The vast majority of my readers are investors. As such, most are at least somewhat familiar with the stock market and are aware that most stocks tend to underperform their benchmarks over any given period. Only a much smaller, select group of stocks deliver the positive returns and create the wealth generated by equities over time.

The goal of most investors and professional investment advisors is to try to identify those stocks that are delivering positive returns and avoid those that are underperforming. Yet, that is a challenge when most stocks tend to underperform over time. Today, we’ll look at some numbers from a recent study that I think you’ll find interesting.

I suspect you’ll be surprised to learn that a large percentage of stocks consistently underperform their benchmarks versus the tiny percentage that creates all the wealth generated by equities. As current-day investors, we’ve enjoyed the longest bull market in history since the Great Recession lows in 2009, but keep in mind that only a relative handful of stocks have generated all this wealth.

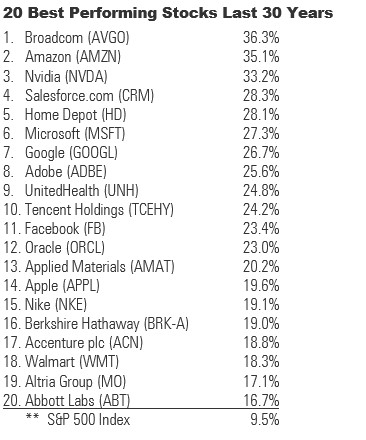

As we go along today, I’ll point out the top 20 performing stocks over the last 30 years. You’ll recognize most or all of the names, I suspect. The key is how do you find stocks like these in their early stages and then hang onto them for decades? It’s a daunting challenge.

What Are The 20 Best Performing Stocks Of The Last 30 Years?

Let’s start with the obvious: The vast majority of stock market wealth is created by just a handful of stocks. Before I start throwing out numbers, what percentage of stocks would you think created the vast majority of stock market wealth, say over the last 30 years? 20%? 15%? 10%? 5%? What’s your guess? Here you go.

For perspective, the global stock markets have created an unprecedented $75.7 trillion in new wealth over the last 30 years. The world has never experienced anything like it. But the shocker is that the nearly $76 trillion in new wealth was generated by just 2.4% of all stocks. Let that sink in before I hit you with the next number.

You probably knew it was a small percentage, but I’ll bet you didn’t know it was that small. I know I didn’t. But here are the latest numbers for stock returns, both good and bad. Let’s start with the bad.

According to a recent study of the performance of more than 64,000 stocks from 1990 to 2020, the compound annual returns for over half of all stocks during that 30-year period were less than the average return for one-month U.S. Treasury bills.

That’s correct: Over the last 30 years, 55.2% of all stocks traded on major exchanges delivered returns less than the one-month Treasury bill rate, which is currently 0.03%. It’s been higher than that over the last 30 years, of course, but who would have thought half of all publicly-traded stocks would have delivered less than the return of the shortest maturity T-bill rate over the last three decades?

Yet, that is indeed the latest finding of researchers at Arizona State University who recently evaluated lifetime returns for every U.S. common stock traded on the New York and American stock exchanges and the Nasdaq since 1926.

Picking The Best Stocks Is Extremely Difficult

Picking the few top-performing stocks among the many thousands of underachieving ones is extremely difficult. But for those who guessed right and had the discipline to stick with those winners through bull and bear markets, the rewards have been truly remarkable. Take a look.

Over the 30 years that ended in 2020, the S&P 500 Index has averaged an annual return of 9.5%, while the big winners shown above have averaged 24.2%. Obviously, the list above will change in the years to come. While the above companies may continue their winning ways, the names on the Top 20 list will change over time.

“Mean reversion” is a powerful force in the stock market, and this magnitude of outperformance by all these companies listed above is not likely to be repeated over the next decade. Plus, up-and-coming tech companies will continue to replace some on the list above going forward.