It’s not just borrowers who are benefiting from the Federal Reserve’s 'patience' on interest rate hikes. Shares of real estate investment trusts (REITs), which allow individual investors to buy stock in commercial real estate portfolios that receive income from a variety of properties, are soaring thanks to the Fed’s dovish shift in policy.

Real estate stocks on the S&P 500 have jumped 13.7% since the start of the year, after falling 5.6% in 2018, as rising rates cut into home sales and reduced the appeal of the sector’s often hefty dividend payments.

But with interest rates remaining low, at least for now, investors are flocking to REIT shares, which offer the benefits of real estate investing—diversification, generally robust dividend income and an inflationary hedge—without the responsibilities of owning and managing property.

Given their rich dividend yields and strong earnings growth, the three REITs below could provide some of the best long-term growth potential for both fixed income and growth investors.

1. Realty Income Corporation

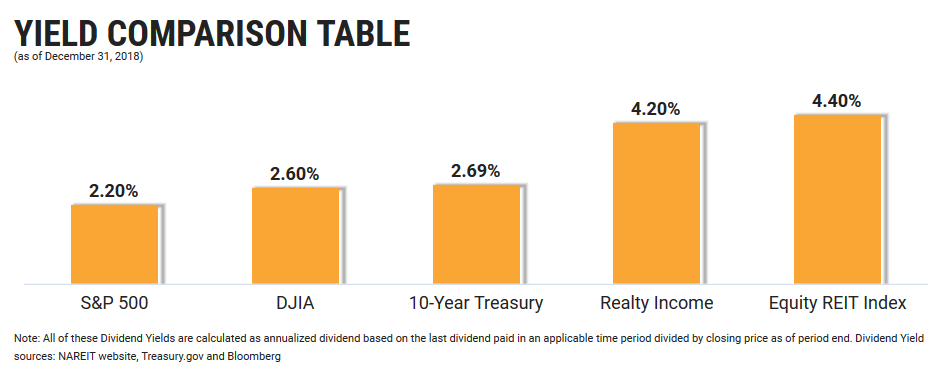

- Yield: 4.2%

- Current Annual Dividend: $2.71

Realty Income Corporation (NYSE:O) is a real estate investment trust that specializes in freestanding retail properties in the U.S. and Puerto Rico. The company, which owns 5,172 properties totaling 89.6 million rentable square feet, focuses on businesses that are less threatened by e-commerce or recessions, such as discount retailers like Dollar Tree (NASDAQ:DLTR) and Dollar General (NYSE:DG). It also concentrates on non-discretionary businesses that have a service component, such as pharmacies, fitness gyms and movie theaters.

The stock, which is trading near an all-time high, is up 13% in 2019. It closed on Friday at $71.24. Year-to-date, shares have gained nearly 38%.

Despite falling short of analyst expectations on both revenue and net earnings in its most recent earnings report on February 20 for the fourth quarter of 2018, investors were encouraged to see that the company's business continues to grow. Its top line was a promising 10% higher on a year-over-year basis, while adjusted funds from operations (AFFO), a more accurate measure of REIT profitability than net income, climbed to $0.79 per share from $0.76 in the fourth quarter of 2017.

On top of that, Realty Income reported that their overall occupancy rate was a near-full 98.6% in 2018, one of its best rates in years.

Realty Income is a low-risk way to bring predictable growth and income to your stock portfolio for the foreseeable future due to a combination of a high dividend payout and strong growth in key metrics.The company is also one of just a few REITs that pays dividends monthly, rather than quarterly.

2. EPR Properties

- Yield: 5.95%

- Current Annual Dividend: $4.50

EPR Properties (NYSE:EPR) is a specialty real estate investment trust based in the U.S. that currently invests in three primary segments: entertainment, such as amusement parks and cinema multiplexes; recreation, including ski resorts; and education such as public charter schools.

The company had 391 properties at the end of 2018. The portfolio breakdown among the three segments was 44% entertainment, 32% recreation, and 21% education; the remaining 3% is described by the company simply as "other."

This random mix seems to be working very well for EPR, whose stock, which closed at $75.39 on Friday, is up 17.7% so far this year. Year-to-date, it has gained roughly 33%.

The company's fourth-quarter results, released last month, showed substantial improvements in key metrics for the period, including a 23% rise in adjusted funds from operations (AFFO). Similar to Realty Income, EPR also distributes a monthly dividend.

EPR Properties' portfolio mix of entertainment and recreation facilities bode well for increased gains going forward. It strongly mirrors the current consumer trend of "experiences over possessions."

3. Boston Properties

- Yield: 2.86%

- Current Annual Dividend: $3.80

Boston Properties (NYSE:BXP) is one of the largest owners, managers and developers of Class A office properties in the country, with a significant presence in five sought-after markets: Boston, Los Angeles, New York, San Francisco and Washington, DC.

The company owns a diverse portfolio of primarily Class A office space totaling 47.7 million square feet and consisting of 164 office properties. It also owns five retail properties, four residential properties and one hotel.

The stock, which closed at $132.74 on the final day of trade last week, recently reached a two-year high, and is up almost 18% this year.

Boston Properties' fourth-quarter results, released on January 29, indicated funds from operations (FFO) per share of $1.59, 7% higher than the prior-year, while adjusted revenues, comprising base rent and recoveries from tenants, increased 7.4% year over year to $651.2 million.

The company also provided an upbeat outlook for 2019, revising its FFO per share guidance higher, to a range of $6.88-to-$7.00, indicating 10% year-on-year growth. All this puts Boston Properties in a prime position to be a leading name in select, high-rent, high barrier-to-entry geographic markets for years to come, a result of its portfolio of in-demand office space locations.