- Technology stocks are out of favor as the US Fed hikes rates to combat inflation

- Aggressive reset in valuations has created bargain-buying opportunities in tech

- Investors should consider buying the dip in Apple, Intel, and IBM

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

- *Year-To-Date Performance: -23.5%

- *Market Cap: $2.2 Trillion

- *Pro+ Fair Value Upside: +5.8%

- *Year-To-Date Performance: -26.7%

- *Market Cap: $154.4 Billion

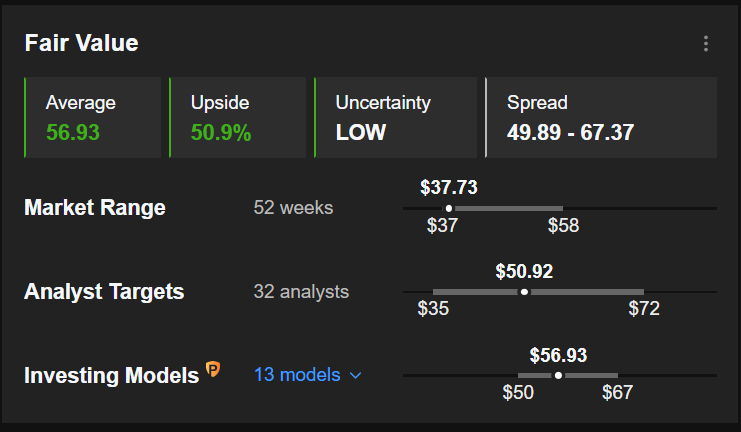

- *Pro+ Fair Value Upside: +50.9%

- *Year-To-Date Performance: +3.1%

- *Market Cap: $124.1 Billion

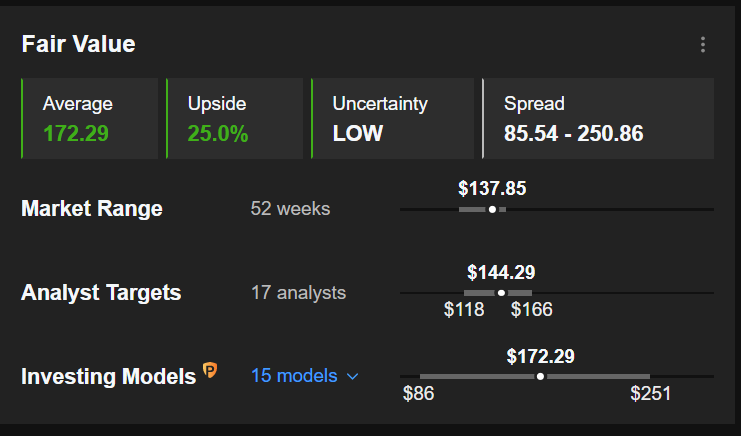

- *Pro+ Fair Value Upside: +25%

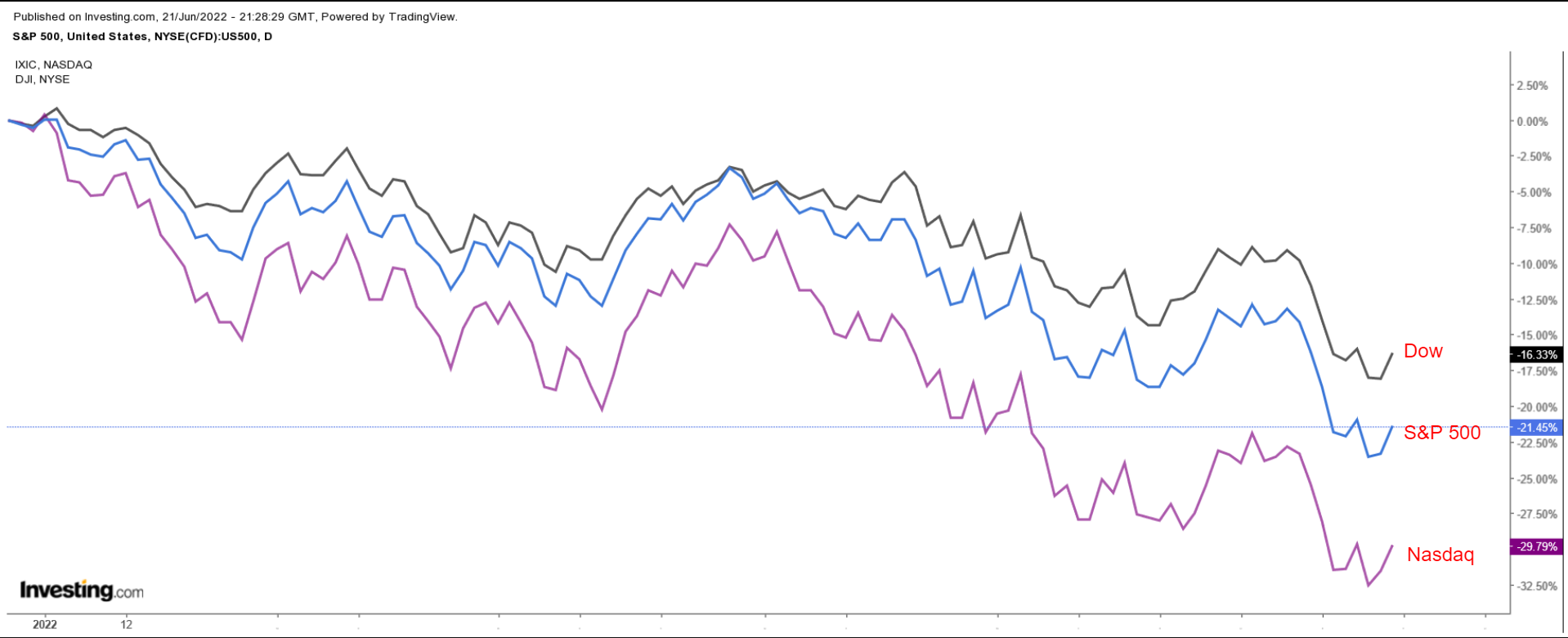

Stocks on Wall Street are on track for one of their worst years on record as a potent combination of slowing growth, soaring inflation, and rising interest rates unnerved investors.

The benchmark S&P 500 index is down 21.8% from its Jan. 3 record close, meeting the technical definition of a bear market.

Meanwhile, the tech-heavy NASDAQ Composite, which slumped into a bear market earlier this year, is roughly 31% below its Nov. 19, 2021, record high.

The Dow is approximately 17% off its record high reached at the start of the year.

Taking that into account, we highlight three bargain stocks from the tech sector which are well worth buying on the dip as the group attempts to bounce back from its months-long sell-off.

