Most stocks that pay more than 10% are, honestly, trash. Their yields usually look big because their stocks have split once or twice “the wrong way.”

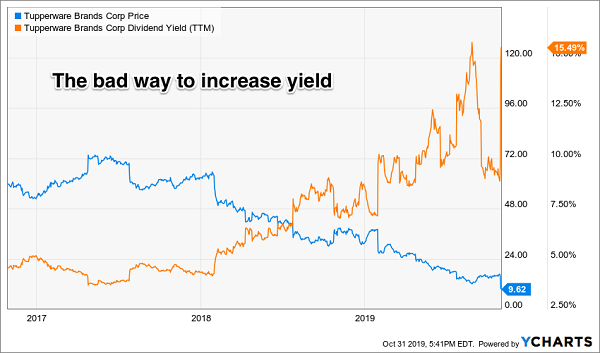

Take Tupperware Brands (NYSE:TUP), for example. The party ended abruptly for these shareholders. I feel bad for anyone who was mistakenly holding these shares “just for the dividend.”

The yield has skyrocketed from the 3% to 4% range into double-digits. Which would normally be pretty sweet, except the reason for the 10%+ payout is a collapse in the stock price from $72 to $9-something:

The Tupperware Party Ends In Tears

“First-level” income investors tend to turn their brains off once they have identified the yield. “Hey, it pays 4%! I don’t care what the price does.” It’s a noble statement but they do care when shares slip into free-fall and shed a year’s worth of dividends in a week’s worth of trading.

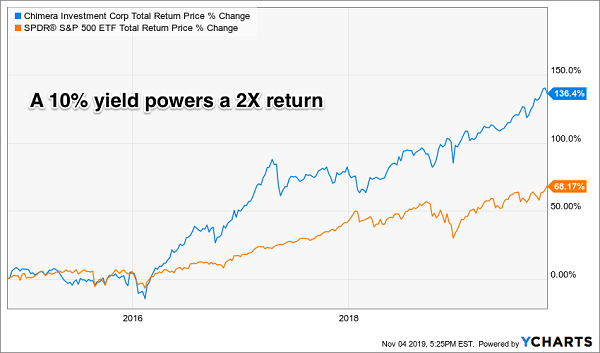

Not all 10% yields are dangerous. Take Chimera Investment Corporation (NYSE:CIM), which pays 9.9% today and is a legit cash machine. This unique mortgage REIT has doubled the S&P 500 itself over the last five years:

A Money Machine

It’s also paid an amazing $4.5 billion in dividends since inception. Chimera mints money from housing loans, which are “too risky” for big banks to take on but plenty profitable for this firm. (It benefits from the lasting stigma established by The Big Short as it’s able to buy high paying assets for cheap.)

The other half of Chimera’s portfolio consists of mostly residential and some commercial mortgage backed securities (MBSs). More than 80% of these are issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac, which means credit risk is absorbed by Uncle Sam’s agencies rather than Chimera.

The nimble Chimera pays its generous $0.50 per share dividend every quarter (an “instant” 2.5% payout on its $20 stock) like clockwork. The firm makes enough money to cover the payout, and the 10% yield acts as a flotation device for the stock.

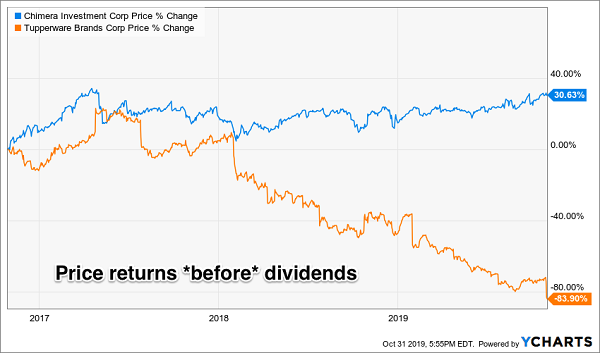

Let’s contrast this situation with our outdated Tupperware set. The obsolete firm slashed its own dividend by 60% recently, thus removing any potential floor for the stock price:

There’s A Right Way (And A Wrong Way) To Yield 10%

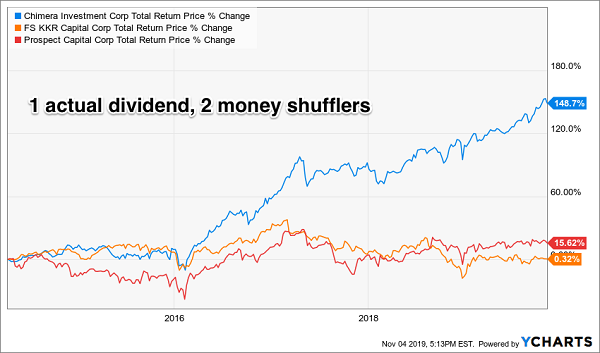

So how do we buy more Chimeras? In the 10% dividend world, we can start with “addition by subtraction.” There are many businesses gone bad, like Tupperware. There are also mediocre ones that will waste your time!

