Citi sees Stoxx 600 reaching 640 by 2026 year-end

Forget inflation predictably floating around 1.5% as in the last decade.

Does this mean this paradigm shift will see inflation consistently print at 4% going forward?

Not necessarily.

But it sure means the volatility and uncertainty around inflation will be higher – and that’s all that matters for global macro portfolios.

Let’s look together at the drivers of inflation going forward, bearing in mind there is a big difference between structural inflation (5-10 years horizon) and the inflation cycle (6-12 months ahead).

Structural drivers of inflation include amongst others demographics, globalization, the fight between labor and capital, and energy policies.

The short-term inflation cycle is instead mostly driven by real-economy money printing (credit and fiscal).

So, Here are the three factors set to boost inflation fluctuation over the next decade:

1. Demographics, de-globalization, and labor versus capital (structural)

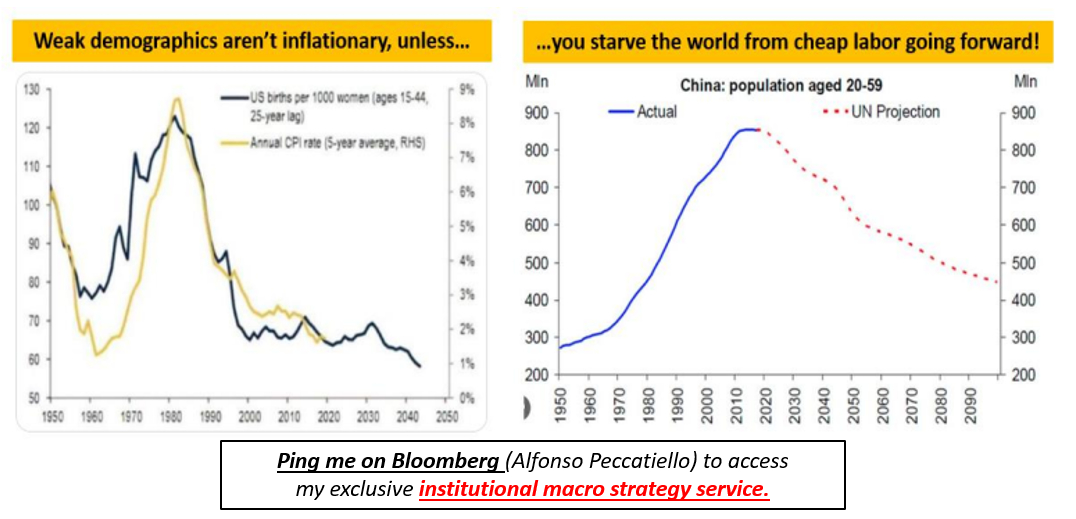

There are two schools of thought: weak demographics are disinflationary (it lowers organic growth rates and consumption while it increases the propensity to savings) or inflationary over the long run (scarcity of skilled labor leads to higher wages, older people will spend more due to higher social safety nets on healthcare, etc).

I think both are somehow right if you apply the right context: we live in a globalized economy.

Using that context it’s clear that the last 10-20 years have seen a perfect confluence of disinflationary forces: weakening demographics in developed countries (left chart) generated disinflationary conditions and we solved the labor scarcity issue by offshoring production to China which in the meantime was benefitting from an ample availability of cheap workers (right chart).

A great cocktail for disinflation: weakly developed market demographics plus cheap Asian-outsourced labor.

But here is the problem – this combo won’t be there anymore.

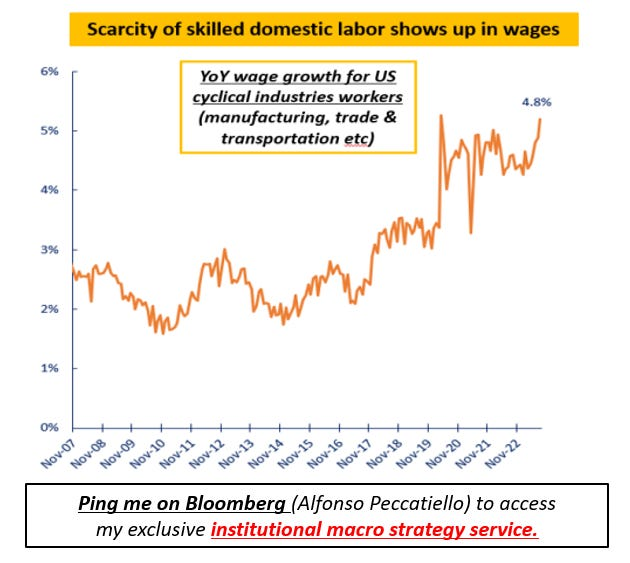

Rapidly reversing Chinese demographics (red dots, right chart) and a marginal push towards de-globalization imply DM economies won’t be able to access a growing cheap pool of labor to the same extent anymore. This will force developed markets to on-shore some production and on the margin bump up wages for scarcely available domestic skilled workers: some impact is already visible.

The counter-arguments here are two:

1. Manufacturing and cyclical industries that will experience scarcity of labor represent a small proportion of the overall labor market and that’s because

2. We live in a technology-driven world and that trend is only going to continue.

The typical US company which needed 8 employees to generate $1 million of revenues in the 90s now only needs 2 - in the fight between capital and labor that doesn’t bode well for wage bargaining power.

Today’s economy is way less labor-intensive and less unionized than in the 90s.

Overall, my take here is that the magic combination of disinflationary tailwinds that we experienced over the last 2 decades won’t repeat itself going forward – on the margin that pushes structural inflation a bit higher but let’s not forget we will still live in a (somehow) globalized, technology-driven world.

In other words: inflation will be way less predictable going forward.