All three still have plenty of room to grow their respective businesses, making them solid long-term investments.

Apple

Apple (NASDAQ:AAPL) has seen its shares endure some turbulence lately as fears over the Federal Reserve’s aggressive rate hike plans triggered a rout in many top-rated technology companies over the past several months.

After hitting a record high of $182.94 on Jan. 4, AAPL stock—which is down 23.5% year-to-date—tumbled rapidly to a low of $129.04 on June 16, its weakest level since June 2021.

Apple shares have since staged a modest rebound, closing at $135.87 on Tuesday, but they still stand roughly 26% below their all-time high.

At current levels, the Cupertino, California-based consumer electronics conglomerate has a market cap of $2.2 trillion, making it the most valuable company trading on the US stock exchange.

Investors that missed the sharp moves higher last year should consider buying AAPL at these bargain prices, given its dependably profitable business model and enormous cash pile.

The tech behemoth is likely to continue to benefit from robust demand for its flagship iPhone 13 model and strong growth in its profitable services business, which includes sales from the App Store, subscription services, extended warranties, and licensing fees.

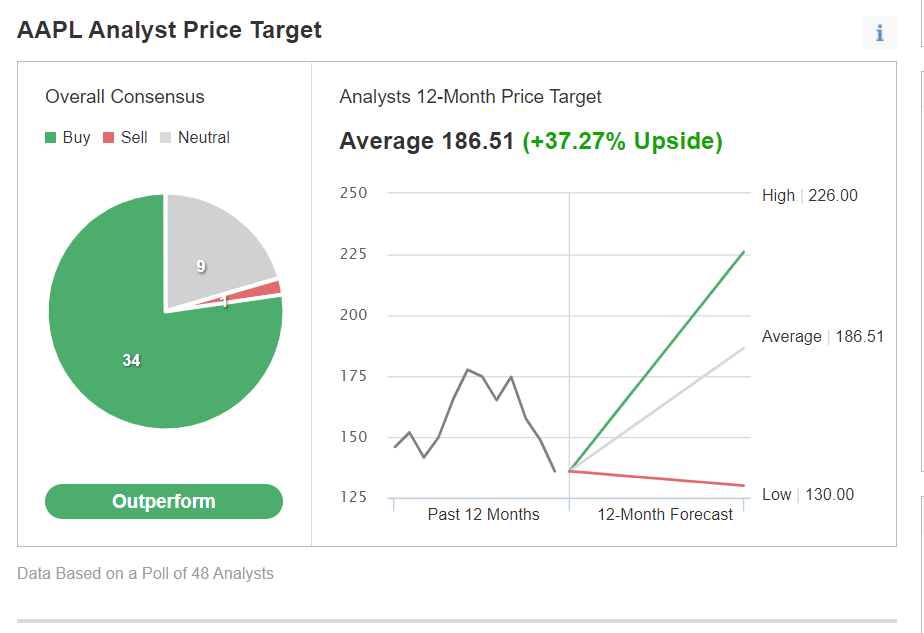

Not surprisingly, in an Investing.com survey of 48 analysts, 34 rated AAPL stock as a ‘buy’; nine rated it as ‘neutral’, and only one considered it a ‘sell’.