Let’s call out FS KKR Capital (NYSE:FSK) and Prospect Capital (NASDAQ:PSEC), two business development companies (BDCs) that make their money by lending to small and medium sized businesses. This is a competitive market and it tends to show in the mediocre returns these firms provide.

FSK and PSEC pay 13.2% and 11.2% today but they tend to “take your dividend back” by tapping their own book value to pay you. This lowers their stock price and, over time, they don’t return much more than zero:

The BDC Shell (LON:RDSa) Game In Perspective

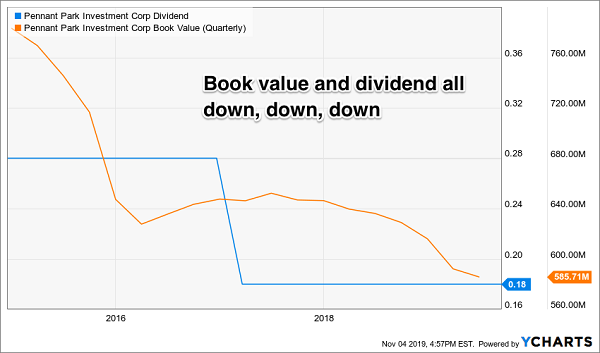

Pennant Park Investment Corp (NASDAQ:PNNT) is another BDC that taps its own capital to pay its (theoretical) 11.9% dividend. This isn’t sustainable, of course, and the firm already cut its dividend by 36% a few years ago. Its book value is still declining, which is a sign that PNNT can’t afford its current payout, either:

The New Payout Still Too Rich For Pennant

The money shufflers, BDCs and beyond, are often adept at masking incompetence behind big stated yields. Western Asset Mortgage Capital (NYSE:WMC) for example pays 138% of its profits as dividends. If there’s anything worse than a triple-digit payout ratio like this (which means you are borrowing money to settle up with shareholders), it’s a negative one, which means you are not even making a profit. Invesco Mortgage Capital (NYSE:IVR) is the firm mortgaging its future to pay investors their 11.4% yield today. Avoid IVR and WMC (which promises a 12.3% yield that isn’t likely to happen for much longer.)

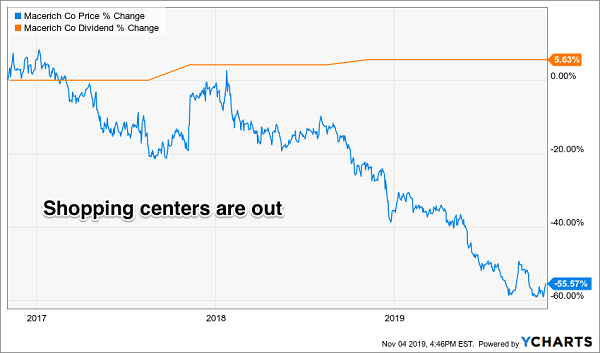

Moving back into the world of “real products,” our job here is to avoid the old Tupperwares of the world. (Or at least recycle them.) Shopping center landlord Macerich (NYSE:MAC) is on the receiving end of Amazon (NASDAQ:AMZN).com’s reduction in brick and mortar retail. This 10.2% yield is living quarter-to-quarter as tenants (and the rents they pay this REIT, or real estate investment trust) are being bombarded by free shipping courtesy of Bezos & Co.

