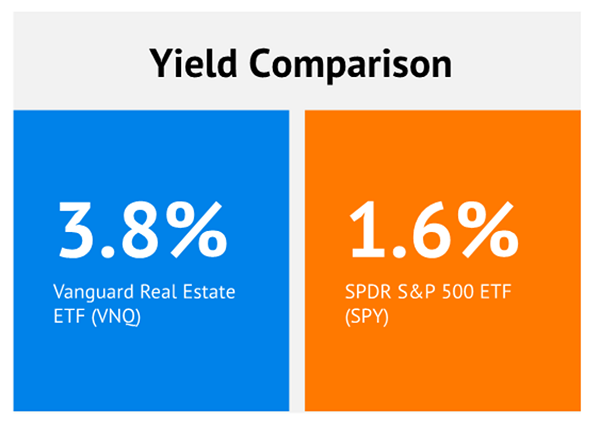

Real estate investment trusts (REITs) are retirement makers right now. Many are paying dividends that are three or even four times the market average.

Plus, these landlords are cheap. They are trading at multiples of cash flow that make them bargains compared with the S&P 500.

Why are these deals available? Rising rates.

In the near term, higher rates mean higher costs of capital for REITs, and more competition for income (as bond yields rise, too). That has knocked real estate stocks down—which is great news for us dividend investors, because it means they pay more.

Today, we’re going to look at a surprising three-pack of REITs that yield 3x to 4x the broader stock market and are outrunning not just the sector over the past few months, but the much better-performing S&P 500.

And oh by the way, each of these three REITs have raised their dividends in the past year. Let’s get into them.

1. Innovative Industrial Properties

- Dividend Yield: 6.5%

Warehouses and logistics centers are among the most popular types of REITs—but despite the name, that’s not what Innovative Industrial Properties (NYSE:IIPR) is.

It’s a weed REIT.

To be more specific, IIPR is a rare real estate play that provides capital for the regulated cannabis industry. It has a sale-leaseback program wherein it buys freestanding industrial and retail properties (primarily marijuana growth facilities) and leases them back, providing cannabis operators with large influxes of capital to expand their operations.

The resulting portfolio currently stands at 111 properties comprising about 8.7 million rentable square feet in 19 states.

Innovative Industrial Properties has put the REIT sector to shame since its December 2016 initial public offering—returning more than 600% to the sector’s 28%—but like many growth shares, IIPR has struggled in 2022. The stock is off nearly 60% year-to-date even with a recent bounce-back, reflecting the deep pain being felt across the marijuana industry.

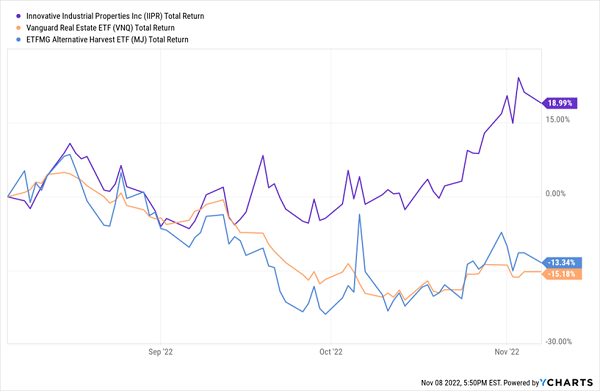

But IIPR has diverged from both real estate and cannabis over the past three months, up 19% versus mid-teen losses for those two areas of the market.

IIPR Shares Are Smokin’ Lately

A great third-quarter report helped. The company’s adjusted funds from operations (AFFO) jumped 25% year-over-year to $2.13 per share—well more than what’s needed to cover the $1.80 per share dividend. (And AFFO through nine months is up 32%.)

That dividend, by the way, has been growing like a, ahem, weed. That $1.80 per share is 20% better than it was a year ago, and it’s been ballooning by 64% annually since the first 15-cent payout in 2017.

Valuation is OK, but certainly not great. Despite a massive hemorrhaging of shares in 2022, IIPR trades at a little more than 13 times forecast AFFO, reflecting a lot of remaining confidence in the stock despite its precipitous tumble.

