Peloton (NASDAQ:PTON) has been getting a lot of press since the onset of the pandemic, with its $2,000+ bikes flying off the shelves. 24 Hour Fitness and Gold’s Gym have filed for Chapter 11 bankruptcy.

It is against this backdrop that Planet Fitness (NYSE:PLNT) stock has emerged as an excellent investment. The long-term outlook for Planet Fitness, whose shares still trade well-below pre-pandemic levels, is actually better than ever.

Here are 5 reasons why:

1. Franchisee Business Model

Planet Fitness directly owns less than 10% of its locations. Franchisees own the other 90%+. This asset-light business model is a godsend during the pandemic.

The actions of franchisees tell you all you need to know about the viability of owning a Planet Fitness during normal times, as 90% of the news stores opened in 2019 were by existing franchisees.

But these aren’t normal times: how are franchisees faring in 2020?

Planet Fitness management has said that a good percentage of franchisees are deep-pocketed private equity firms. The franchisees have been able to work with lenders and weather the storm.

2. Comps Were Amazing Pre-COVID

Before the onset of the pandemic, Planet Fitness had recorded 53 straight quarters of positive same-store sales growth.

Obviously, business has taken a turn for the worse in 2020, but the long-term outlook hasn’t changed. If anything, it’s gotten better. The importance of a healthy lifestyle is more apparent than ever with the effect of COVID-19 on people with pre-existing conditions. Around a third of Planet Fitness’ new members are first-time gym-goers in normal times; post-COVID, that number may increase further.

3. Expansion Is In The Cards

Planet Fitness is planning to double its number of locations from just over 2,000 to 4,000+.

A Similar Story Has Played Out Before:

On the heels of the 2008 crisis, Planet Fitness started growing its long-term market-share. With chains like Gold’s Gym and 24 Hour Fitness struggling, an expansion will be even easier than before.

Not to mention, the real estate market will be attractive, with prime locations opening up due to struggling businesses shutting down across industries.

4. People Will Work Out At Planet Fitness Post-COVID

I’m not saying that Peloton and other home workout companies are going to fall off post-pandemic.

But at the same time, “brick-and-mortar” gyms aren’t going anywhere. Especially Planet Fitness.

Planet Fitness costs just $10 a month. Home gym set-ups can easily run into the thousands. And that’s if people even have the space, which they often don’t.

Casual gym-goers will come back to Planet Fitness en masse after the pandemic ends. If anything, planet fitness would benefit from losing some of its “fitness-freak” members. After all, the low-cost gym membership model only works because most people don’t use it 5 times a week.

5. The Price Is Right

Planet Fitness was growing at an impressive rate prior to the pandemic.

From 2015 to 2019, revenue grew at a CAGR of 20.1%. Over the same period, net income grew at a CAGR of 58.8%.

Remember, this is a company with impressive long-term comp growth that is planning to double its number of gyms.

Planet Fitness is trading at 41x its 2019 earnings, which feels like a steal.

Again, this is a gym that is positioned to weather the tough conditions of the pandemic. I already touched on the business model, but the numbers also show that there is no reason for concern: Planet Fitness’ adjusted EBITDA came in at a loss of $9.3 million in Q2. Not what you want to see, but this is a nearly $5 billion company with almost half-a-billion dollars in cash on its balance sheet. Planet Fitness will be just fine in the short-term.

The Final Word

An investment in Planet Fitness might not pay off in 2020.

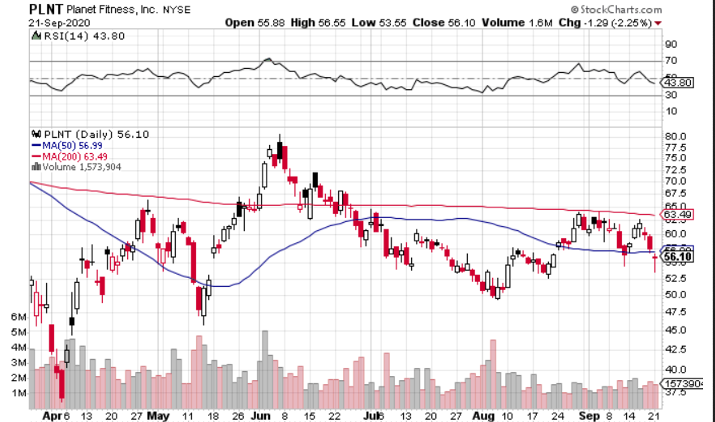

The chart isn’t exactly a thing of beauty and business isn’t going to get much better next quarter. But patience is a virtue and in the case of Planet Fitness, it can pay off handsomely. Look to pick up some shares now before the company’s long-term upside becomes apparent to the rest of the market.