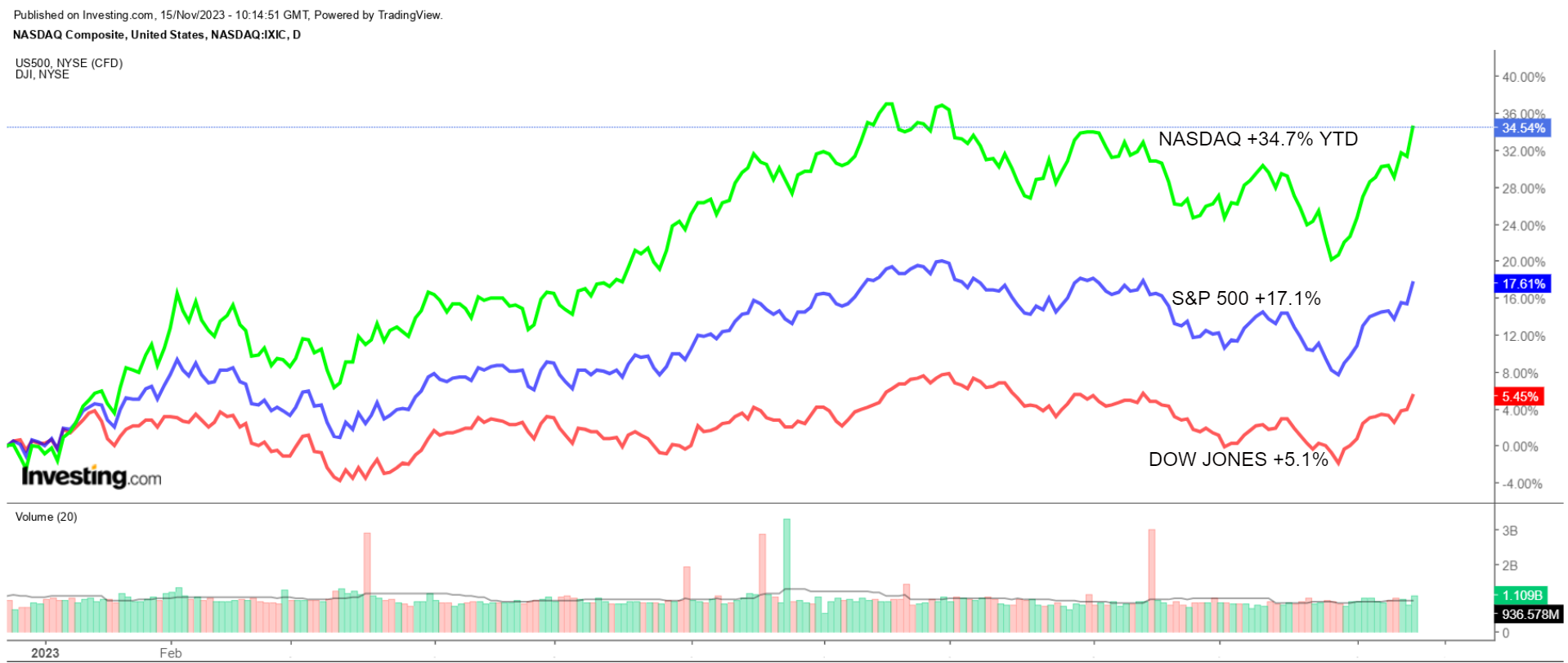

- High-growth technology stocks are back in demand thanks to easing inflation worries and receding fears over further Fed rate hikes.

- The Nasdaq Composite will continue to lead the market higher as the end of the Fed’s rate-hiking era approaches.

- As such, here are three leading growth stocks worth buying amid the current backdrop.

