Here's a snippet of what I wrote in my post of November 9, 2018 with respect to world market headwinds and 'harmonic globalism'...

"Based on the combative political rhetoric I've seen leading up to and, especially, since the U.S. midterm elections this week, I think that will increase on all sides (Democrats, Republicans, media, and President Trump) until the 2020 elections. In fact, I think that will be like what we've witnessed in 2017/18 on steroids.

I'll go so far as to posit that Democrats have (unwittingly and conveniently) now become the President's scapegoat, so that when the U.S. economy slows in 2019 and shows signs of recession in 2020, he can simply blame Dems for obstruction, gridlock and a waste of taxpayer dollars on endless investigations into his administration. It will cannibalize some (or a considerable amount) of the economic and market gains made since the Presidential election in November 2016 under Trump, and he will accuse Dems of destructive governance and legislative failure as a platform on which to run in 2020.

A failure of U.S. and world markets to recapture convincing sustained buying and to reduce volatility, coupled with escalating domestic and foreign political unrest, as well as President Trump's trade wars and a world-wide shift from an embrace of harmonic globalism to a more divisive world order of nationalism/protectionism will signal, either continued market gridlock/consolidation, or escalating weakness.

Government, corporate, banking, and/or personal debt crises will determine exactly if/when the 9-year bull market bubble blows up, I think.

Appearing in the Profile section on my trading blog is the following:

From volatile, whipsaw market action (as evidenced in the above charts and graphs), contentious world-wide political rhetoric and actions, weakening global financials, military buildups, and even increasingly severe weather disturbances, etc., so far this year, I'd say that all three of those behaviours are in retrograde to some degree or other. It's unlikely all of it will abate any time soon.

Buckle up!"

Here's an excerpt of what I wrote on December 17, 2018 in my 2019 Market Forecast...

"I think that 2019 is likely to bring the same level of volatility and uncertainty, not just in U.S. equity markets, but in other world markets and world politics, as well. I'm getting the impression that major world markets are doubting the ability of their respective political leaders and central banks to continue to stimulate markets to the same degree that they've enjoyed since 2009. In fact, even with all the tax cuts and removals of many regulations that we've seen this year in the U.S., markets are still down extensively. With central bankers tightening their monetary policies, and no further fiscal stimulus packages on the horizon in the U.S., I don't see a convincing bullish bias returning any time soon.

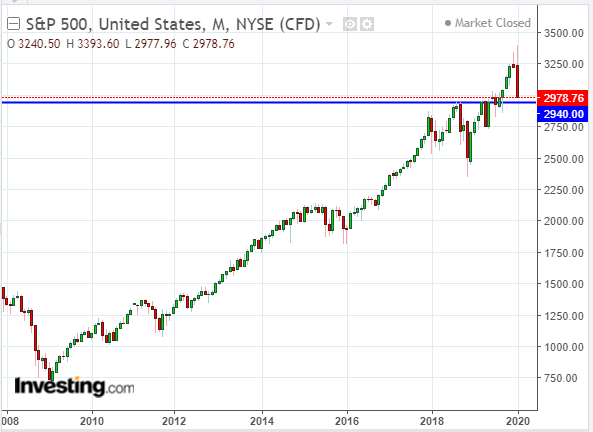

Depending on where both the SPX and SPX:VIX Ratio close at the end of December, I anticipate, either a slower level of equity accumulation, if there is much, to, potentially, propel the SPX to retest its prior all-time high of 2940.91, or to resume further declines, putting the SPX at 2400, or lower, as I've repeatedly mentioned since August and as I last described here. In fact, 2250 would be the next major support below that level, followed by 2000, as is evident on the above three charts of the SPX.

Under the latter scenario, I'd expect money to rotate into bonds (which has already been the case over the past several months, as shown on the following monthly charts of 2/5/10/30-year bonds) and/or cash (U.S. $)."

I came upon this WSJ article tonight...

I don't disagree with the points raised in that piece. In fact, I believe it mirrors the concerns I had in 2018.

