Amgen (AMGN)

Amgen (NASDAQ:AMGN) appears to have been building a very long top since July last year. Coming into the week it is piercing support with the RSI entering the oversold territory and the MACD falling and negative. Look for continuation to participate lower.

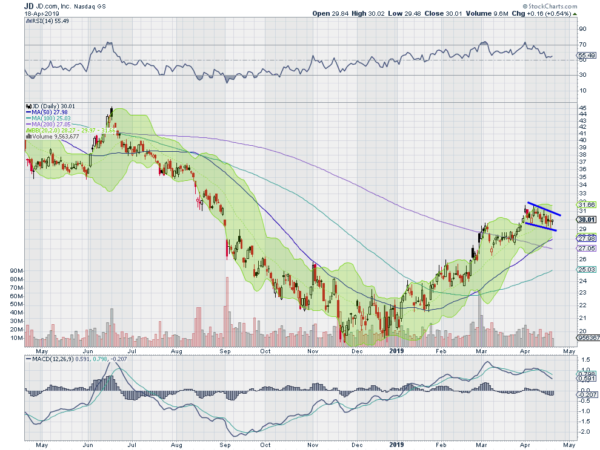

JD.Com (JD)

Jd.Com Inc Adr (NASDAQ:JD) has been rounding up out of a bottom. Two weeks ago it printed a Golden Cross in its consolidation. The RSI has reset lower in the bullish zone with the MACD also pulling back from highs but positive. Look for a break of consolidation to participate.

Manitowoc (MTW)

Manitowoc Company Inc (NYSE:MTW) started a move lower in August that found support in December. Since then it has made a higher low and is on the way towards a higher high. The RSI is rising and bullish with the MACD positive and lifting off of the zero line. Look for continuation to participate.

Sensata Technologies (ST)

Sensata Technologies Holding NV (NYSE:ST) rose out of a double bottom in February, finding resistance into the end of the month. It pulled back to a higher low into March and then reversed. It comes into the week at resistance with the RSI rising and bullish and the MACD positive and moving up. Look for a pushover resistance to participate.

Western Union Company (WU)

Western Union Company (NYSE:WU) started moving lower in June last year and found a bottom in December. Since then it has taken two legs higher and retrenched after each. It is now moving back higher with the RSI rising in the bullish zone and the MACD level and avoiding a cross down. Look for continuation to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to head lower while Crude Oil pauses in its move higher. The US Dollar Index looks to continue to move sideways while US Treasuries may be ending their pullback. The Shanghai Composite and Emerging Markets look to continue to move to the upside.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed though in the shorter timeframe with the QQQ strong and heading higher, the SPY consolidating and the IWM retrenching. All three look stronger in the weekly timeframe. Use this information as you prepare for the coming week and trad’em well.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.