10-Year Note Non-Commercial Speculator Positions:

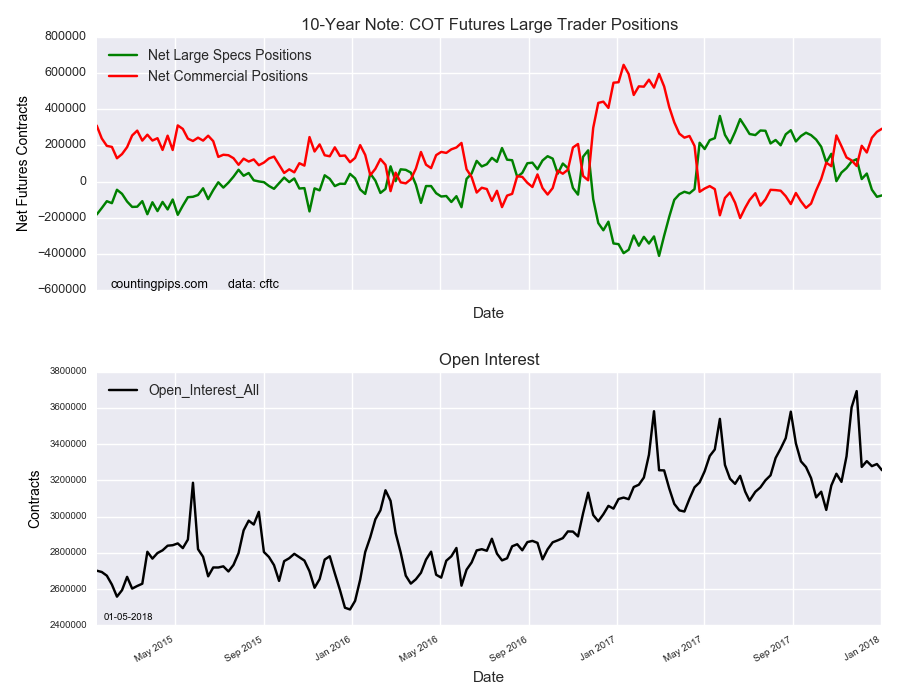

Large Treasury Note speculators cut back on their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -75,840 contracts in the data reported through Tuesday January 2nd. This was a weekly rise of 7,826 contracts from the previous week which had a total of -83,666 net contracts.

Speculative positions improved this week although remain in an overall bearish position for a third straight week. Net positions for speculators had been in bullish territory for thirty-five straight weeks before turning bearish on December 19th.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 292,210 contracts on the week. This was a weekly boost of 17,284 contracts from the total net of 274,926 contracts reported the previous week.

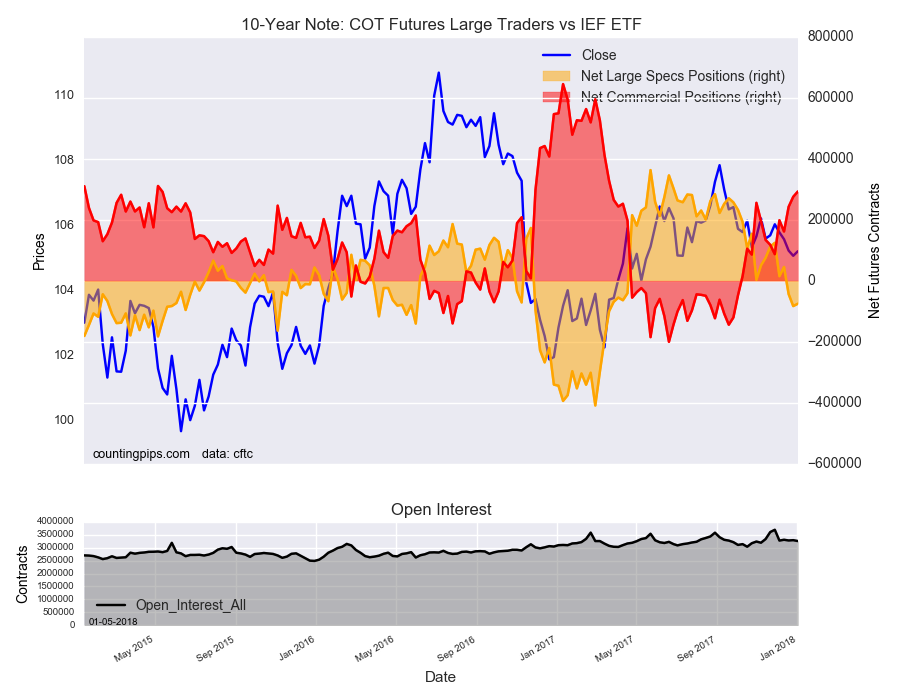

iShares Core MSCI EAFE (NYSE:IEFA) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $105.22 which was an uptick of $0.14 from the previous close of $105.08, according to unofficial market data.