2. Simon Property Group

- Dividend Yield: 6.2%

Whoever said malls are dead—well, they still might be right, but mall mega-REIT Simon Property Group (NYSE:SPG) is at least showing signs of life.

Simon has more than 250 properties across the globe, including locations in the 25 biggest U.S. markets by population. That laser focus on brick-and-mortar real estate naturally made it a pariah during the onset of COVID, and while SPG shares eventually came within a whisper of their pre-COVID highs last year, they’ve struggled again in 2022, off well more than 20%.

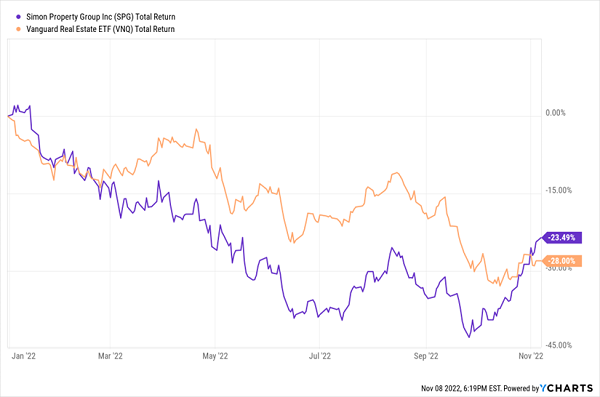

But what makes SPG worth a closer look (other than its juicy yield) is the tail end of this chart:

SPG Comes to Life While Most Real Estate Wobbles

Simon had itself a ball of a third quarter, in which it beat FFO estimates, delivered a 160-basis-point YoY improvement to in occupancy to 94.5%, signed 900 new leases, and raised minimum base rents by a little less than 2%.

What’s fueling the success? Well, the trend toward online shopping, which accelerated during COVID, has pulled back a little, coaxing businesses to continue opening stores. But SPG and other mall operators are getting more creative about their spaces, opening them up to co-working suites, spas, fitness centers and other nontraditional mall tenants.

Also noteworthy is that Simon raised its payout to $1.80 per share, which is about 9% higher year-over-year.

To be clear: SPG hacked its dividend by 38% in 2020, to $1.30 per share from $2.10 previously. So shareholders still aren’t completely square, but SPG has been raising its payout every quarter for two years now. And that dividend is only about 60% of Q3’s FFO, so coverage isn’t an issue here.

What is at issue is the major headwind SPG will have to contend with, which is the recession that just about every economist and strategist is forecasting. Malls in general, and SPG specifically, inherently struggle when the economy teeters. So there’s still room for Simon’s situation to get worse before, and if, it ultimately gets better.

3. Getty Realty

- Dividend Yield: 5.4%

Single-tenant retail REIT specialist Getty Realty (NYSE:GTY) is a unicorn in 2022. It’s not just outperforming the real estate sector over the past few months and all year—it has actually delivered gains (on a total-return basis) so far in 2022.

Getty’s in the Green

GTY defines the term “boring is beautiful.”

This is a massive net-lease REIT, boasting more than 1,000 properties across 38 states and Washington, D.C. But its retailers are downright yawn-worthy: car washes, auto parts and service stores, convenience and gas stations. Tenants include Valvoline (NYSE:VVV), BP (NYSE:BP) and 7-Eleven.

The attraction here, then, clearly isn’t roughshod growth—it’s stability. And you’ll find that in more than just the real estate portfolio.

Many of its levered-up brethren are busy sweating the costs from higher interest rates. But Baird’s analyst team highlights Getty’s “low leverage, no near-term debt maturities, and no apparent issues on the horizon.” That has allowed them to focus on investing in (both acquiring and developing) new properties while other businesses are looking to exit.

The dividend draws a similar picture. The most recent payout hike was a 5% raise to 41 cents per share, which is right in line with its 5.1% annual average dividend growth over the past five years. But compared to a lot of REITs that had to yank back on the dividend chain during COVID, that kind of consistency is welcome.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."