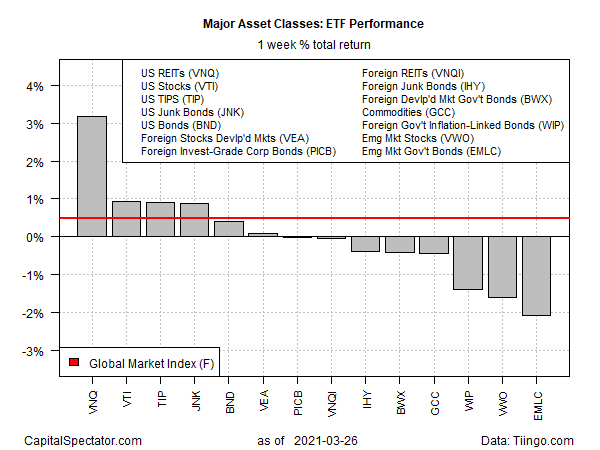

Property shares in the U.S. topped returns for last week’s mixed results for the major asset classes, based on a set of exchange traded funds through the close of trading on Friday, March 26.

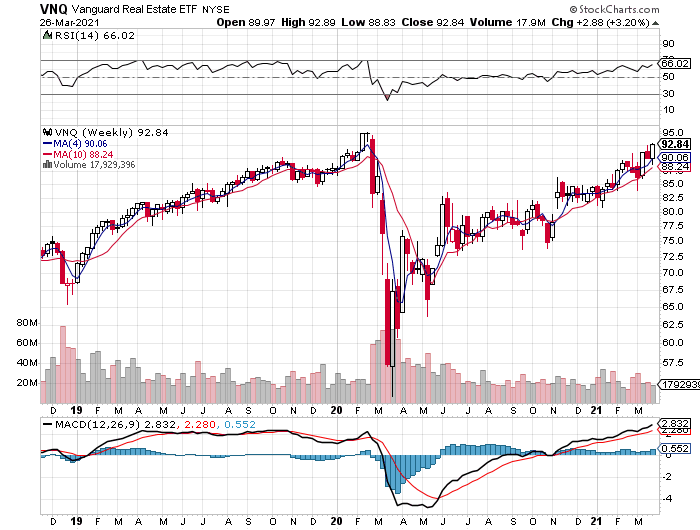

Vanguard U.S. Real Estate (VNQ) rose 3.2% last week, lifting the fund to its highest close since the coronavirus crisis triggered a global markets crash a year ago.

Supporting real estate shares is the outlook in some quarters that commercial properties will be at the forefront of an economic recovery. As Barron’s noted last week, “real-estate investment trusts are enjoying a solid start to 2021, despite a rise in interest rates, as investors favor industries that stand to benefit from a reopening of the economy.”

Global markets overall posted mixed results last week. Stocks and bonds in the U.S. were in the plus column while equities and fixed income in emerging markets led the declines.

VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC) took the biggest hit last week for our ETF proxies representing the major asset classes. EMLC fell 2.1%, leaving the fund near a one-year low.

Despite the recent headwinds for emerging markets, some analysts see pockets of opportunity in these countries. “The pickup in U.S. yields, the slightly stronger U.S. dollar and Europe’s hapless vaccination rollout have hurt EM, but valuations are again looking interesting in China technology,” advises Hasnain Malik, head of equity strategy at Tellimer in Dubai. “For those prepared to look beyond COVID disruption, commodity exporters and tourist destinations offer great opportunities.”

Despite mixed results for markets overall last week, the Global Markets Index (GMI.F) rebounded after a loss in the previous week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETF proxies, rose 0.5% last week.

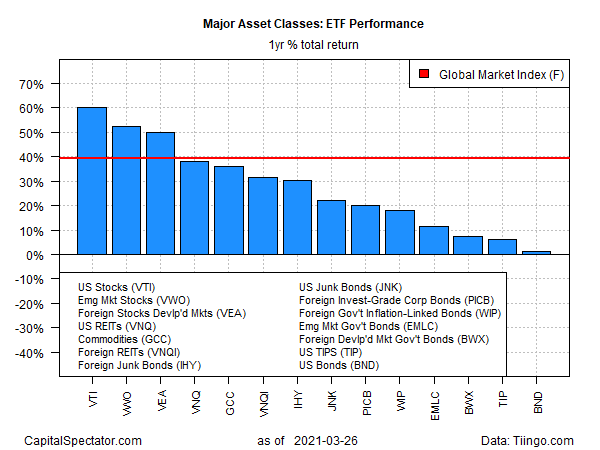

For trailing one-year returns, U.S. stocks are the top performer for the major asset classes through last week’s close. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 60.0% on a total return basis over the past 12 months.

Note that one-year returns for global markets generally are unusually high at the moment because year-ago prices were dramatically depressed due to the coronavirus crash. Accordingly, trailing one-year results will remain temporarily elevated due to extreme year-over-year comparisons until last year’s markets collapse washes out of the annual comparisons.

All the major asset classes are posting one-year gains at the moment. The softest increase: investment-grade bonds in the U.S. via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND), which closed with a 1.3% total return on Friday versus its year-ago price.

GMI.F is up 39.3% for the past year.

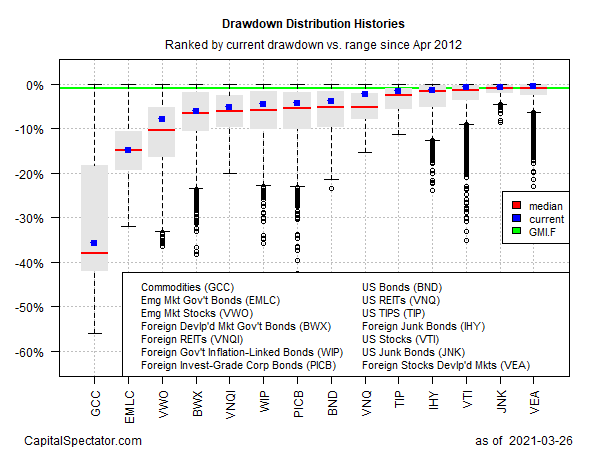

Monitoring funds through a drawdown lens shows that foreign stocks in developed markets continue to post the smallest drawdown for the major asset classes. VEA ended last week’s trading with a slight 0.5% peak-to-trough decline.

The deepest drawdown is still found in broadly defined commodities via GCC: the ETF, which equally weights a broad basket of commodities, is down 35.8% from its previous high.

GMI.F’s current drawdown is a modest 0.9% slide from its previous peak.