2. Energy Policies (structural)

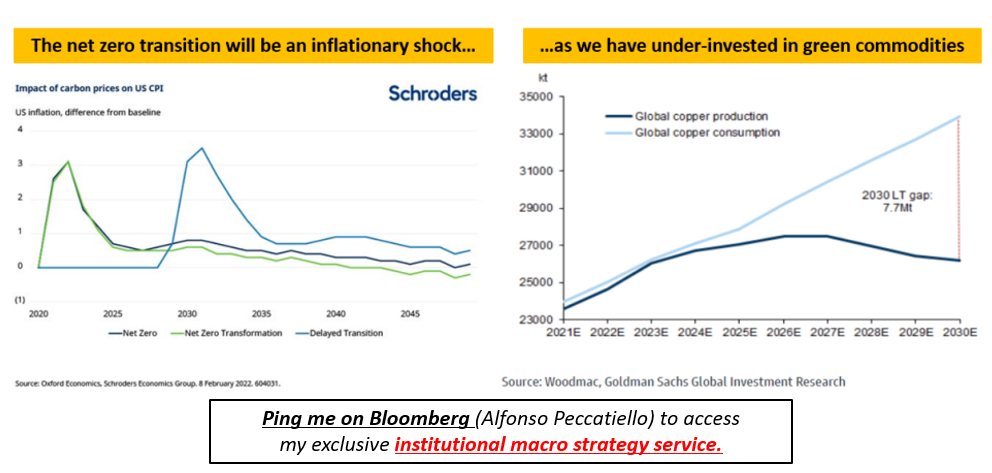

The net-zero attempt (ehm transition) will definitely be a net inflationary force for the next 1-2 decades.

It’s pretty simple: as policymakers will penalize (read: tax more) industries that produce excess CO2 the economics will somehow force countries to decarbonize – but funnily enough in the initial phase of the transition the world will still consume fossil fuels whose after-tax prices will be higher (left chart).

On top of it the net-zero transition requires a dramatically higher amount of green commodities (e.g. copper) which is an under-invested industry as shown in the right chart.

Supply and investments in green commodities take time while the demand boost will be sudden: the likely outcome is that commodity prices will have to somehow adjust higher hence fueling inflationary pressures.

The counter-arguments here are that the net-zero transition will take much longer and be much milder than anticipated, and that today’s assumptions about the needed quantity of green commodities doesn’t take technology into account: we will probably find smarter ways to generate the same output needing less input.

My take here is similar to the demographics story: on the margin, the net-zero transition will be net inflationary but look at the left chart – the volatility (rather than the ‘’new average’’) of inflation will be the key change.

Conclusion: Structural Inflation

The ‘’new average’’ for structural inflation over the next two decades is likely to be higher than the 1.5% we experienced in the 2010s – how high?

Very hard to say whether 3% or 5%, but I have a much higher confidence in making another call: inflation will be much more unpredictable and swing around way more wildly over the next 2 decades.

3. Money Printing (cyclical)

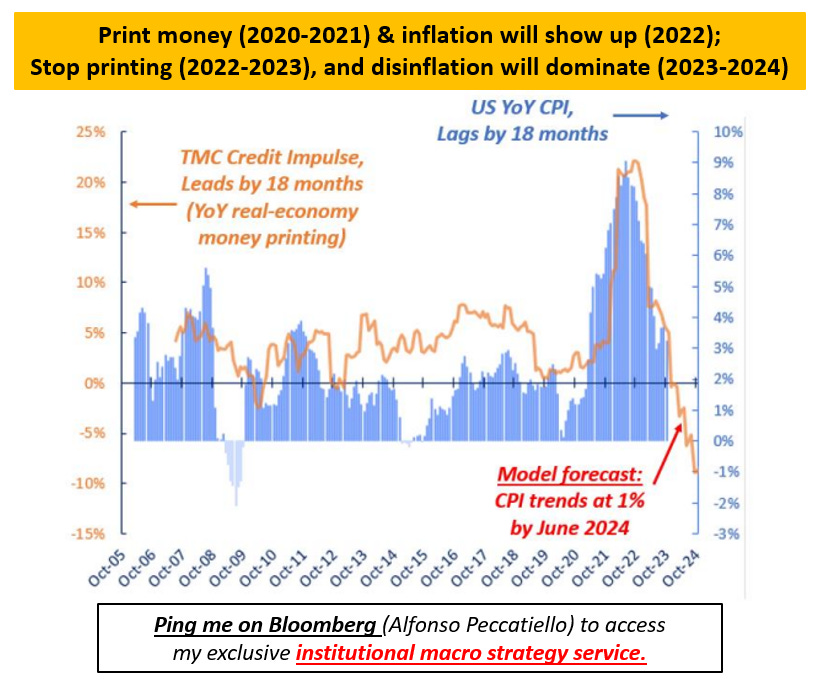

Central Banks don’t print inflationary forms of money: commercial banks (credit) and governments (deficits) do.

This is why years of QE did nothing to inflation but a globally concerted real-economy money printing exercise in 2020-2021 woke up the inflation beast: we printed real-economy money through massive deficits and credit creation and inflation punctually showed up in 2022.

Where next?

My TMC Credit Impulse measures real-economy money printing and it predicted (18-24m lead time) big inflationary pressures in 2022 and the following disinflation trend we have seen in 2023 so far.

It now says headline inflation will trend around 1% (!) only in June next year, with core inflation annualizing around 2-2.50%: the Fed will feel like the job is done.

2% inflation seems impossible for the supporters of the ‘’new inflation paradigm’’ but that misses a key point.

We might as well have inflation averaging 3-4% in the next two decades (structural) but the higher inflation volatility could easily result in more disinflation in 2024 (cyclical).

Don’t confuse long-term structural trends with the short-term inflation cycle!

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.