- Unlock the potential of InvestingPro for up to 55% off this Black Friday and never miss out on a market winner again

- *Year-To-Date Performance: +225.1%

- *Market Cap: $17.2 Billion

- *Year-To-Date Performance: +97.5%

- *Market Cap: $49.6 Billion

- *Year-To-Date Performance: +48.4%

- *Market Cap: $35.8 Billion

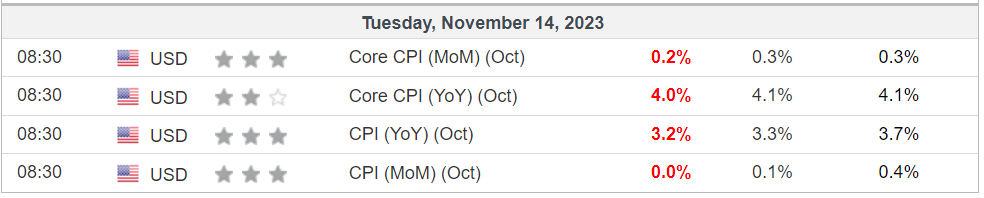

The U.S. stock market looks set to extend its rally through the end of the year, after Wall Street cheered fresh inflation data that supported the view that the Federal Reserve may be done raising interest rates.

Source: Investing.com

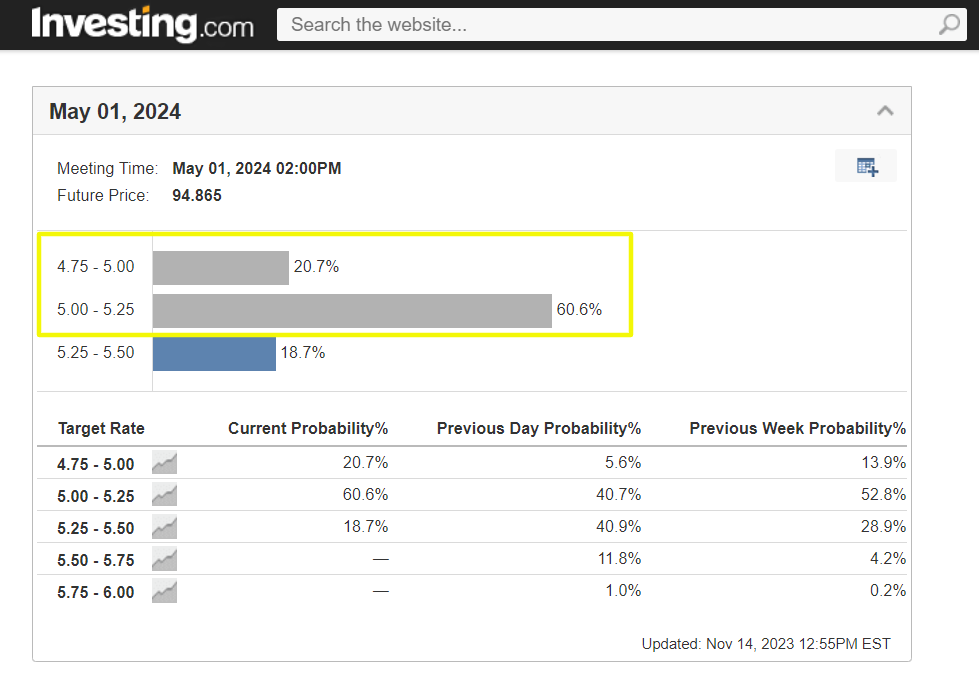

Expectations of the Fed cutting rates next year also rose following the soft CPI report. As of Wednesday morning, U.S. rate futures priced in an 80% chance of a rate cut in May, compared with 45% on Monday, according to the Investing.com Fed Monitor Tool.

The tech-heavy Nasdaq has been the top performer of the three major U.S. indexes by a wide margin so far in 2023, surging 34.7% year-to-date. That compares to an increase of 17.1% for the benchmark S&P 500 over the same time span and a 5.1% gain for the blue-chip Dow Jones Industrial Average.

The ongoing rally has been fueled by shares of the mega-cap tech companies, with Nvidia (NASDAQ:NVDA), and Meta Platforms (NASDAQ:META) both posting triple-digit gains thus far, while Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), and Apple (NASDAQ:AAPL) are also up solidly on the year.

Taking that into consideration, I recommend buying shares of DraftKings, CrowdStrike, and Datadog amid increasing odds that the Fed is done hiking interest rates and will pivot to easing monetary policy in 2024.

