Introduction

Xinyuan Real Estate Co Ltd (NYSE:XIN) is a real estate company listed on the New York Stock Exchange, has gotten far more attention than warranted by size because of its high “Yahoo (NASDAQ:YHOO.O) Finance-type valuations.” And because XIN gets an “F” for public relations among NYSE-listed companies, there have been numerous articles written (Zhang, Morss, Garcia, Ramos since its last quarterly report speculating about or asserting what the future holds.

On Friday, February 27th, more will be learned when XIN reports its results for the last quarter of 2014. Equally important, it will send its 6-K numbers to the SEC. The point of this article is to highlight what we need to look for. I will follow up with another piece on what has been learned once the data is reported.

Troubling News

XIN followers are fully aware of the somewhat worrisome news reported with little commentary by the company. There was decline in real estate in China resulting from government policies. There was also the resignation of a couple of Board members and the replacement of several senior executives. But most important was the liquidation of the private equity company TPG’s convertible notes. XIN agreed to buy them back for $86 million. At the time, I speculated that:

TPG was targeting on some high return deal with XIN. Once it saw it was going to take more time than they anticipated, TPG wanted to get out. It could immediately redeem its convertible notes with a small profit and did.TPG has held off redeeming its stock because of the capital losses involved (they bought in on August 26, 2013 when XIN’s price was $5.54). Unfortunately, this all-too-likely further liquidation will overhang the market until it occurs.

XIN indicated the liquidation took place because it found the financial agreements required by these converts too restrictive. At the time, I did not believe XIN. I thought it was trying to put a positive spin on what was really bad news for the company. However, in light of XIN’s borrowing spree to purchase more properties over the last few months, the XIN explanation sounds increasingly probable.

Key Things to Look For Going Forward

1. Inventory and Sales

Real estate involves borrowing money to buy land and building properties. Profits depend on selling for more than the cost of the land and properties built. Profit growth depends on holding costs down and increasing the property/building inventory.

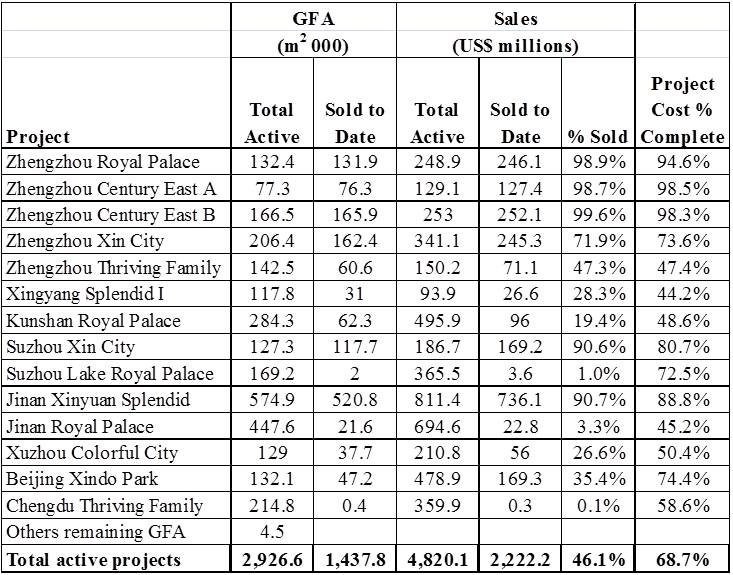

Data from XIN’s latest 6-K are presented in Table 1. At that time, sales of $2.2 billion covered 68.7% project costs. That meant it would take an additional $3.2 billion to cover all project costs. The table also gives an estimate of the total sales value of the total inventory – $4.8 billion. If these prices hold up, that would leave a profit of $1.6 billion for the company.

Table 1. – XIN Properties (Gross Floor Area) and Sales

How significant would $1.6 billion be to XIN? Very. At the end of September 2014, XIN had long term debt of $861 million. A $1.6 billion profit could wipe out that debt and leave $739 million for the company.

On Friday, we should get an update on this information.

2. Prices

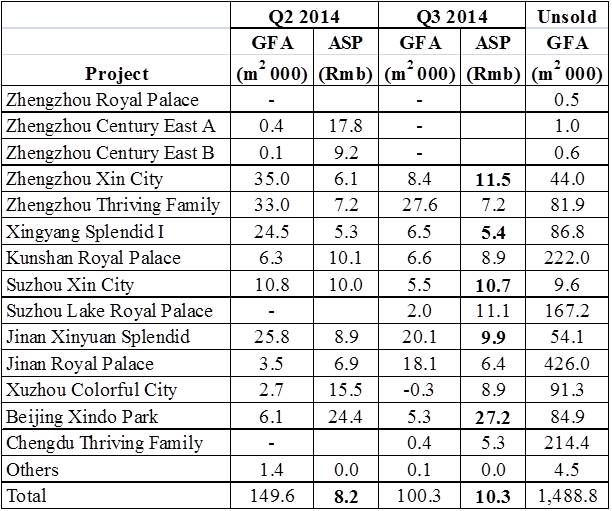

A slowdown in Chinese real estate could be reflected in slower sales and/or lower prices. Table 2 gives gross floor area (GFA) and average selling price per m2 (ASP) for XIN’s active properties as reported in its latest 6-K. Government real estate restrictions started in the 2nd quarter of 2014. It is notable that for a number of XIN’s properties (shown in bold), selling prices actually increased. And the average selling price for all properties increased from 8.2RMB to 10.2RMB.

Table 2. – XIN’s Active Properties and Sales

One might ask whether XIN has enough in the pipeline to be ready for a real estate rebound. The answer is yes. In addition to the 1.5 million square meters of GFA available at the end of the 3rd quarter, it had an additional 1 million square meters of GFA coming available in late 2014. In addition, Zhang has just reported that XIN spent $177 million in December to purchase four land parcels in Zhengzhou.

We will get an update on these numbers as well on Friday.

The Chinese Real Estate Market

Many investors have a US frame of reference on real estate. So when they here “downturn”, they imaging a slowdown across the board. It is important to impress just how different the Chinese market is from the US.

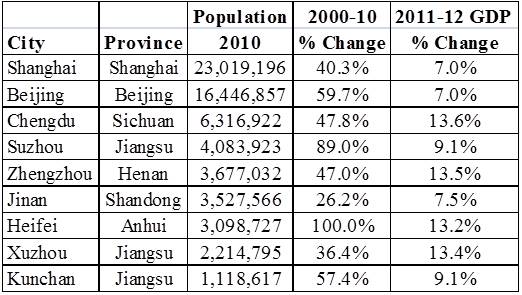

Evidence for this can be seen in Table 3 where the population and GDP growth of cities where XIN is investing is presented. Population and GDP growth are the drivers of real estate demand and there is nothing in the West that is comparable to what is happening in China.

Table 3. – Growth in XIN’s Cities

Just look at the numbers in the far right column: no country in the developed world has annual population growth rates like these. And wherever we are in the Chinese real estate cycle, a lot more housing will be needed.

Dividend and Stock Buy Backs

In 6 months ending in June 2014, XIN paid out 36% of profits in dividends. This is a big chunk for a company so eager to get more financing for real estate. With recent profit declines, I would not be surprised to hear it announce a cut in dividends this Friday. And stock buybacks? I would not be surprised to hear a suspension announced. XIN wants to raise as much as it can to invest in real estate. And it has amply demonstrated it is not in the business to make its stock holders feel good.