$500K can be enough money to retire on. Even as early as age 50!

The trick is to convert the pile of cash into cash flow that can pay the bills. I’m talking about $35,000 to $40,000 per year or more in dividend income on that nest egg, thanks to 7% and 8% yields.

These are passive payouts that show up every quarter or, better yet, every month. Meanwhile, we keep that $500K nest egg intact. Or, better yet, grind that principal higher steadily and safely.

Got more in your retirement account? Cool, more monthly dividend income for you!

We’ll talk about specific stocks, funds, and yields in a moment. First, let’s wipe the false promises of mainstream finance from our minds.

Step 1: Forget “Buy and Hope” Investing

Most half-million-dollar stashes are piled into “America’s ticker” SPY. The SPDR® S&P 500 (NYSE:SPY) is the most popular symbol in the land. For many 401(K)’s, this is all the “go to” ticker.

Sad for two reasons. First, SPY yields just 1.6%. That’s $8,000 yearly on $500K… poverty level stuff.

Second, SPY fell 18% last year. That is no Bueno because that $500K would have shrunk to $410K. We protect against losses like these at all costs.

Step 2: Ditch 60/40, Too

The 60/40 portfolio has been exposed as senseless. Retirees were sold a bill of goods when promised that a 60% slice of stocks and 40% of bonds would somehow be a “safe mix” that would not drop together. That can work—but not always, and that “sometimes” can hurt.

Inflation plus an aggressive Federal Reserve plus a (thus far) persistently steady economy—has drop-kicked both equities and fixed income. The result is that bonds have not been the haven guaranteed by the 60/40 high priests.

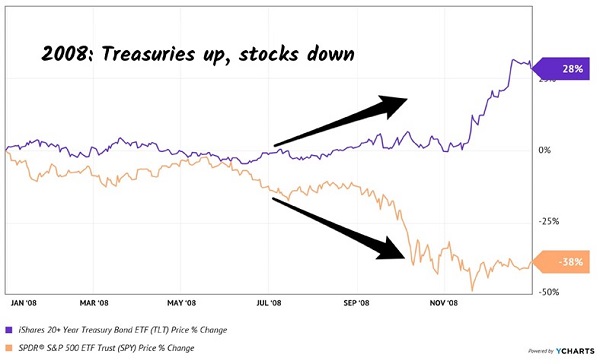

In a way, 2022 has been a worse dumpster fire than 2008. Granted, almost everything crashed in the Financial Crisis, but US Treasuries rallied, and the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) delivered a 28% gain that year:

In 2008, Bonds Did Great

Last year, however, TLT got tagged. Sure, it still paid its dividend. But even including payouts, the fund dropped 31%. Worse than the S&P 500. Ouch!

When stocks and bonds are dicey, where do we turn? To a better bet: a strategy to retire on dividends alone that leaves that beautiful pile of cash untouched.

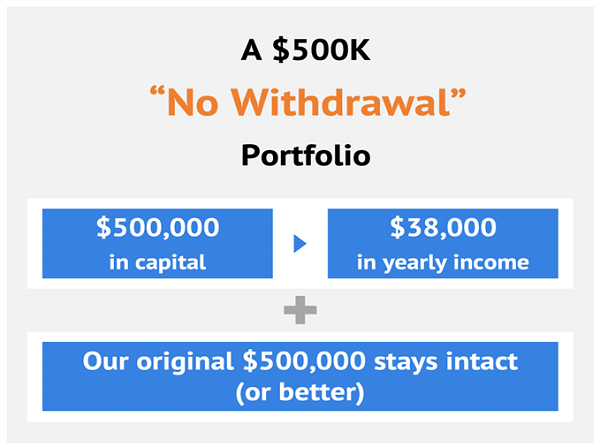

Step 3: Create a “No Withdrawal” Portfolio

Tom Jacobs and I wrote the book on dividend-powered retirement. In the book, we outline our “no withdrawal” approach to retirement:

- Save a bunch of money. (“Check.”)

- Buy safe dividend stocks with big yields.

- Enjoy the income while keeping the original principal intact.

To make that million last and our working and saving lives worthwhile, we need 7% to 8% yields. And while we typically don’t see these stocks touted on Bloomberg or CNBC, they are around.

Of course, there are plenty of landmines in the high-yield space. Some of these stocks are cheap for a reason, which is why we need to be contrarian when looking for income.

We must identify why a yield is incorrectly allowed to be so high. (In other words, we need to figure out why the stock is priced so cheaply!)

The highest-paying 13 stocks in my Contrarian Income Report portfolio average a 7.6% payout. This baker’s dozen of dividends spins off $76,000 for every million dollars invested!

