The Canadian renewable energy stocks we’ve discovered have the potential for decent gains this year

SmallCapPower | May 11, 2020: The recent meltdown in the oil price might actually benefit the renewable energy industry, as some fossil fuel jobs and capital may begin to flow into sustainable power. Renewable energy companies focus on providing clean and sustainable sources of power. There are various methods for producing renewable energy, which is generated from solar, wind, geothermal, hydroelectric (from the ocean or waterwheels), or hydrogen plants, among others. Today we have identified three Canadian renewable energy stocks that could perform well relative to other industries in 2020.

*Returns are based on closing stock prices as of May 8, 2020

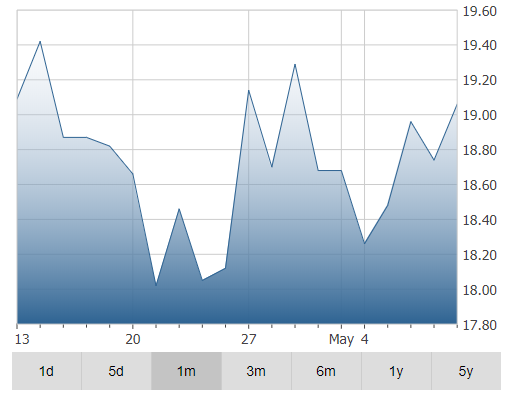

Innergex Renewable Energy (TSX:INE) – $19.06

Innergex Renewable Energy conducts operations in Canada, the United States, France and Chile and manages a large portfolio of high-quality assets currently consisting of interests in 68 operating facilities with an aggregate net installed capacity of 2,588 MW (gross 3,488 MW), including 37 hydroelectric facilities, 26 wind farms and five solar farms. Innergex also holds interests in seven projects under development, two of which are under construction, with a net installed capacity of 296 MW (gross 378 MW), and prospective projects at different stages of development with an aggregate gross capacity totaling 7,115 MW. In 2019, Innergex generated revenues from continuing operations that rose 16% year over year to $557.0 million, with a 16% increase in Adjusted EBITDA to $409.2 million. INE stock is currently yielding 3.8%.

- One-Year Return: 40% (Excluding dividends)

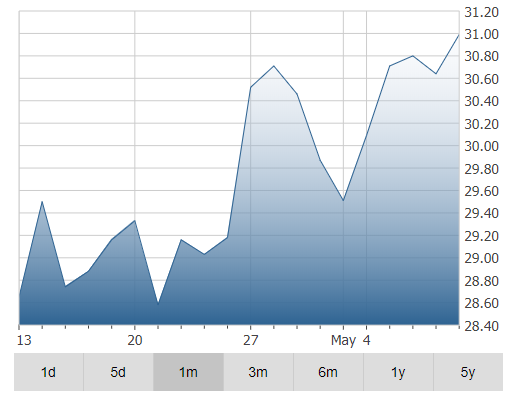

Northland Power (OTC:NPIFF) – $30.99

- Northland Power is a global developer, owner and operator of sustainable infrastructure assets. The Company owns or has an economic interest in 2,429 MW (net 2,014 MW) of operating generating capacity and 382 MW of generating capacity under construction, representing the Deutsche Bucht offshore wind project in the German North Sea (NYSE:SE) and the La Lucha solar project in Mexico. Northland also owns a 60% equity stake in the 1,044 MW Hai Long projects under development in Taiwan and operates a regulated utility business in Colombia. On March 30, 2020, Northland Power said it does not anticipate changes to its 2020 financial guidance as a result of COVID-19. NPI stock is currently yielding 3.9%.

- One-Year Return: 34% (Excluding dividends)

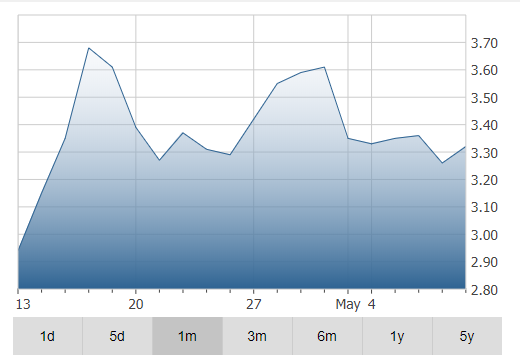

Xebec Adsorption Inc (TSXV:XBC) – $3.32

Xebec is a global provider of gas generation, purification and filtration solutions for the industrial, energy and renewables marketplace. Well-positioned in the energy transition space with proprietary technologies that transform raw gases into clean sources of renewable energy, Xebec’s 1500+ customers range from small to multi-national corporations, governments and municipalities looking to reduce their carbon footprints. On April 15, 2020, Xebec Adsorption reported 2019 revenue of $49.3 million, a 144% year-over-year increase, along with EBITDA of $5.1 million and a net profit of $2.0 million.

- One-Year Return: 146% (Excluding dividends)