These Token Dividend Hikes Don’t Fool Mr. Market

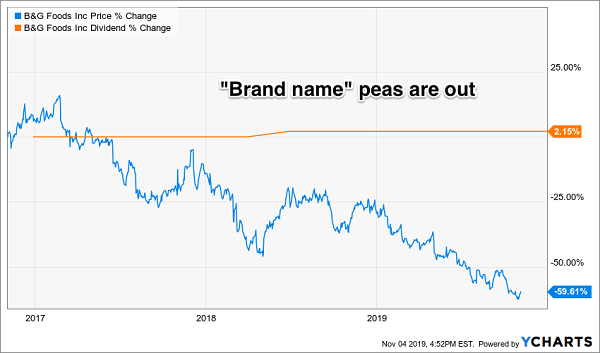

B&G Foods (NYSE:BGS) is another “token hiker” that is being beat up for lunch money every day the market opens. Its frozen and canned Green Giant vegetables don’t have the monopoly on peas that they used to. Food shoppers are pickier about quality and have less brand loyalty than ever before, and B&G’s 11.9% yield depends on the uptake of products like Green Giant Veggie Tots (yikes).

A Pea-Sized Dividend Hike: Not Enough Of A Distraction

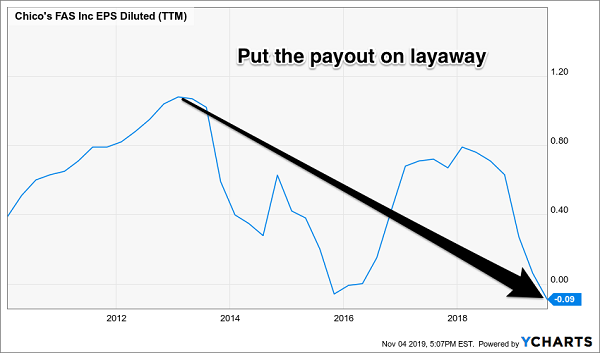

Chico’s FAS (NYSE:CHS) used to be a cool store that sold high-end gear to women with money. The firm also used to make money, too, but its brand has faded and the company no longer makes a profit. Which means it should be paying any dividend, let alone a 10% yield on its depressed share price:

Available In Many Money-Losing Sizes

Safe Dividend Machines That Pay 10% Today

Our newest “perfect income play” pays a safe 10%. That’s right. A secure 10%!

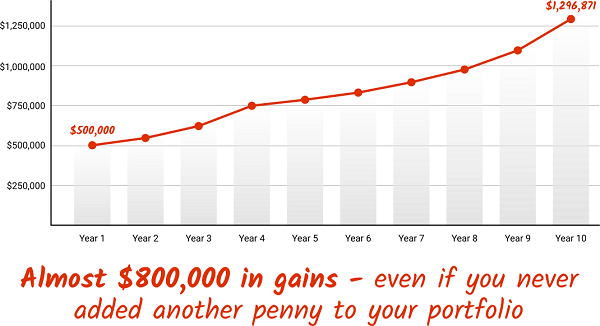

Put $50K into this stock and you’ll see $5,000 per year in dividends. Or $50K in annual dividends on a relatively modest $500,000! You get the idea.

What’s the ticker? Well, that’s what I’m here to show you today.

After years of keeping it my personal secret, I’m finally revealing my Perfect Income Portfolio. A simple, proven, and time-tested strategy you can use to double, triple, even quadruple your income–almost immediately!

Plus, I’m also going to give you THREE specific investments you can buy right now for MAXIMUM income combined with MAXIMUM stability!

This is a strategy I could easily charge thousands of dollars for.

But today, I’m handing you the keys to the kingdom right here on this page.

All you’ve got to do is take action and implement what you’ve discovered. If you want to take charge of your retirement income, you can easily build a portfolio which returns 10%+ per year—without EVER having to withdraw from your savings.

Now, compare this to the S&P 500’s 1.9% dividend and we’re talking about a $40,500 difference on a $500,000 portfolio—every single year! That’s the sort of life-changing money that can provide true security and freedom.

Best of all, as you’ll see today, it only takes a few minutes to set up this vastly more profitable portfolio.

When I talk about the Perfect Income Portfolio, I’m speaking about a collection of safe dividend stocks and funds that:

As I mentioned, this was built from years of painstaking research, trial and error, and financial modelling. I designed it for my own personal portfolio and my desire to enjoy a large income…without exposing myself to too much risk or withdrawing from my savings.

And, in the obsessive pursuit of this goal, I quickly realized traditional income strategies just weren’t going to cut it.

So, instead of listening to the mainstream advice like…”invest in the Dividend Aristocrats” …”withdraw 4% per year”…”lower your expenses”…”cut back on luxuries”…I decided to carve my own path instead.

This journey led me to uncover three little-known investment ‘vehicles’ that can safely and securely double, triple or even quadruple your income—almost immediately.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."