And you don’t have to be a millionaire to take advantage of this strategy. A $500K nest egg will create $38,000 in annual income. You get the idea.

The important thing is that these yields are safe, which creates stability for the stock (and fund) prices attached to them. We want our income with our principal intact. It’s the only way to retire comfortably without having to stare at stock tickers all day, every day.

Now, many blue-chip yields are safe. They need to hit the gym and bulk up a bit. Here’s how we take excellent yet modest dividends and make them into braggarts.

Step 4: Supersize Those Yields

Mastercard (NYSE: MA) is a near-perfect dividend stock. Its payout is constantly climbing, up 96% over the last five years. (MA shareholders, you can thank every business that accepts Mastercard for your “pennies on every dollar” rake.)

Swipe, swipe, swipe. Remember cash? Me neither. Another 2020 casualty, with Mastercard making a few dimes or dollars on every plastic transaction.

The cashless tsunami has been in motion for years, but international growth prospects remain huge! Just a few years ago, 80%+ of transactions in Spain, Italy, and even tech-savvy Japan were in cash. We expect more dividend hikes as cash morphs into plastic.

The only chink in MA’s armor? Everyone knows it is a dynamic dividend stock. So, it only yields 0.6%. Investors keep bidding it higher, knowing the next dividend raise is just around the corner. The yield stays tiny.

So, the compounding of those hikes makes MA a great stock for our kids and grandkids. You and I, however, don’t have the time to wait for 0.6% to grow. And $6,000 on our $500K nest egg simply won’t get it done.

Let’s instead consider the top-notch closed-end fund (CEF) Gabelli Dividend & Income Closed Fund (NYSE:GDV), managed by legendary value investor Mario Gabelli. Mastercard is Gabelli’s second-largest holding. But we income investors would prefer GDV because it boasts a sweet 6.1% dividend, paid monthly.

Not only that, but thanks to the selloff of ’22, we have a rare opportunity to buy Mario’s portfolio for just 87 cents on the dollar. Yup, GDV trades at a 13% discount to its net asset value or NAV. It’s a great way to boost MA’s payout and snag a discount.

Where does this discount come from? CEFs have fixed pools of shares, so they can (and do) trade higher and lower than their NAVs, or “fair” values (the value of their holdings minus any debt). We contrarians can step in when they are temporarily out of favor, like after a pullback when liquidity is low, and buy them at generous discounts.

GDV holds more blue-chip dividend payers alongside MA, such as Microsoft (NASDAQ:MSFT) and JPMorgan (NYSE:JPM). These stocks are already cheaper than a year ago, and with GDV, we can purchase them at a 13% discount.

These high-quality stocks wouldn’t usually qualify for our “retire on $500K” portfolio because everyone knows they are excellent long-term investments. Even though these companies consistently raise their dividends, investor demand for the stocks keeps their prices high and current yields low. They never meet our current yield requirement.

GDV does. Its monthly dividend adds up to a 6.1% annual yield.

But Brett, 6.1% isn’t 7.6%. Good point, so let me give you one more idea. Eaton (NYSE:ETN) Vance Tax-Managed Global Diversified Equity Income Closed Fund (NYSE:EXG) is another CEF with a similar blue-chip dividend portfolio. But EXG generates even more income than GDV by selling covered calls on its shares. More cash flow means a bigger dividend—and EXG pays an elite 8.4%!

So, do we buy and hold EXG and GDV forever, collecting their monthly dividends merrily along the way? Not quite.

In bull markets, these funds are great. But in bear markets, they’ll chew you up.

Step 5: Protect That Principal!

My CIR readers will fondly recall the 15 months we held GDV and EXG, collecting monthly dividends plus price gains that added up to 43% of total returns.

What was happening in that period from October 2020 until February 2022? The Federal Reserve was printing money like crazy. Yes, it did stoke inflation, but we enjoyed a more-than-offsetting boost in asset prices.

Starting in 2022, we had the opposite situation. The stock market was topping, and we didn’t want to fight the Fed. We sold high, and look what happened since:

EXG and GDV: Each Down 13% Since We Cashed In

Might we repurchase these funds someday? Of course. When the time is right.

For whatever reason, “market timing” is taboo among long-term investors. That’s a shame because it is pretty important. By aligning our dividends with the market backdrop, we can protect our principal from bear markets like we saw this year.

Step 6: Start Here to Retire on $500K

“Tried and true” money advice—like the 60/40 portfolio and the 4% withdrawal rule—have been properly exposed as broken. Good riddance!

I’d love to tell you more about my solution, the 8% “No Withdrawal” Retirement Portfolio. Including my favorite stocks and funds to buy right now.

While we wait on bull market dividend darlings like EXG and GDV, we have to flash BUY signals in select corners of the bond market.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the US markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."