1. DraftKings

Receding inflation fears and growing optimism that the Fed is all done raising rates will continue to power shares of DraftKings (NASDAQ:DKNG), which has seen its growth story gather momentum lately thanks to an improving fundamental outlook.

DKNG stock ended Tuesday’s session at a fresh 52-week high of $37.03, earning the Boston, Massachusetts-based sportsbook operator a valuation of $17.2 billion.

Shares of the sports betting firm are up an astonishing 225% year-to-date amid excitement over the company’s improved profitability outlook as it cements itself as the leader of the highly competitive online gambling industry.

Notwithstanding the recent turnaround, DKNG still trades 50% below its all-time intraday peak of $74.38 set in March 2021.

The online gambling specialist reported blowout earnings and revenue earlier this month, driven primarily by its efficient acquisition of new customers.

DraftKings reported a net loss of $0.61 per share, narrowing from a loss of $1.00 per share in the same period a year earlier. Revenue for the third quarter jumped 57% annually to $790 million, crushing forecasts for sales of $699 million.

The sports betting company reported 2.3 million monthly unique payers in the third quarter, representing a year-over-year increase of 40%. In addition, the average revenue per monthly unique payer increased by 14% to $114.

Looking ahead, I believe DraftKings is well positioned for further gains as it continues to expand into new jurisdictions and draw in more customers to its platform. Currently, the company is live with mobile sports betting in 22 states and live with iGaming in five states.

2. CrowdStrike

CrowdStrike (NASDAQ:CRWD) is well placed to extend its powerful rally amid growing bets that the Fed has reached the end of its monetary tightening cycle and as the economy continues to undergo a sea change of digitization.

The Austin, Texas-based information security specialist has been one of the main beneficiaries of the surge in cyber spending from corporations and governments around the world as they respond to growing digital security threats.

Shares broke out to a fresh 52-week high of $209 on Tuesday, a level not seen since April 2022, before closing the session at $207.97. At its current valuation, CrowdStrike has a market cap of about $50 billion.

CRWD stock is 97.5% year-to-date, reflecting the company’s strong fundamentals and long-term growth prospects. Despite the massive rally this year, shares remain roughly 30% away from the all-time high of $298.48 reached in November 2021.

Widely viewed as one of the leading names in the cloud-based cybersecurity industry, CrowdStrike is forecast to report explosive profit and sales growth when it delivers third-quarter financial results on November 29.

Consensus calls for earnings per share of $0.74, improving 85% from EPS of $0.40 in the same period last year. Revenue is forecast to climb 34.8% to $777.3 million amid growing demand for its cloud-based cybersecurity platform.

According to an InvestingPro survey, profit estimates have been revised upward 38 times in the past three months, compared to zero downward revisions, as Wall Street grows increasingly bullish on the cybersecurity company.

It should be noted that CrowdStrike has topped Wall Street’s expectations for earnings and revenue in every quarter since it went public in June 2019, underlining the strength of its underlying business.

3. Datadog

With the Fed likely to start cutting interest rates sooner than expected, I believe that Datadog (NASDAQ:DDOG) is one of the best companies to own amid the current environment as it benefits from strong enterprise demand for its security monitoring and analytics tools.

DDOG ended Tuesday’s session at $109.09, its highest closing price since August 1. At current levels, Datadog has a market cap of $35.8 billion.

Shares of the New York-based company have been on a major uptrend for most of the year, rising around 49% in 2023. Even after the strong year-to-date gains, DDOG stock is still 45% below the record peak of $199.68 reached in November 2021.

In a sign of how well its business has performed lately, the cloud security-monitoring platform provider reported better-than-expected third-quarter earnings and upbeat full-year guidance.

Datadog said adjusted earnings per share improved 95% from the year-ago period to $0.45, better than the $0.34 analysts expected. Revenue for the quarter came out to $547.5 million, up 25% year-over-year, and topping estimates of $524.7 million.

The security software maker said that it had 3,130 customers with annual recurring revenue (ARR) of $100,000 or more as of the end of September, up 20% from the year-ago period.

Datadog’s fourth-quarter outlook made clear it does not expect any slowdown in the coming months, with revenue forecast to grow by 21% year-over-year to a record $566 million.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys for maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.