Among those surveyed, the stock had a roughly 37% upside potential with an average 12-month price target of $186.51.

Source: Investing.com

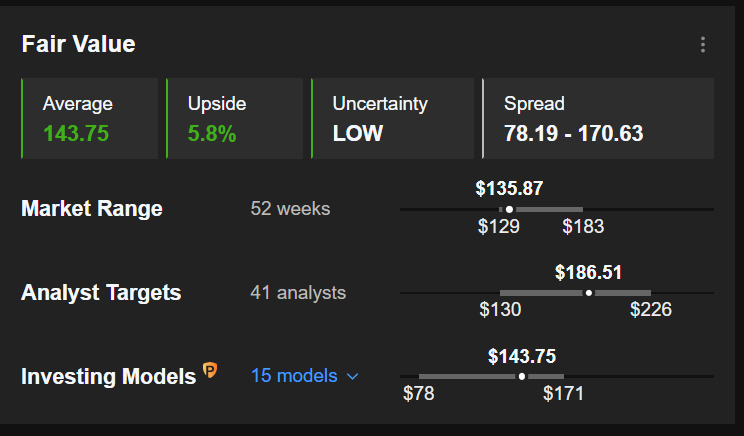

Likewise, according to a number of valuation models, including P/E or P/S multiples or terminal values, the average fair value for AAPL stock on InvestingPro stands at $143.75, a potential 5.8% upside from the current market value.

Source: InvestingPro

Intel

Intel (NASDAQ:INTC) shares have cratered nearly 27% year-to-date, with investors becoming increasingly concerned by the chipmaker’s future prospects.

Once widely-considered the undisputed leader in the computer processors industry, Intel has been steadily losing market share to rivals such as Taiwan Semiconductor Manufacturing (NYSE:TSM), Advanced Micro Devices (NASDAQ:AMD), and NVIDIA (NASDAQ:NVDA) in recent years.

INTC stock, which has been making a series of new 52-week lows in recent sessions, closed at $37.73 on Tuesday, not far from its weakest level since September 2017.

At current levels, the Santa Clara, California-based semiconductor company has a market cap of approximately $154.4 billion.

In our view, the sizable decline in Intel’s stock has created a compelling buying opportunity for long-term investors given its bargain-basement valuation and ongoing turnaround efforts.

With a forward price-to-earnings (P/E) ratio of just 10.5, Intel comes at a significant discount when compared to its notable peers, such as NVDA and AMD, which trade at 25.7 and 16.7 forward earnings.

The chipmaking giant is also a quality dividend stock. INTC currently offers a quarterly payout of $0.365 per share, which implies an annualized dividend of $1.46 at a yield of 3.95%, one of the highest in the tech sector.

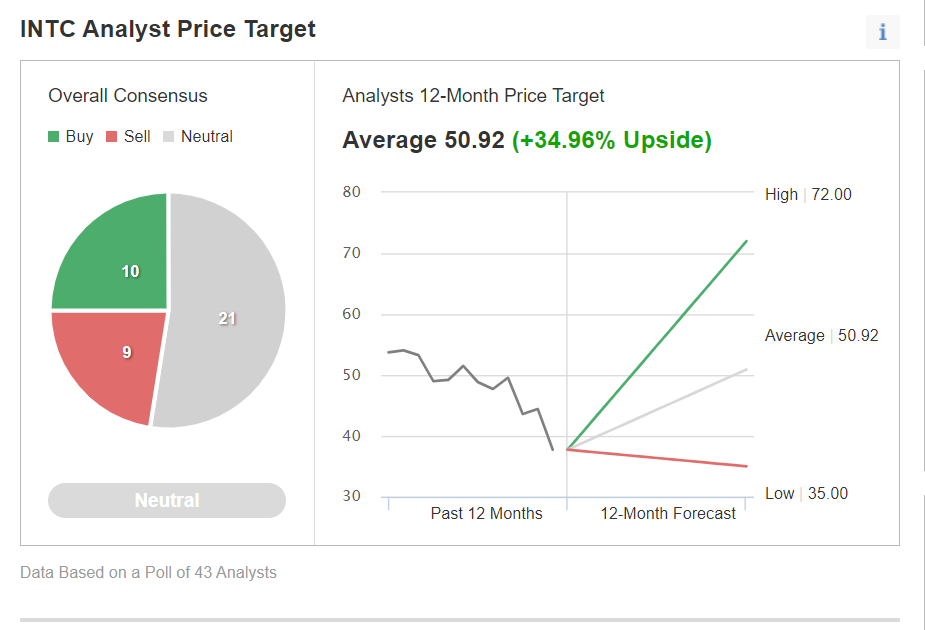

Indeed, 10 out of 43 analysts surveyed by Investing.com rate Intel’s stock as ‘outperform’, while 21 considered it as a ‘hold’.