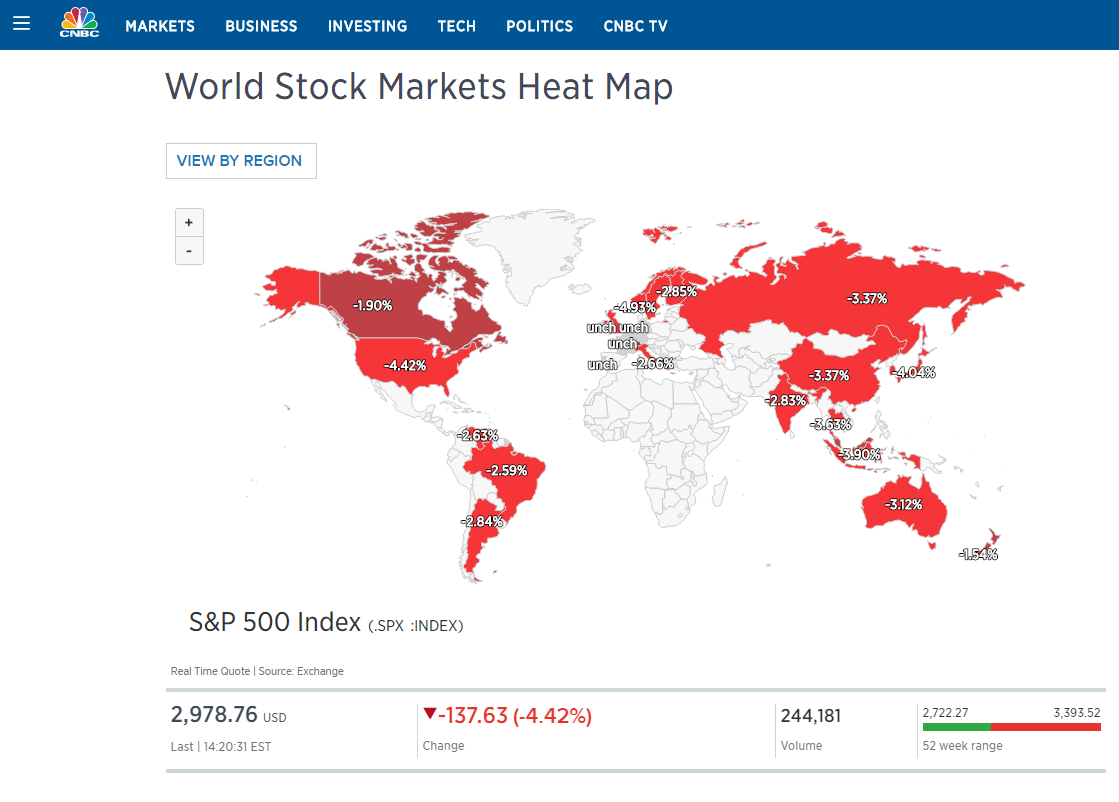

After the market rout that we've witnessed over the past few days, it would seem that my dire warnings are beginning to materialize, albeit finally sparked by a world-wide flu virus that may or may not become a pandemic. However, I believe that such a correction was already building for the reasons I mentioned above, but was finally pushed over the edge by what could be described as gasoline being poured on a simmering fire.

It would seem that, in a perfect world, a better world economic balance could be struck:

I think President Trump began on the right track with his Tax Cuts and Jobs Act when it was passed in Congress on December 20, 2017 and became effective in January 2018, together with his many cuts in regulations over his first term.

In my opinion, that should have been followed up with an infrastructure stimulus package, but was not. Instead, the President began a trade war with a variety of countries, to the detriment of those countries, as well as the U.S. What he didn't count on was the occurrence of a 'black swan event' in the form of a highly-contagious flu virus before he could work out all the kinks in his desired reciprocal trade deals with those countries. This has occurred on top of all the above imbalances that have taken place to date, coupled with the uncertainty of which party's candidate will be U.S. President in November this year.

So, here we are...facing similar U.S. political headwinds that markets faced prior to the November 2018 mid-term election (as I discussed in May of 2018), coupled with everything else.

The SPX did, in fact, retest its prior high of 2940.91 in 2019, as I had forecast in December 2018. It exceeded it to carry on up to a new all-time high of 3393.60 just a few days ago. It plummeted back to close just above 2940.91 on Thursday. It seems to me that, perhaps, that is where current fair value sits.

However, based on the sharp velocity of the equity purge the past few days, it may have further to go before we see price, either stabilize, or reverse. Keep an eye on the various markets I identified in this post for potential clues in this regard.