By definition, it’s not every day or even every year (heck, it’s barely every decade) that you see the biggest IPO in nine years.

As my colleague Ben Lobel noted in his initial pre-IPO article, Rivian Automotive (NASDAQ:RIVN) raised nearly $12B based on its official IPO price of $78/share, the largest amount raised since Facebook’s (FB) $16B in 2012. While this figure is staggering, Rivian may nonetheless have left billions on the table based on the first week’s price action.

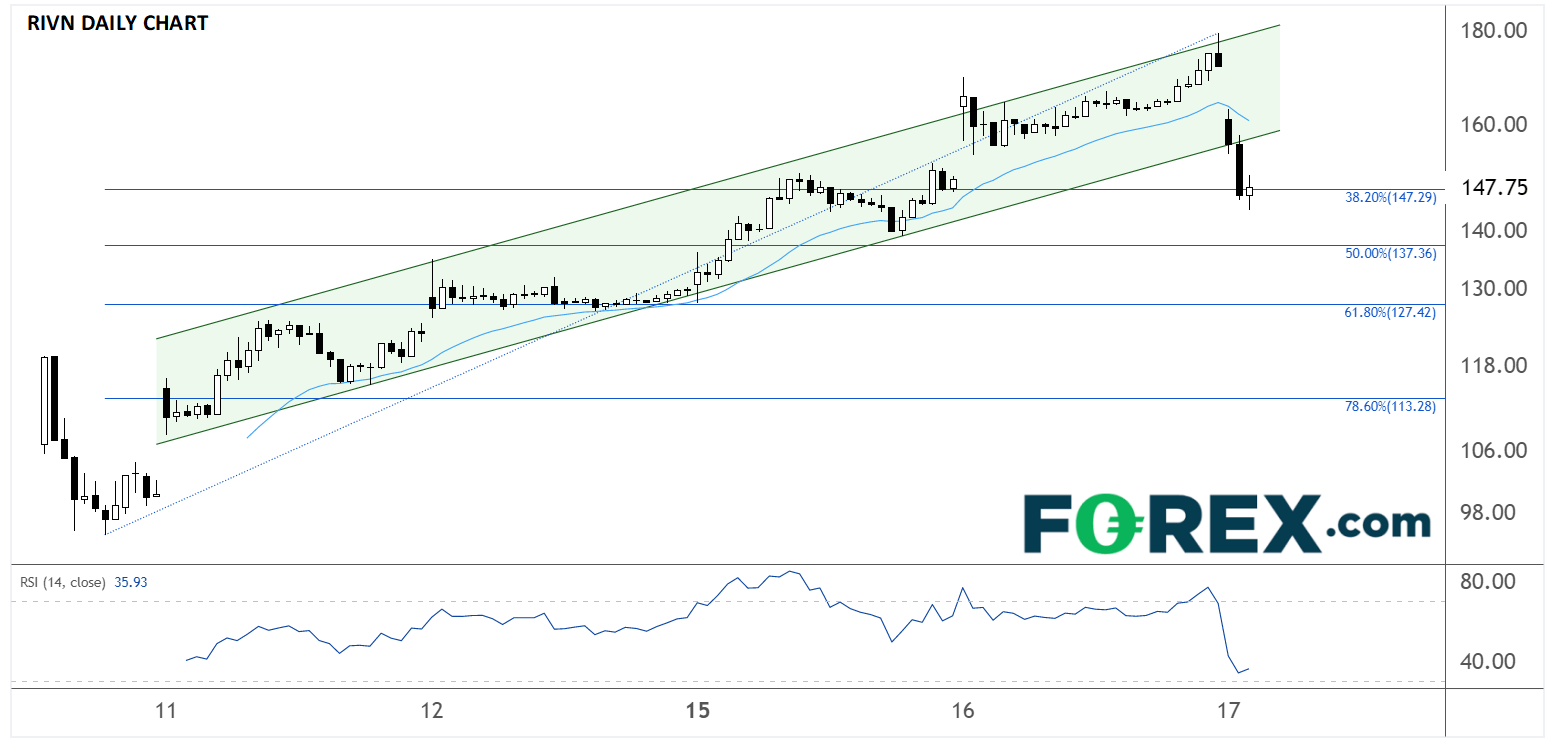

As the 15-min daily chart below shows, RIVN’s first trades went off near $107, and the stock has surged from there, closing Tuesday’s trade above $172, up more than 120% from the $78 IPO price, though the stock closed lower in Wednesday trading, it's still up more than 86% from the IPO price.

Source: StoneX, TradingView

How does Rivian’s first week of trading compare to rival Tesla’s?

To answer the above question in a word: Favorably.

Elon Musk’s EV behemoth is the paragon that all the nascent EV startups seek to emulate, and based on its first week of trade, RIVN is ahead of the pace. Turning our calendars back to June 2010, Tesla Motors (NASDAQ:TSLA) priced its IPO at a (split-adjusted) $3.40 per share, saw an IPO-day spike to nearly $5, then faded throughout the rest of its first week to close at $3.22, below its IPO price. Of course, that ultimately marked essentially the lowest price that TSLA shares ever saw, but if we’re looking at first-week performance only, RIVN is dramatically outperforming TSLA.

Rivian’s first-week surge in context: What does it mean for markets and the global auto industry?

As we’ve seen throughout the last couple of years, RIVN’s IPO reinforces that traders’ demand for fast-growing companies in innovative industries is insatiable, regardless of whether they’re currently profitable, and the recent bout of higher inflation is doing little to dampen that appetite.

The more interesting questions raised by the IPO related to the global automobile market. Looking at the market capitalizations of the 10 largest global auto companies, a clear trend emerges (EV-only manufacturers in italics):

- Tesla Motors: $1,089B

- Toyota (NYSE:TM): $259B

- Volkswagen (DE:VOWG_p): $136B

- BYD (OTC:BYDDY): $133B

- Rivian: $125B

- Daimler (OTC:DDAIF): $108B

- General Motors (NYSE:GM): $92B

- Lucid Motors (NASDAQ:LCID): $87B

- Ford (NYSE:F): $78B

- Great Wall Motors (OTC:GWLLY): $70B

For reference, electric vehicles accounted for just 2.6% of the global auto market in 2020. In other words, with four EV-focused automakers in the Top 10 (and 3 in the Top 5!), it’s clear that EV manufacturers are punching way above their weight. In essence, it appears that traders are essentially valuing the gas-powered segments of incumbent automakers at zero and viewing the global vehicle market as purely a race to produce EVs at scale.

The biggest risk to this perspective is that manufacturing intricate machines like modern vehicles at scale is unfathomably complex, and current market valuations are suggesting that young upstart EV manufacturers like Rivian and Lucid will be able to scale up to mass production smoothly, or at least more quickly than legacy automakers with decades (in some cases more than a century’s worth) of experience can retool to producing primarily EVs.

It remains to be seen whether that will ultimately be the case, but after Rivian’s impressive first week, it’s critical for traders to understand the narratives and competitive dynamics at play in the broader industry.