- Software giant Adobe shares have declined close to 24% since January

- Q2 outlook was weaker than estimates, creating headwinds for stock

- Long-term investors could consider buying at current levels

- Invesco NASDAQ Internet ETF (NASDAQ:PNQI)

- iShares Expanded Tech-Software Sector ETF (NYSE:IGV)

- Nuveen Winslow Large-Cap Growth ESG ETF (NYSE:NWLG)

- SmartETFs Advertising & Marketing Technology ETF (NYSE:MRAD)

- First Trust Expanded Technology ETF (NYSE:XPND)

Shareholders in the digital media and marketing software group Adobe (NASDAQ:ADBE) have seen the value of their investment slump 23.9% year-to-date and about 8% over the past 52 weeks. Meanwhile, the Dow Jones Software Index has fallen just 13.2% so far this year but has returned 16.6% in the past 12 months.

On Nov. 22, 2021, ADBE shares went over $699, hitting a record high. However, after the release of Q1 FY22 results, the stock price plunged to its 52-week low of $407.94.

Adobe is well-known for its range of creative and digital marketing software offerings and recent metrics show that Adobe is among the top 10 software names globally. In terms of graphics software, the market share of Adobe Photoshop is over 46%. In the same segment, next come Adobe InDesign (30.17%) and Adobe Illustrator (12.62%).

How Recent Metrics Came In

The software company released Q1 figures on Mar. 22. It reported a 9% year-on-year growth in revenue to $4.26 billion. Adobe classifies revenue in two main segments: digital media which was $3.11 billion and digital experience which was $1.06 billion.

Analysts noted that subscription-based revenue was $3.96 billion, or about 93% of total revenue. Wall Street loves subscription-based businesses as it implies relatively reliable cash flow quarter-after-quarter.

Adobe earned an adjusted $3.37 a share. Meanwhile, it repurchased about 3.8 million shares in Q1.

On the results, Shantanu Narayen, cited:

“Adobe achieved record Q1 revenue as Creative Cloud, Document Cloud and Experience Cloud continue to be pivotal in driving the digital economy.”

But, management warned that the war in Ukraine would dent Q2 metrics as it halted sales in Russia and Belarus and its sales in Ukraine would also be affected.

Adobe now expects Q2 sales of $4.34 billion and adjusted EPS of $3.30, both of which are lower than analysts had been estimating.

Ahead of the release, Adobe was trading at around $465. But on Mar. 25, it closed at $431.62 which means the shares lost around 7.5% of their value since the earnings announcement.

What To Expect From Adobe Stock

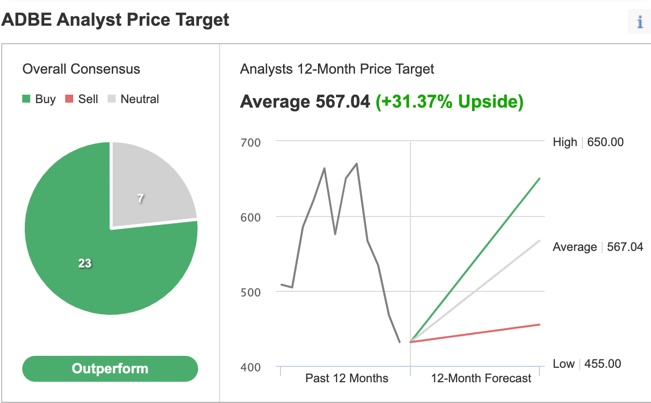

Among 30 analysts polled via Investing.com, ADBE stock has an "outperform" rating.

Chart: Investing.com

Wall Street also has a 12-month median price target of $567.04 which is an increase of more than 31% from current levels. The 12-month price range currently stands between $455 and $650.

Similarly, according to a number of valuation models, including P/E or P/S multiples or terminal values, the average fair value for Adobe stock on InvestingPro stands at $571.90.

In other words, fundamental valuation suggests shares could increase about 32%.

We can also look at Adobe’s financial health as determined by ranking more than 100 factors against peers in the information technology sector.

For instance, in terms of growth and profit, it scores 4 out of 5. Its overall score of 3 points is a good performance ranking.

At present, ADBE’s P/E, P/B, and P/S ratios are 42.2x, 14.8x and 12.6x. Comparable metrics for peers stand at 26.6x, 16.1x, and 14.1x.

Our expectation is for Adobe stock to build a base within the wide range of $400 and $450 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding ADBE Stock To Portfolios

Adobe bulls, who are not concerned about short-term volatility, could consider investing now. Their target price would be $567.04, analysts’ forecast.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has ADBE stock as a holding. Examples include:

Finally, investors who expect Adobe stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion of ADBE stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Adobe Stock

Price: $431.62

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Adobe) and the same expiration date.

The trader wants ADBE stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the June 17 expiry 440 strike call for $26.10 and selling the 450 strike call for $21.50.

Buying this call spread costs the investor around $4.60, or $460 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the ADBE stock price at expiration is below the strike price of the long call (or $440 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($10 – $4.60) x 100 = $540.

The trader will realize this maximum profit if the Adobe stock price is at or above the strike price of the short call (higher strike) at expiration (or $450 in our example).

Bottom Line

Innovative products, as well as strong profit growth, have meant that, over the last decade, Adobe shares have outperformed. Yet, recently, the stock has come under significant pressure.

However, the share price slide has improved the margin of safety for buy-and-hold investors who could consider investing soon. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of Adobe stock.