The average INTC stock analyst price target is around $51, representing an upside of approximately 35% from current levels over the next 12 months.

Source: Investing.com

Similarly, the quantitative models in InvestingPro point to a gain of roughly 51% in INTC stock from current levels over the next 12 months, bringing shares closer to their fair value of $56.93.

Source: InvestingPro

IBM

International Business Machines (NYSE:IBM) is one of the few major tech stocks to deliver positive returns in 2022, outperforming the broader market by a wide margin as it continues to make progress on its massive multiyear restructuring.

Shares of the Armonk, New York-based company are up 3.1% year-to-date, compared to the S&P 500’s 21% decline over the same timeframe.

Over the past year, IBM has reshaped its business, spinning off its managed IT services unit, now known as Kyndryl, to focus on hybrid cloud computing and artificial intelligence.

IBM stock rose to $144.73 on June 6, a level not seen since October 2021; it ended Tuesday’s session at $137.85, earning it a valuation of $124.1 billion.

IBM is poised to continue to benefit from its turnaround efforts, while taking advantage of strong demand for its hybrid cloud offerings, which will help power future earnings growth and allow it to focus on increasing shareholder returns.

The 111-year-old tech titan, which is the highest-yielding stock in the technology sector, raised its dividend for the 27th consecutive year in April.

IBM currently offers an annualized dividend payout of $6.60 per share at a sky-high yield of 4.89%, nearly triple the implied yield for the S&P 500, which is 1.64%.

Additionally, at a P/E ratio of 24.6, IBM’s stock is a relative bargain compared to its major competitors, such as Microsoft (NASDAQ:MSFT), and Oracle (NYSE:ORCL), which trade at around 27 and 28 times earnings, respectively, and Amazon (NASDAQ:AMZN), which has a P/E ratio of 52.5.

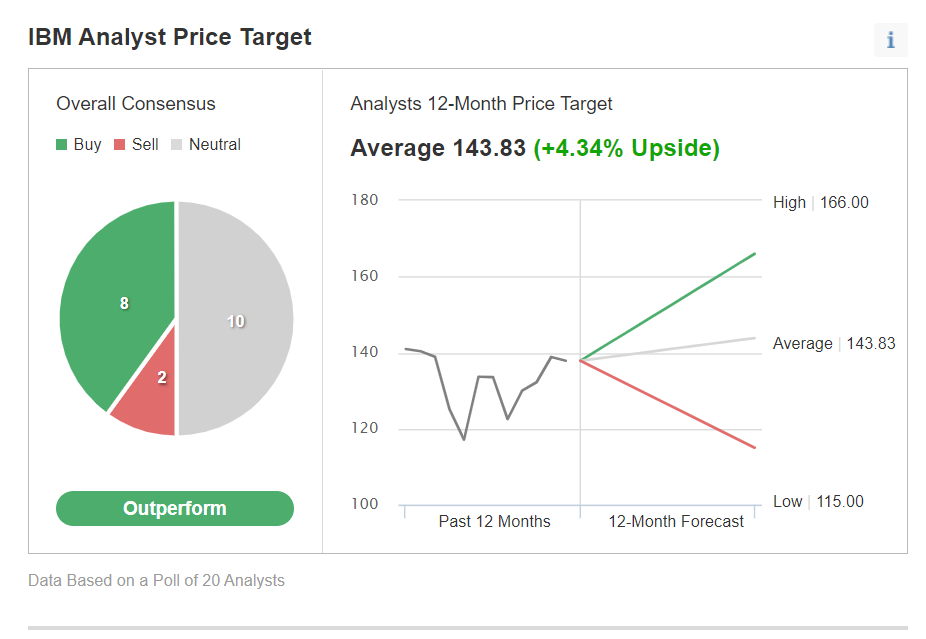

Out of the 20 analysts covering the stock, per an Investing.com survey, the consensus recommendation comes to ‘outperform’ with fairly high conviction. Eight analysts rate IBM at ‘buy’, ten consider it a ‘hold’, and two have it at ‘sell’.

Meanwhile, their average target price of $143.83 gives IBM implied upside of roughly 4.3% over the next year.

Source: Invesing.com

Additionally, the average fair value price for IBM stock on InvestingPro stands at $172.29, a potential 25% upside from the current market value.

Source: InvestingPro

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »