NASDAQ:HDS) rose from a February low and broke over the prior high in May. It kept going to a top in August. From there, it pulled back, finding support just above the March low. It bounced up to the 200-day SMA and then fell back, leaving it at recent support. The RSI is falling in the bearish zone with the MACD falling back into negative territory. Look for a break of support to participate.

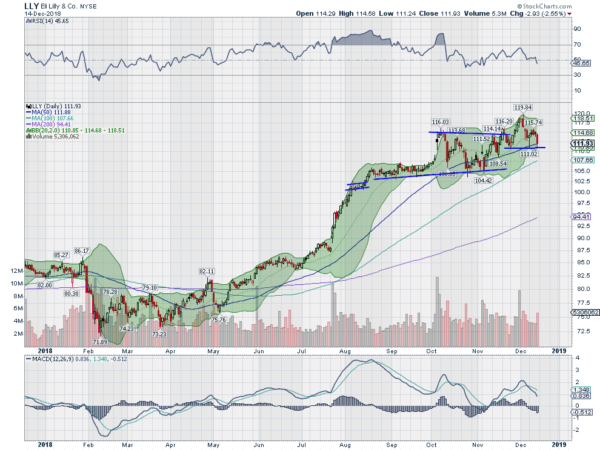

Eli Lilly and Company (NYSE:LLY) started higher out of consolidation in April. It slowly accelerated and moved higher to a plateau in August. It rested and started higher again in October, but quickly fell back. Another push higher took it to a top at the end of November. It has been pulling back from that top since and is now at support. The RSI is falling through the mid line with the MACD falling. Look for a break of support to participate.

Up Next:

Elsewhere look for Gold to pause in its uptrend while Crude Oil consolidates in its downtrend. The US Dollar Index looks to pause in its uptrend while US Treasuries consolidate in their short term rise. The Shanghai Composite continues in broad consolidation in its downtrend and Emerging Markets are pausing in their move lower.

Volatility looks to remain elevated, keeping in the new higher range. This continues to keep the bias lower for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ) . Their charts show the pressure with the IWM leading markets lower, the SPY breaking a range to join it and the QQQ dropping to the bottom of recent trading, hanging on by a fingernail. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.